Region:Middle East

Author(s):Rebecca

Product Code:KRAB6876

Pages:84

Published On:October 2025

By Type:The market can be segmented into various types, including LNG Trucks, LNG Refueling Stations, LNG Storage Solutions, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and consumer preferences influencing their growth.

The LNG Trucks segment is currently leading the market due to the increasing adoption of LNG as a fuel source in the transportation sector. This trend is driven by the need for cost-effective and environmentally friendly alternatives to traditional fuels. Companies are increasingly investing in LNG trucks to reduce operational costs and comply with government regulations promoting cleaner energy. The growing logistics and freight transportation sectors are also contributing to the demand for LNG trucks, making it the dominant sub-segment in the market.

By End-User:The market can also be segmented based on end-users, including Transportation and Logistics, Industrial Applications, Government and Public Sector, and Others. Each end-user category has distinct requirements and influences the demand for LNG trucking and refueling stations.

The Transportation and Logistics segment is the largest end-user of LNG, accounting for a significant portion of the market. This dominance is attributed to the growing need for efficient and sustainable transportation solutions. Companies in this sector are increasingly adopting LNG to lower fuel costs and meet environmental regulations. The industrial applications segment also shows substantial growth, driven by the need for cleaner energy sources in manufacturing and production processes.

The Saudi Arabia LNG Trucking and Refueling Stations Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, National Gas and Industrial Company (GASCO), Al-Fanar Company, Al-Jomaih Energy and Water Company, Al-Muhaidib Group, Al-Babtain Group, Al-Khodari & Sons Company, Al-Suwaidi Industrial Services, Al-Faisaliah Group, Al-Mansoori Specialized Engineering, Saudi Industrial Services Company (SISCO), Al-Rajhi Holding Group, Al-Hokair Group, Al-Muhaidib Contracting, Saudi Logistics Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LNG trucking and refueling stations market in Saudi Arabia appears promising, driven by increasing government support and a growing emphasis on sustainability. As infrastructure expands and awareness improves, LNG is expected to gain traction as a preferred transportation fuel. The anticipated rise in LNG consumption, projected to reach 1.5 million tons by future, will further solidify its role in the energy landscape, aligning with global trends towards cleaner energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | LNG Trucks LNG Refueling Stations LNG Storage Solutions Others |

| By End-User | Transportation and Logistics Industrial Applications Government and Public Sector Others |

| By Application | Long-Distance Transportation Urban Delivery Services Heavy-Duty Vehicles Others |

| By Distribution Mode | Direct Sales Online Sales Distributors and Dealers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Subsidies for LNG Infrastructure Tax Incentives for LNG Adoption Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| LNG Trucking Operations | 100 | Fleet Managers, Logistics Coordinators |

| Refueling Station Management | 80 | Station Operators, Business Development Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Energy Analysts |

| Environmental Impact Assessments | 60 | Sustainability Officers, Environmental Consultants |

| End-User Feedback on LNG | 90 | Transport Company Executives, Fleet Operators |

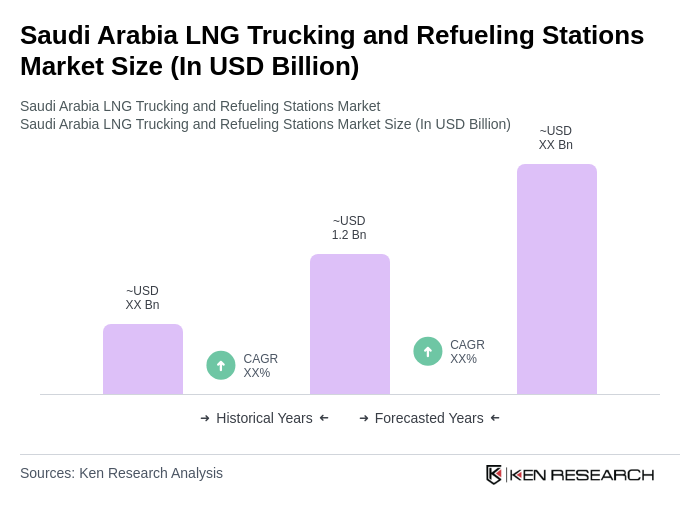

The Saudi Arabia LNG Trucking and Refueling Stations Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for cleaner fuel alternatives and government initiatives promoting LNG usage.