Region:Middle East

Author(s):Shubham

Product Code:KRAD1059

Pages:87

Published On:November 2025

By Type:The maternity wear market can be segmented into various types, including dresses, tops & tunics, bottoms (pants, leggings, skirts), outerwear (abayas, jackets, cardigans), activewear & athleisure, nursing wear, loungewear & sleepwear, maternity swimwear, undergarments & support wear, and others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse lifestyle choices of pregnant women. Demand for versatile and adaptive designs, such as nursing-friendly tops and stretchable bottoms, is rising as consumers prioritize comfort and multi-functionality .

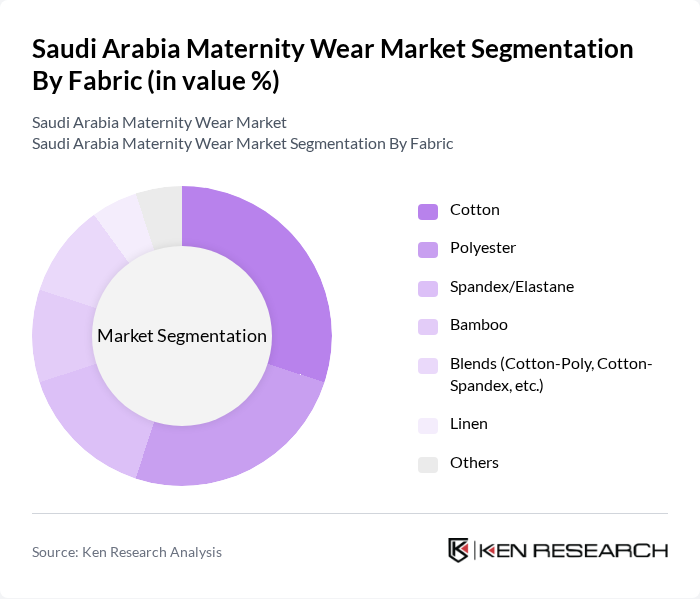

By Fabric:The market can also be segmented by fabric types, including cotton, polyester, spandex/elastane, bamboo, blends (cotton-poly, cotton-spandex, etc.), linen, and others. Each fabric type offers unique benefits, such as breathability, stretchability, and comfort, which are essential for maternity wear. There is a growing preference for soft, stretchable, and eco-friendly fabrics, with viscose lycra and bamboo blends gaining traction for their adaptability and comfort during pregnancy .

The Saudi Arabia Maternity Wear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mothercare Saudi Arabia, H&M MAMA, ASOS Maternity, Seraphine, PinkBlush Maternity, Boohoo Maternity, Next Maternity, Zara Maternity, Gap Maternity, Mamas & Papas, Destination Maternity, Isabella Oliver, Envie de Fraise, Noon.com (Maternity Category), Namshi (Maternity Category) contribute to innovation, geographic expansion, and service delivery in this space. These brands focus on product diversification, online and offline retail expansion, and the introduction of adaptive, comfort-driven designs to address evolving consumer needs .

The Saudi Arabia maternity wear market is poised for significant transformation, driven by evolving consumer preferences and increased digital engagement. As e-commerce continues to expand, brands are likely to enhance their online presence, making maternity wear more accessible. Additionally, the integration of sustainable practices and eco-friendly materials will resonate with environmentally conscious consumers. The focus on comfort and functionality will further shape product offerings, ensuring that the market remains responsive to the needs of expectant mothers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Dresses Tops & Tunics Bottoms (Pants, Leggings, Skirts) Outerwear (Abayas, Jackets, Cardigans) Activewear & Athleisure Nursing Wear Loungewear & Sleepwear Maternity Swimwear Undergarments & Support Wear Others |

| By Fabric | Cotton Polyester Spandex/Elastane Bamboo Blends (Cotton-Poly, Cotton-Spandex, etc.) Linen Others |

| By Distribution Channel | Online Retail (E-commerce, Brand Websites, Marketplaces) Offline Retail (Physical Stores) Specialty Maternity Stores Department Stores Supermarkets & Hypermarkets Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Age Group | Teens (15-19) Young Adults (20-29) Adults (30-39) Mature Adults (40+) Others |

| By Occasion | Everyday Wear Work Wear Special Events & Occasions Maternity Photoshoots Religious & Cultural Events Others |

| By Region | Central Region (Riyadh, Qassim, etc.) Eastern Region (Dammam, Khobar, etc.) Western Region (Jeddah, Makkah, Madinah, etc.) Southern Region (Abha, Jizan, etc.) Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expectant Mothers | 120 | Women aged 18-40, currently pregnant |

| Maternity Wear Retailers | 60 | Store Managers, Buyers, and Owners |

| Healthcare Professionals | 50 | Obstetricians, Gynecologists, and Midwives |

| Fashion Designers | 40 | Designers specializing in maternity and women's apparel |

| E-commerce Platforms | 40 | Marketing Managers, Product Managers |

The Saudi Arabia Maternity Wear Market is valued at approximately USD 1.8 billion, reflecting a significant growth trend driven by increasing birth rates, rising disposable incomes, and a growing awareness of maternity fashion among expectant mothers.