Region:Middle East

Author(s):Rebecca

Product Code:KRAC3331

Pages:94

Published On:October 2025

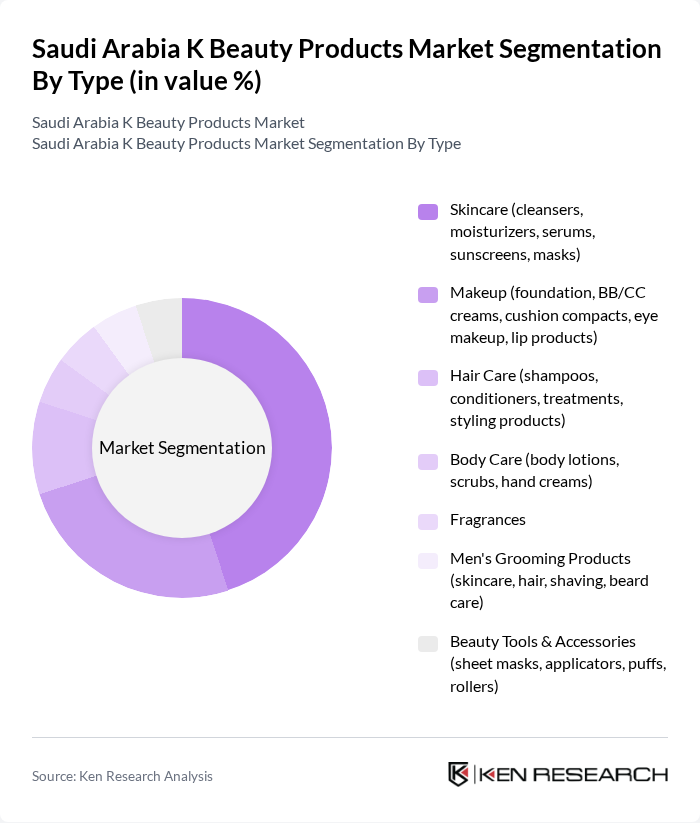

By Type:The market is segmented into skincare, makeup, hair care, body care, fragrances, men's grooming products, and beauty tools & accessories. Skincare products—including cleansers, moisturizers, serums, sunscreens, and masks—dominate the market, reflecting the strong consumer focus on multi-step skincare routines and the perceived effectiveness of K Beauty formulations. Makeup products, such as foundation, BB/CC creams, cushion compacts, and lip products, also hold a significant share, driven by trends in natural and corrective cosmetics. Hair care and body care segments are supported by growing interest in holistic beauty and personal wellness, while fragrances, men’s grooming, and beauty tools & accessories continue to expand as consumers diversify their routines.

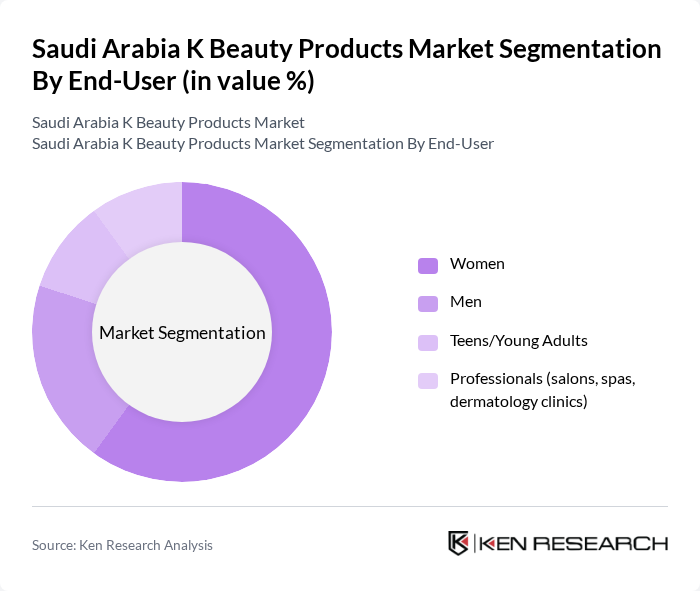

By End-User:The end-user segmentation includes women, men, teens/young adults, and professionals such as salons and spas. Women represent the largest consumer group, driven by high engagement with skincare and beauty products and a strong interest in premium and innovative formulations. Men are increasingly adopting grooming and skincare routines, reflecting broader shifts in beauty standards. Teens and young adults are notable for their willingness to experiment with new products, especially those promoted by social media influencers. Professionals, including salons, spas, and dermatology clinics, contribute to market growth by integrating K Beauty products into their service offerings.

The Saudi Arabia K Beauty Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amorepacific Corporation, LG Household & Health Care Ltd., Innisfree, Etude, Missha (ABLE C&C Co., Ltd.), The Face Shop (LG Household & Health Care), Laneige, Skinfood, TonyMoly, Holika Holika, COSRX, Neogen Dermalogy, Dear, Klairs, Dr.Jart+ (Estée Lauder Companies), A'PIEU (ABLE C&C Co., Ltd.), Banila Co, Nature Republic, Mediheal, Beauty of Joseon, Some By Mi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the K Beauty products market in Saudi Arabia appears promising, driven by evolving consumer preferences and a growing emphasis on sustainability. As the demand for clean beauty products continues to rise, brands that prioritize eco-friendly practices and transparency in ingredient sourcing are likely to thrive. Additionally, the increasing popularity of subscription box services is expected to enhance consumer engagement, providing personalized experiences that cater to individual skincare needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare (cleansers, moisturizers, serums, sunscreens, masks) Makeup (foundation, BB/CC creams, cushion compacts, eye makeup, lip products) Hair Care (shampoos, conditioners, treatments, styling products) Body Care (body lotions, scrubs, hand creams) Fragrances Men's Grooming Products (skincare, hair, shaving, beard care) Beauty Tools & Accessories (sheet masks, applicators, puffs, rollers) |

| By End-User | Women Men Teens/Young Adults Professionals (salons, spas, dermatology clinics) |

| By Sales Channel | Online Retail (e-commerce platforms, brand websites) Department Stores Specialty Beauty Stores Pharmacies/Drugstores Direct Sales (MLM, pop-up stores, events) |

| By Price Range | Premium Mid-range Mass/Budget |

| By Packaging Type | Bottles Tubes Jars Sachets/Single-use Packs |

| By Brand Origin | Korean Brands International Brands (non-Korean) Local/Regional Brands |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K Beauty Retailers | 60 | Store Managers, Beauty Advisors |

| Online Consumers of K Beauty Products | 120 | Frequent Online Shoppers, Beauty Enthusiasts |

| Beauty Influencers and Bloggers | 40 | Content Creators, Social Media Influencers |

| Dermatologists and Skincare Experts | 40 | Healthcare Professionals, Skincare Specialists |

| Distributors and Wholesalers | 40 | Supply Chain Managers, Business Development Executives |

The Saudi Arabia K Beauty Products Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by consumer awareness, demand for innovative products, and the influence of social media and beauty influencers.