Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4162

Pages:94

Published On:December 2025

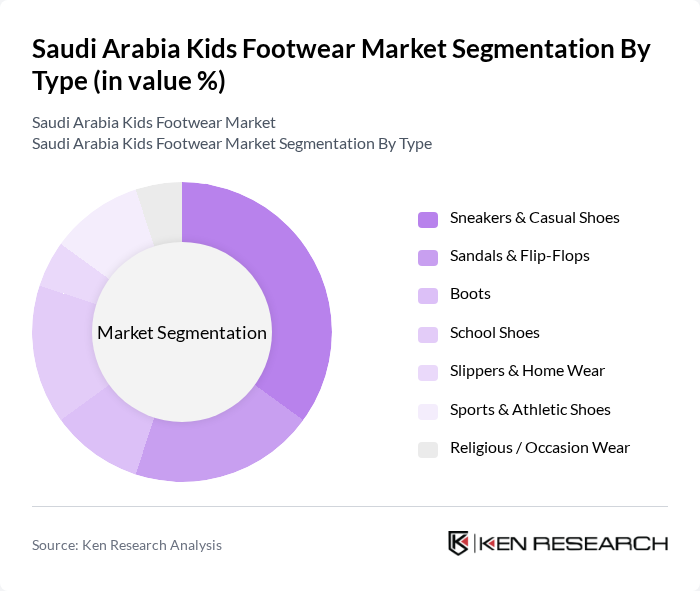

By Type:The market is segmented into various types of footwear, including Sneakers & Casual Shoes, Sandals & Flip-Flops, Boots, School Shoes, Slippers & Home Wear, Sports & Athletic Shoes, and Religious / Occasion Wear. Among these, Sneakers & Casual Shoes dominate the market due to their versatility, everyday usability, and comfort, appealing to both parents and children as preferred options for school, leisure, and outdoor activities. The trend towards casualization in children's fashion, combined with rising participation in sports and outdoor play and the influence of global athletic and lifestyle brands, has further propelled the demand for these types of footwear, making them a staple in many children's wardrobes.

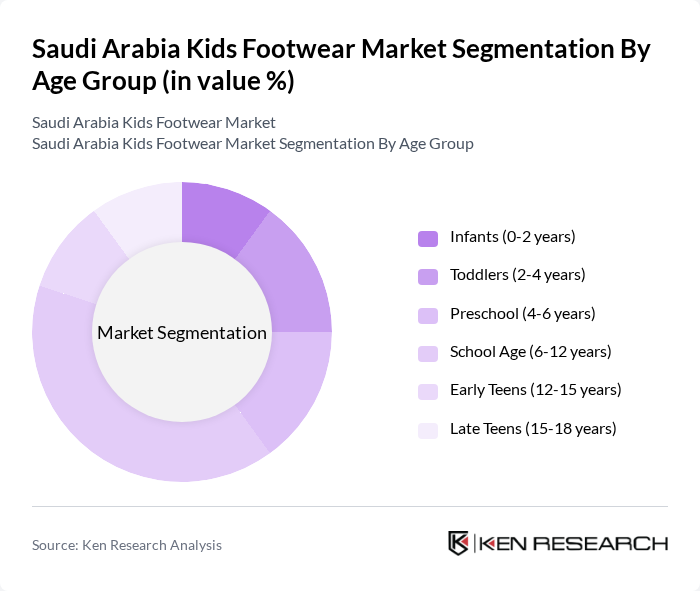

By Age Group:The market is also segmented by age groups, including Infants (0-2 years), Toddlers (2-4 years), Preschool (4-6 years), School Age (6-12 years), Early Teens (12-15 years), and Late Teens (15-18 years). The School Age (6-12 years) segment leads the market, driven by the necessity for school uniforms, frequent replacement needs due to growth, and the growing trend of children participating in extracurricular activities and sports that require specific types of footwear such as athletic and training shoes. Parents are increasingly focused on providing their children with appropriate footwear that supports their active lifestyles, offers proper foot support, and aligns with school and sports dress codes.

The Saudi Arabia Kids Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Skechers U.S.A., Inc., Clarks (C. & J. Clark International Ltd.), Geox S.p.A., Crocs, Inc., Bata Shoe Company (Bata Saudi Arabia), Converse (a Nike brand), New Balance Athletics, Inc., Vans (VF Corporation), Reebok International Ltd., Hush Puppies (Wolverine World Wide, Inc.), Fila Holdings Corp., Centrepoint (Landmark Group – Babyshop & Shoe Mart), Namshi (Kids Footwear), Noon (Kids Footwear), Redtag (Kids Footwear) contribute to innovation, geographic expansion, and service delivery in this space, supported by the growth of organized retail chains and online platforms in Saudi Arabia.

The Saudi Arabia kids' footwear market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly materials and production methods. Additionally, the integration of technology, such as smart shoes that monitor health metrics, will likely attract tech-savvy parents. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sneakers & Casual Shoes Sandals & Flip-Flops Boots School Shoes Slippers & Home Wear Sports & Athletic Shoes Religious / Occasion Wear |

| By Age Group | Infants (0-2 years) Toddlers (2-4 years) Preschool (4-6 years) School Age (6-12 years) Early Teens (12-15 years) Late Teens (15-18 years) |

| By Gender | Boys Girls Unisex |

| By Distribution Channel | Online Retail (E-commerce Platforms) Brand-Owned Stores Multi-Brand Footwear Stores Supermarkets/Hypermarkets Department Stores Others (Traditional/Independent Retailers) |

| By Material | Leather Synthetic & PU Textile / Canvas Rubber / EVA Eco-friendly / Sustainable Materials |

| By Price Range | Budget (Mass Market) Mid-range Premium Luxury & Designer |

| By Occasion | Everyday Casual Wear School Wear / Uniform Sports & Outdoor Activities Festive & Formal Events Home & Indoor Wear |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Footwear Outlets | 120 | Store Managers, Sales Representatives |

| Online Footwear Retailers | 90 | E-commerce Managers, Digital Marketing Specialists |

| Footwear Manufacturers | 70 | Production Managers, Product Development Heads |

| Consumer Insights | 150 | Parents of children aged 0-12, Child Psychologists |

| Market Analysts | 50 | Industry Analysts, Market Research Experts |

The Saudi Arabia Kids Footwear Market is valued at approximately USD 1.3 billion. This valuation reflects a growing demand driven by increasing disposable incomes, a rising population of children, and heightened awareness among parents regarding the importance of quality footwear for children's health.