Region:Middle East

Author(s):Rebecca

Product Code:KRAB1791

Pages:90

Published On:October 2025

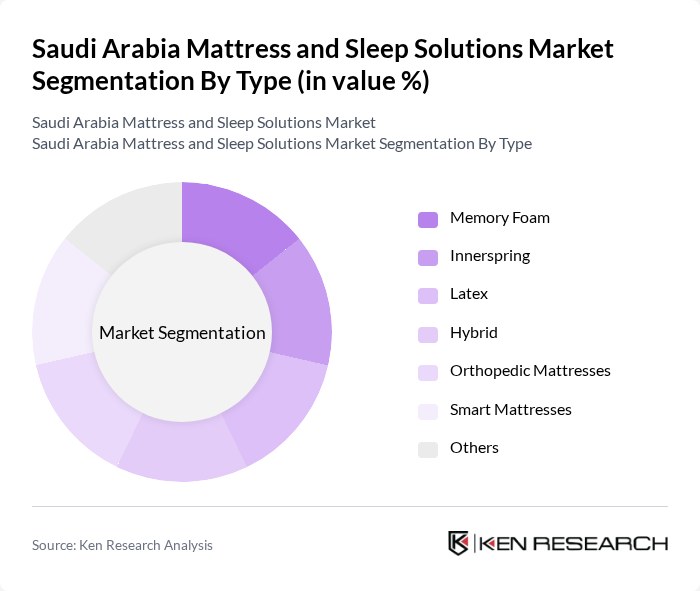

By Type:The mattress market is segmented into various types, including Memory Foam, Innerspring, Latex, Hybrid, Orthopedic Mattresses, Smart Mattresses, and Others. Among these,Memory Foammattresses are gaining significant traction due to their comfort, support, and pressure-relieving features, appealing to consumers seeking better sleep quality.Innerspringmattresses remain popular for their traditional feel, breathability, and affordability, whileHybridandSmart Mattressesare emerging as trends for tech-savvy and health-conscious consumers looking for advanced sleep tracking and customization features .

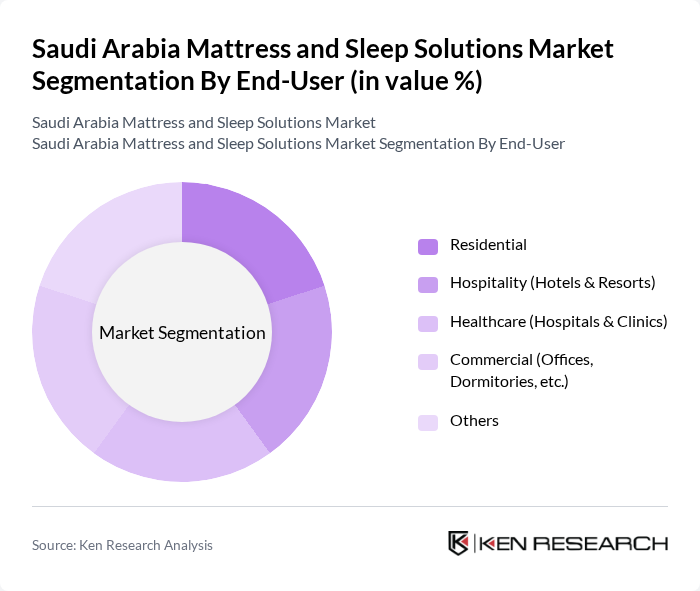

By End-User:The end-user segmentation includes Residential, Hospitality (Hotels & Resorts), Healthcare (Hospitals & Clinics), Commercial (Offices, Dormitories, etc.), and Others. TheResidentialsegment dominates the market, accounting for the majority of demand as consumers increasingly invest in quality sleep solutions for their homes, supported by government housing initiatives and rising homeownership. TheHospitalitysector is also significant, driven by the growth of tourism, hotel development, and the need for comfortable accommodations.Healthcarefacilities are recognizing the importance of quality mattresses for patient recovery and comfort, while commercial and institutional buyers are increasingly seeking fire-retardant and durable products .

The Saudi Arabia Mattress and Sleep Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nakheel Mattress Factory, Sleep High, IKEA Saudi Arabia, King Koil, Sealy, Tempur, Serta, Restonic, Sleepnice, Al Rajhi Group, Dunlopillo, Comfort Solutions, Dreamland, Royal Mattress, and Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi mattress and sleep solutions market is expected to evolve significantly in the coming years, driven by technological advancements and changing consumer preferences. As smart mattresses gain traction, manufacturers are likely to invest in innovative features that enhance sleep quality. Additionally, the increasing focus on sustainability will push brands to develop eco-friendly products, aligning with consumer demand for environmentally responsible options. This dynamic landscape presents opportunities for growth and differentiation in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Memory Foam Innerspring Latex Hybrid Orthopedic Mattresses Smart Mattresses Others |

| By End-User | Residential Hospitality (Hotels & Resorts) Healthcare (Hospitals & Clinics) Commercial (Offices, Dormitories, etc.) Others |

| By Distribution Channel | Online Retail (E-commerce) Offline Retail (Specialty Stores, Hypermarkets, etc.) Direct Sales (B2B) Wholesale/Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Foam Fabric/Textile Metal (Springs/Coils) Natural/Organic Materials Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Budget Brands Others |

| By Application | Home Use Hospitality Use Healthcare/Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Preferences | 120 | Homeowners, Renters aged 25-55 |

| Retail Sales Insights | 80 | Store Managers, Sales Representatives |

| Health and Sleep Expert Opinions | 50 | Sleep Specialists, Physiotherapists |

| Online Shopping Behavior | 100 | eCommerce Shoppers, Digital Marketing Managers |

| Trends in Sleep Accessories | 60 | Product Designers, Retail Buyers |

The Saudi Arabia Mattress and Sleep Solutions Market is valued at approximately USD 760 million, reflecting significant growth driven by increased consumer awareness of sleep health, rising disposable incomes, and urbanization trends.