Region:Middle East

Author(s):Dev

Product Code:KRAD0378

Pages:86

Published On:August 2025

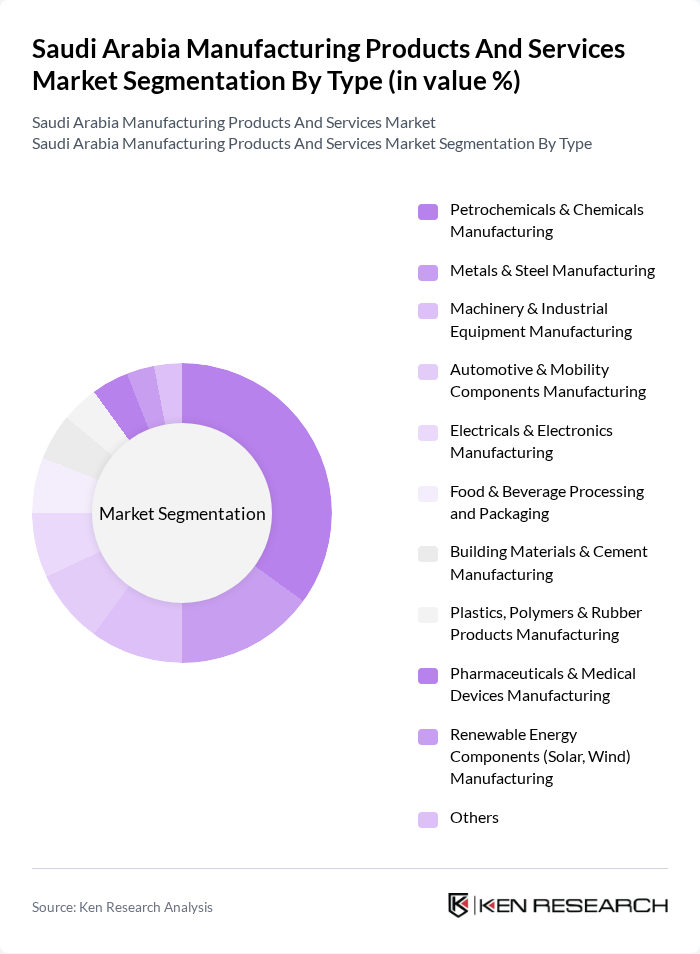

By Type:The manufacturing sector in Saudi Arabia is diverse, encompassing various types of products and services. The key subsegments include Petrochemicals & Chemicals Manufacturing, Metals & Steel Manufacturing, Machinery & Industrial Equipment Manufacturing, Automotive & Mobility Components Manufacturing, Electricals & Electronics Manufacturing, Food & Beverage Processing and Packaging, Building Materials & Cement Manufacturing, Plastics, Polymers & Rubber Products Manufacturing, Pharmaceuticals & Medical Devices Manufacturing, Renewable Energy Components (Solar, Wind) Manufacturing, and Others. Among these, Petrochemicals & Chemicals Manufacturing is the leading subsegment, driven by the country’s abundant oil and gas feedstock, large integrated chemical complexes, and global demand for chemical products .

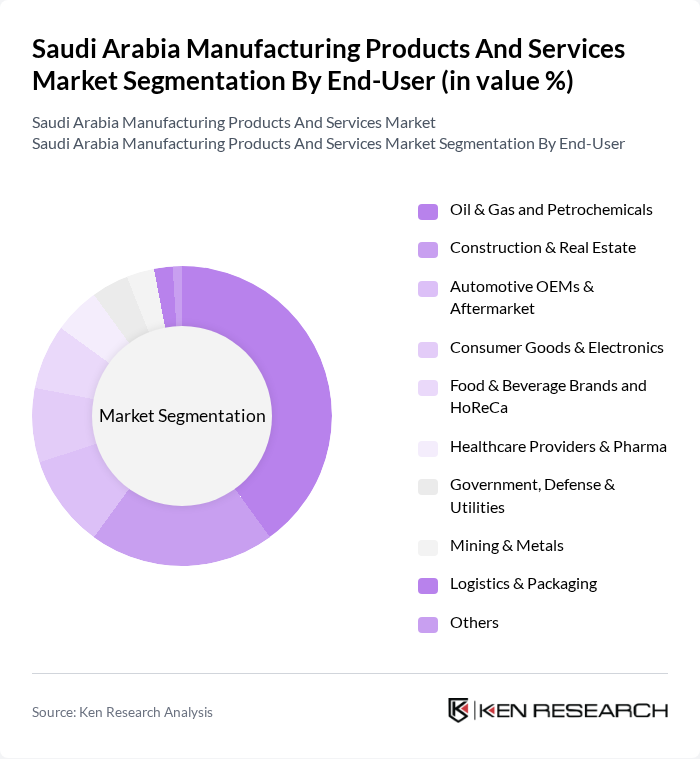

By End-User:The end-user segments for the manufacturing market in Saudi Arabia include Oil & Gas and Petrochemicals, Construction & Real Estate, Automotive OEMs & Aftermarket, Consumer Goods & Electronics, Food & Beverage Brands and HoReCa, Healthcare Providers & Pharma, Government, Defense & Utilities, Mining & Metals, Logistics & Packaging, and Others. The Oil & Gas and Petrochemicals segment is the most significant, reflecting the country’s long-established hydrocarbon value chain and the continued strength of chemical manufacturing output within non-oil industry metrics .

The Saudi Arabia Manufacturing Products and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Aramco), Saudi Arabian Mining Company (Ma’aden), Saudi Aramco Base Oil Company – Luberef, Sadara Chemical Company, Saudi International Petrochemical Company (Sipchem), National Industrialization Company (Tasnee), Saudi Iron & Steel Company (Hadeed), Al Rajhi Steel, Zamil Industrial Investment Company, Alfanar, Saudi Ceramic Company, Saudi Cable Company, Arabian Cement Company, Yamama Cement Company, Saudi Arabia Glass Company Ltd., Middle East Specialized Cables (MESC), Saudi Aramco Total Refining and Petrochemical Company (SATORP), Saudi Arabian Amiantit Company, Advanced Petrochemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian manufacturing sector appears promising, driven by ongoing government initiatives and a focus on technological advancements. In future, the integration of smart manufacturing technologies is expected to enhance operational efficiency, while sustainability practices will become increasingly vital. As the sector evolves, collaboration with international firms will likely foster innovation and knowledge transfer, positioning Saudi Arabia as a competitive player in the global manufacturing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Petrochemicals & Chemicals Manufacturing Metals & Steel Manufacturing Machinery & Industrial Equipment Manufacturing Automotive & Mobility Components Manufacturing Electricals & Electronics Manufacturing Food & Beverage Processing and Packaging Building Materials & Cement Manufacturing Plastics, Polymers & Rubber Products Manufacturing Pharmaceuticals & Medical Devices Manufacturing Renewable Energy Components (Solar, Wind) Manufacturing Others |

| By End-User | Oil & Gas and Petrochemicals Construction & Real Estate Automotive OEMs & Aftermarket Consumer Goods & Electronics Food & Beverage Brands and HoReCa Healthcare Providers & Pharma Government, Defense & Utilities Mining & Metals Logistics & Packaging Others |

| By Application | Discrete Manufacturing Process Manufacturing Product Assembly Testing & Quality Control Packaging & Labelling Warehousing & Distribution Maintenance, Repair & Overhaul (MRO) Others |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funds, Grants & Subsidies Sovereign and PIF-backed Investments Others |

| By Distribution Mode | Direct (B2B Contracts) Distributors & Industrial Wholesalers Online & E-Procurement Portals Retail & Trade Counters System Integrators & EPCs Others |

| By Price Range | Economy Mid-Range Premium Capex-Intensive (Project-Based) Others |

| By Policy Support | Local Content (IKTVA, NIDLP) Incentives Tax, Customs & Zakat Incentives SME & Industrial Cluster Programs Export & Financing Support (SIDF, EXIM) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Automotive Component Production | 80 | Supply Chain Managers, Engineering Directors |

| Food and Beverage Processing | 90 | Operations Supervisors, Compliance Officers |

| Textile Manufacturing | 70 | Plant Managers, Product Development Heads |

| Construction Materials Production | 60 | Procurement Managers, Project Managers |

The Saudi Arabia Manufacturing Products and Services Market is valued at approximately USD 90 billion, reflecting a significant growth trajectory supported by government initiatives under Vision 2030, which emphasizes non-oil industrial growth.