Region:Middle East

Author(s):Dev

Product Code:KRAD3440

Pages:80

Published On:November 2025

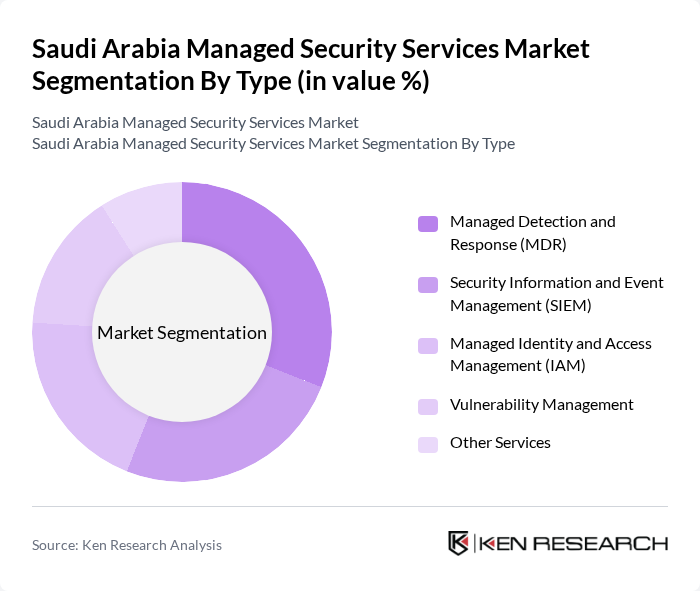

By Type:The segmentation by type includes various services that cater to different security needs. The subsegments are Managed Detection and Response (MDR), Security Information and Event Management (SIEM), Managed Identity and Access Management (IAM), Vulnerability Management, and Other Services. Each of these subsegments plays a crucial role in addressing specific security challenges faced by organizations. MDR, in particular, is experiencing rapid growth as enterprises migrate from log aggregation to active threat hunting and response .

The Managed Detection and Response (MDR) subsegment is currently dominating the market due to the increasing sophistication of cyber threats and the need for real-time threat detection and response. Organizations are increasingly recognizing the importance of proactive security measures, leading to a surge in demand for MDR services. This trend is further fueled by the growing complexity of IT environments and the need for specialized expertise in threat management .

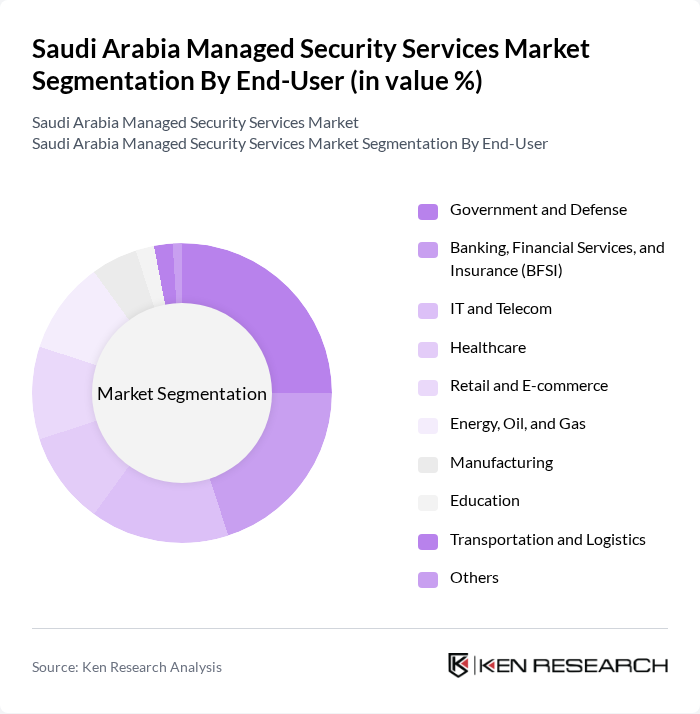

By End-User:The end-user segmentation includes various sectors such as Government and Defense, Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Healthcare, Retail and E-commerce, Energy, Oil, and Gas, Manufacturing, Education, Transportation and Logistics, and Others. Each sector has unique security requirements that drive the demand for managed security services. The Government and Defense sector continues to lead due to significant investments in national security infrastructure and stringent regulatory requirements .

The Government and Defense sector is the leading end-user of managed security services, driven by stringent security requirements and the need to protect sensitive information. This sector's high budget allocation for cybersecurity initiatives further enhances its demand for managed services. Additionally, the BFSI sector follows closely, as financial institutions face constant threats and regulatory pressures, necessitating robust security measures .

The Saudi Arabia Managed Security Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Cybersecurity (Sirar by STC), Saudi Information Technology Company (SITE), IBM Corporation, Cisco Systems Inc., SecurityHQ, Accenture PLC, Capgemini SE, TechArch, Arabic Computer Systems (ACS), Fortinet, Check Point Software Technologies, Palo Alto Networks, Trend Micro, SecureWorks Corp, CrowdStrike contribute to innovation, geographic expansion, and service delivery in this space.

The future of the managed security services market in Saudi Arabia appears promising, driven by ongoing digital transformation and increasing cybersecurity threats. As organizations prioritize robust security frameworks, the integration of advanced technologies like AI and machine learning will become essential. Additionally, the government's commitment to enhancing cybersecurity infrastructure will likely foster innovation and collaboration among service providers, ensuring that businesses can effectively mitigate risks and comply with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Security Information and Event Management (SIEM) Managed Identity and Access Management (IAM) Vulnerability Management Other Services |

| By End-User | Government and Defense Banking, Financial Services, and Insurance (BFSI) IT and Telecom Healthcare Retail and E-commerce Energy, Oil, and Gas Manufacturing Education Transportation and Logistics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Service Model | Managed Security Services Consulting Services Integration Services Others |

| By Industry Vertical | BFSI Healthcare Manufacturing IT and Telecom Retail Defense/Government Energy and Utilities Education Transportation and Logistics Others |

| By Security Type | Threat Management Vulnerability Management Compliance Management Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 60 | IT Security Managers, Risk Assessment Officers |

| Healthcare Managed Security Services | 50 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 40 | Cybersecurity Policy Makers, IT Administrators |

| Retail Sector Security Solutions | 45 | Operations Managers, IT Security Analysts |

| Telecommunications Security Services | 40 | Network Security Engineers, Service Delivery Managers |

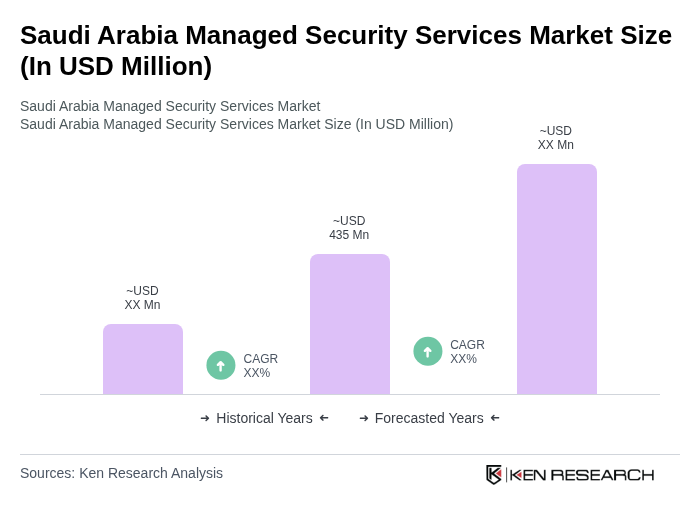

The Saudi Arabia Managed Security Services Market is valued at approximately USD 435 million, reflecting a significant growth driven by increasing cyber threats, regulatory compliance needs, and the adoption of cloud-based services.