Region:Middle East

Author(s):Dev

Product Code:KRAD0590

Pages:92

Published On:August 2025

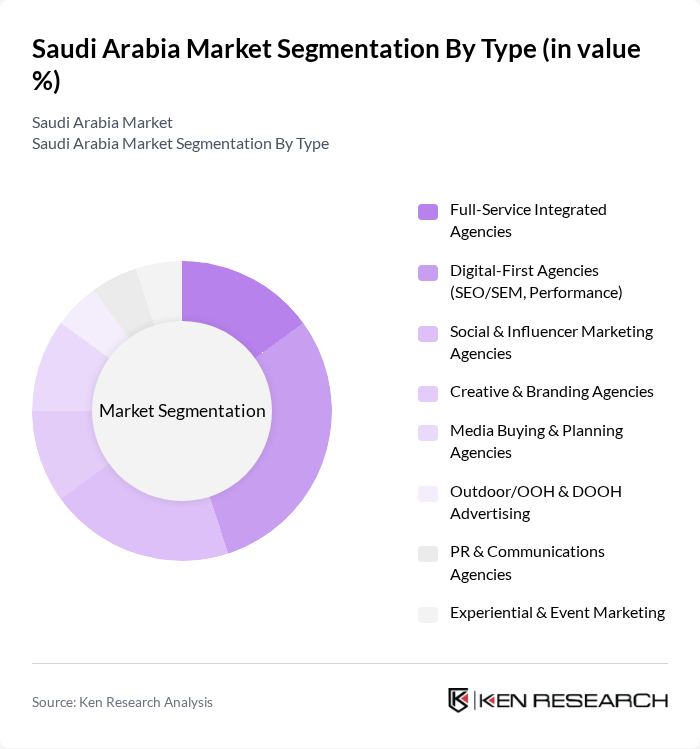

By Type:The marketing and advertising agency market can be segmented into various types, including Full-Service Integrated Agencies, Digital-First Agencies, Social & Influencer Marketing Agencies, Creative & Branding Agencies, Media Buying & Planning Agencies, Outdoor/OOH & DOOH Advertising, PR & Communications Agencies, and Experiential & Event Marketing. Among these, Digital-First Agencies are currently leading the market due to the increasing reliance on digital platforms for advertising and consumer engagement, supported by rising online ad spend, strong e-commerce growth, and performance-led budgets under Vision 2030 .

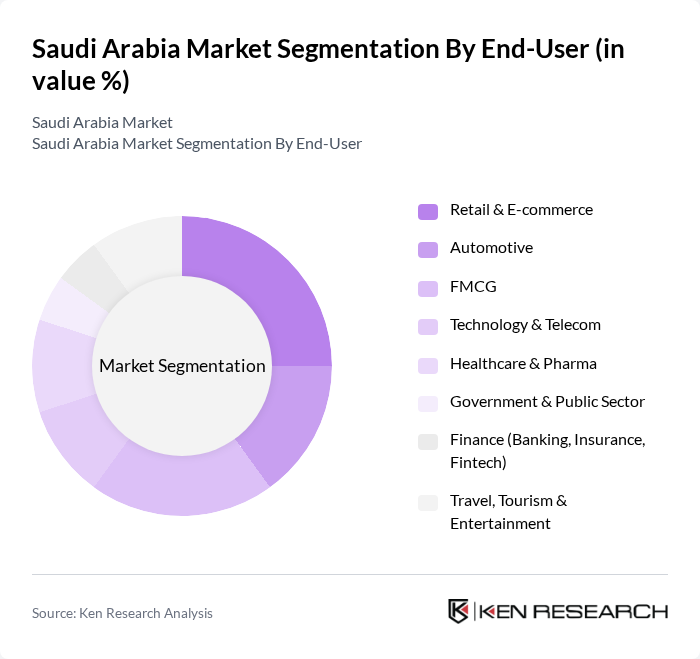

By End-User:The end-user segmentation of the marketing and advertising agency market includes Retail & E-commerce, Automotive, FMCG, Technology & Telecom, Healthcare & Pharma, Government & Public Sector, Finance (Banking, Insurance, Fintech), and Travel, Tourism & Entertainment. The Retail & E-commerce sector is currently the dominant segment, driven by rapid online shopping growth and heavier investment in digital advertising, with e-commerce revenue scale-ups and mobile-first consumer behavior reinforcing retail’s leadership in agency demand .

The Saudi Arabia marketing and advertising agency market is characterized by a dynamic mix of regional and international players. Leading participants such as Publicis Groupe (Starcom, Saatchi & Saatchi, Leo Burnett Saudi Arabia), WPP plc (Ogilvy, VML, GroupM, Grey, Mindshare), Omnicom Group (BBDO, TBWA\RAAD, OMD, PHD), Interpublic Group (McCann, FP7 McCann, UM, Initiative), Dentsu Group (Dentsu, iProspect, Carat), Havas Group (Havas Creative, Havas Media), MBC Group (MBC Media Solutions, Shahid advertising), Choueiri Group (Saudi Arabia Media Company – SAMC), Al Arabiah OOH (Arabian Contracting Services Co.), Al Watania Advertising (United Electronic Company – eXtra Media), SRMG (Saudi Research and Media Group), stc Channels & stc play (Advertising Solutions), UTURN Entertainment (digital content & influencer network), Extend (Extend Ad – digital advertising network), Creative Waves (Saudi digital marketing agency) contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabian marketing and advertising industry is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. As digital platforms continue to dominate, agencies will increasingly leverage data analytics and AI to enhance targeting and personalization. Furthermore, the growing emphasis on sustainability will shape marketing strategies, compelling agencies to adopt eco-friendly practices. This dynamic environment presents both challenges and opportunities, necessitating agility and innovation from industry players to thrive in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Integrated Agencies Digital-First Agencies (SEO/SEM, Performance) Social & Influencer Marketing Agencies Creative & Branding Agencies Media Buying & Planning Agencies Outdoor/OOH & DOOH Advertising PR & Communications Agencies Experiential & Event Marketing |

| By End-User | Retail & E-commerce Automotive FMCG Technology & Telecom Healthcare & Pharma Government & Public Sector Finance (Banking, Insurance, Fintech) Travel, Tourism & Entertainment |

| By Region | Riyadh (Central) Eastern Province (Dammam, Khobar, Dhahran) Makkah Region (Jeddah, Makkah, Taif) Madinah & Tabuk (Northwest) Asir, Jizan & Najran (South) |

| By Application | Brand Awareness & Positioning Lead Generation & Performance Marketing Customer Engagement & Retention (CRM/Loyalty) Market Research & Analytics Product Launches & Event Activations |

| By Investment Source | Private Sector Budgets Government & Giga-Project Spend (Vision 2030) Foreign Direct Investment Public-Private Partnerships Startups & SME Spend (Monsha’at-supported) |

| By Policy Support | Local Content & Saudization Requirements Data Protection & Advertising Compliance Incentives for Digital Economy & Innovation Media Licenses & E-Advertising Regulations |

| By Pricing Strategy | Retainer-Based Pricing Project-Based/Fee-for-Service Performance-Based/Outcome-Linked Hybrid Models (Retainer + Performance) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector Insights | 100 | Project Managers, Operations Directors |

| Construction Industry Trends | 80 | Site Managers, Procurement Specialists |

| Retail Consumer Behavior | 120 | Marketing Managers, Retail Analysts |

| Technology Adoption in Manufacturing | 70 | IT Managers, Production Supervisors |

| Real Estate Market Dynamics | 90 | Real Estate Developers, Investment Analysts |

The marketing and advertising agency market in Saudi Arabia is valued at approximately USD 2.32.4 billion, reflecting consistent growth driven by digitalization, social media adoption, and economic diversification under Vision 2030.