Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9110

Pages:91

Published On:November 2025

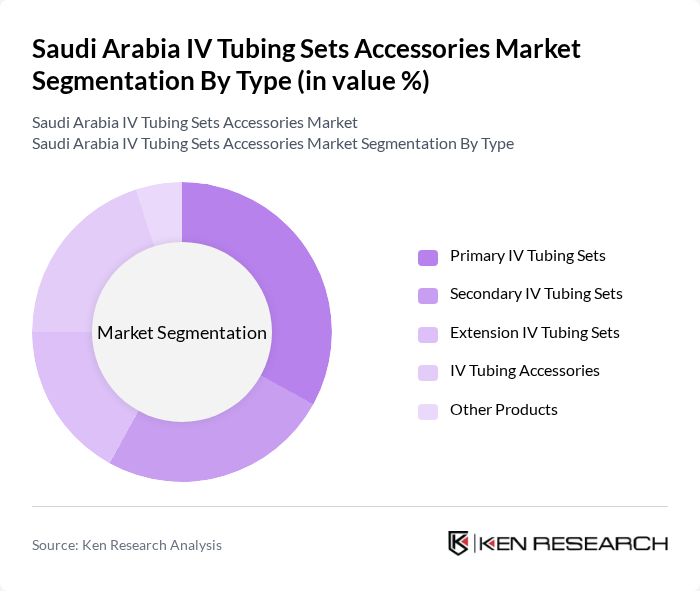

By Type:The market is segmented into various types of IV tubing sets and accessories, which cater to different medical needs and applications. Primary IV tubing sets are widely used in hospitals and clinics, while secondary and extension sets are gaining traction due to their specific functionalities. IV tubing accessories also play a crucial role in enhancing the efficiency and safety of IV therapy .

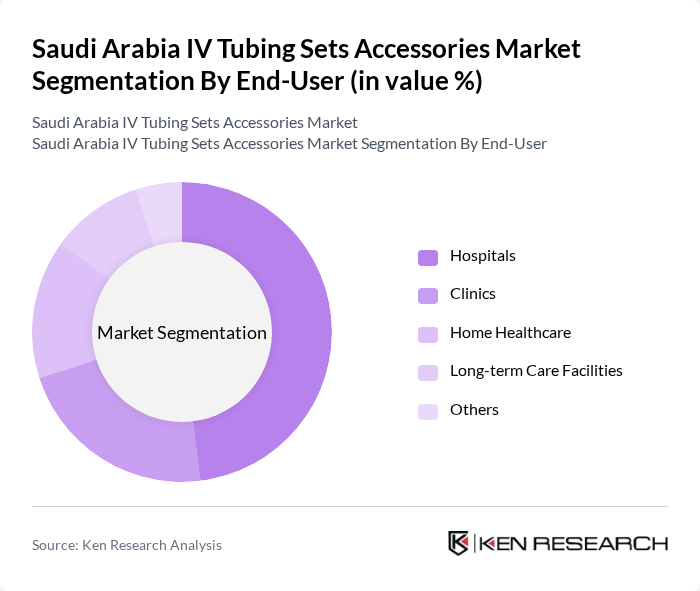

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, long-term care facilities, and others. Hospitals are the largest consumers of IV tubing sets and accessories due to the high volume of patients requiring IV therapy. Home healthcare is emerging as a significant segment, driven by the growing trend of at-home treatments and patient monitoring .

The Saudi Arabia IV Tubing Sets Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., B. Braun Melsungen AG, Terumo Corporation, Smiths Medical (ICU Medical, Inc.), Medtronic plc, Fresenius Kabi AG, Cardinal Health, Inc., Nipro Corporation, Vygon S.A., Polymedicure Ltd., JMS Co., Ltd., Mindray Medical International Limited, Al Faisaliah Medical Systems (FMS) – Saudi Arabia, Al Zahrawi Medical Supplies LLC, Al-Dawaa Medical Services Co. contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia IV tubing sets accessories market is poised for significant growth, driven by increasing healthcare investments and a rising burden of chronic diseases. The integration of smart technologies and eco-friendly materials is expected to shape product development, enhancing patient care. Additionally, the expansion of telemedicine and home healthcare solutions will create new avenues for market players, fostering innovation and collaboration within the industry. Overall, the future landscape appears promising, with opportunities for growth and advancement.

| Segment | Sub-Segments |

|---|---|

| By Type | Primary IV Tubing Sets Secondary IV Tubing Sets Extension IV Tubing Sets IV Tubing Accessories Other Products |

| By End-User | Hospitals Clinics Home Healthcare Long-term Care Facilities Others |

| By Application | Oncology Pain Management Nutritional Support Antibiotic Therapy Others |

| By Material | PVC Polyurethane Silicone Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Pricing Model | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Clinical Usage in Hospitals | 50 | Doctors, Nurses, Clinical Coordinators |

| Manufacturers of IV Accessories | 40 | Product Managers, Sales Directors |

| Distributors and Wholesalers | 40 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies and Health Authorities | 40 | Regulatory Affairs Specialists, Policy Makers |

The Saudi Arabia IV Tubing Sets Accessories Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This valuation is influenced by factors such as the increasing prevalence of chronic diseases and advancements in healthcare infrastructure.