Region:Middle East

Author(s):Rebecca

Product Code:KRAD2755

Pages:95

Published On:November 2025

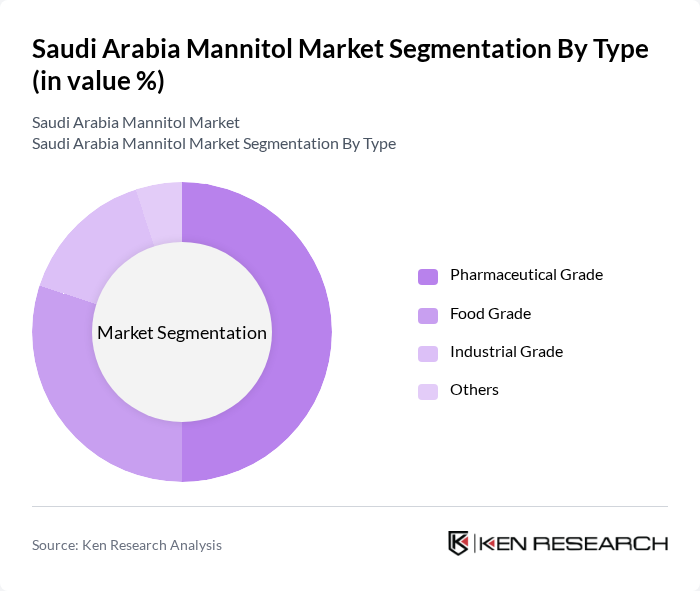

By Type:The market is segmented into Pharmaceutical Grade, Food Grade, Industrial Grade, and Others. Among these, the Pharmaceutical Grade segment is the most dominant due to the increasing use of mannitol in drug formulations, particularly in the production of injectable medications and as a bulking agent in tablets. The Food Grade segment is also significant, driven by the rising demand for low-calorie sweeteners in the food and beverage industry. The Industrial Grade segment is used in specialty chemical applications, while the Others segment includes niche uses in research and biotechnology .

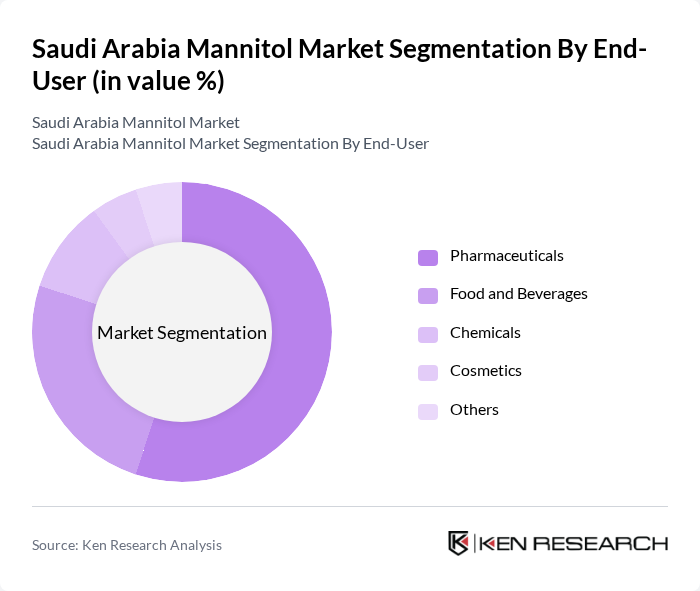

By End-User:The end-user segments include Pharmaceuticals, Food and Beverages, Chemicals, Cosmetics, and Others. The Pharmaceuticals segment leads the market, driven by the increasing use of mannitol in various pharmaceutical applications, including as a sweetener in syrups and as a bulking agent in tablets. The Food and Beverages segment is also growing, fueled by the rising consumer preference for healthier food options, including sugar-free and low-calorie products. The Chemicals segment utilizes mannitol in specialty applications, while Cosmetics and Others represent smaller but emerging segments .

The Saudi Arabia Mannitol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères, SPI Pharma, Mingtai Chemical Co., Ltd., Cargill, Incorporated, Merck KGaA (EMD Millipore), Fuso Chemical Co., Ltd., Qingdao Bright Moon Seaweed Group Co., Ltd., Huzhou Zhenhua Chemical Co., Ltd., Shijiazhuang Huabang Pharmaceutical Co., Ltd., Hubei Nanhang Industrial Co., Ltd., Hubei Shunhui Pharmaceutical Co., Ltd., Jiangsu Shunfeng Chemical Co., Ltd., Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Zhejiang Jianfeng Chemical Co., Ltd., Shanghai Huayi Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mannitol market in Saudi Arabia appears promising, driven by increasing health consciousness and the expansion of the pharmaceutical and food sectors. As consumers seek healthier alternatives, mannitol's role as a low-calorie sweetener is expected to grow. Additionally, advancements in production technology may reduce costs, making mannitol more competitive. Collaborations with research institutions could lead to innovative applications, further enhancing market dynamics and positioning mannitol as a key ingredient in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Grade Food Grade Industrial Grade Others |

| By End-User | Pharmaceuticals Food and Beverages Chemicals Cosmetics Others |

| By Application | Sweetener Stabilizer Bulking Agent Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Source of Supply | Domestic Production Imports Exports Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Product Managers, Regulatory Affairs Specialists |

| Food Industry Utilization | 80 | Food Technologists, Quality Assurance Managers |

| Cosmetic Industry Insights | 60 | Formulation Chemists, Brand Managers |

| Distribution Channels | 50 | Supply Chain Managers, Sales Managers |

| Market Trends and Innovations | 40 | Industry Analysts, Research Scientists |

The Saudi Arabia Mannitol Market is valued at approximately USD 5 million, driven by increasing demand in the pharmaceutical and food industries, particularly for low-calorie and sugar-free products.