Region:Middle East

Author(s):Rebecca

Product Code:KRAC2549

Pages:88

Published On:October 2025

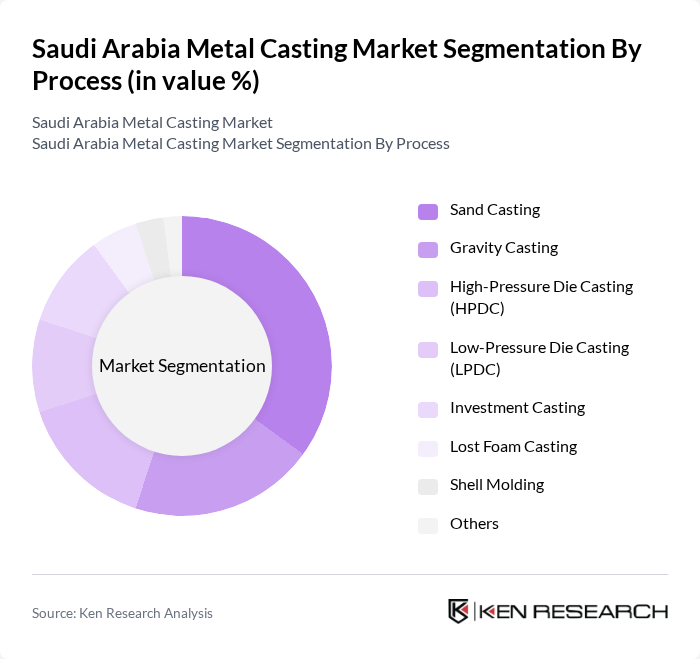

By Process:The metal casting market can be segmented based on various processes used in manufacturing. The primary processes include Sand Casting, Gravity Casting, High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Investment Casting, Lost Foam Casting, Shell Molding, and Others. Sand Casting remains the most widely used process due to its versatility, cost-effectiveness, and suitability for producing a broad range of components, especially in automotive and industrial machinery. The adoption of high-pressure die casting and investment casting is rising, driven by demand for precision and lightweight parts in automotive and aerospace sectors .

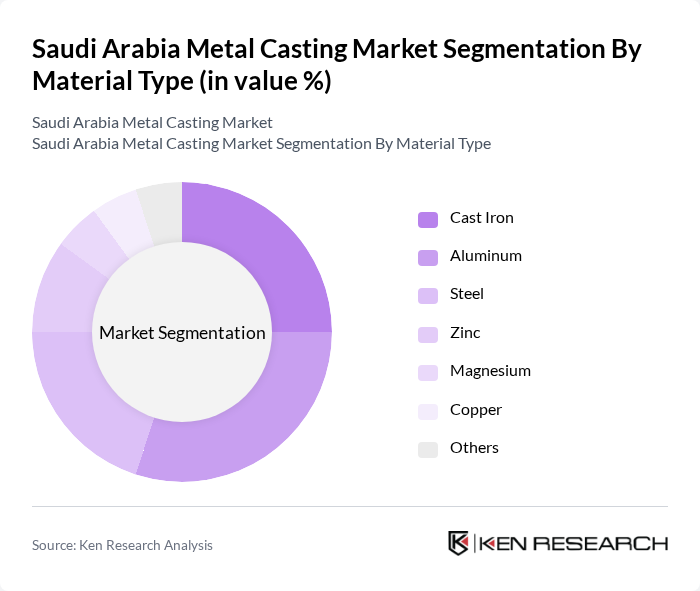

By Material Type:The market can also be segmented based on the types of materials used in metal casting. The primary materials include Cast Iron, Aluminum, Steel, Zinc, Magnesium, Copper, and Others. Aluminum is the leading material, driven by its lightweight properties, excellent corrosion resistance, and suitability for automotive and aerospace applications. Cast iron and steel remain essential for heavy-duty industrial and construction components, while demand for zinc and magnesium is rising in precision casting for electronics and transportation .

The Saudi Arabia Metal Casting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Mining Company (Ma'aden), Gulf Casting Company, Saudi Cast, Al-Jazira Foundry, Al-Rajhi Steel, Al-Babtain Group, Al-Suwaidi Industrial Services, Al-Muhaidib Group, Al-Khodari & Sons, Al-Falak Casting, Saudi Steel Pipe Company, Al-Mansoori Specialized Engineering, Arabian International Company (AIC Steel), Zamil Steel, Al-Tuwairqi Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia metal casting market appears promising, driven by ongoing investments in technology and infrastructure. As the government continues to support local manufacturing through incentives and initiatives, the industry is likely to see increased efficiency and competitiveness. Additionally, the shift towards sustainable practices and advanced materials will play a crucial role in shaping the market landscape, enabling local manufacturers to meet both domestic and international demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Process | Sand Casting Gravity Casting High-Pressure Die Casting (HPDC) Low-Pressure Die Casting (LPDC) Investment Casting Lost Foam Casting Shell Molding Others |

| By Material Type | Cast Iron Aluminum Steel Zinc Magnesium Copper Others |

| By End Use | Automotive and Transportation Equipment and Machine Building and Construction Aerospace and Military Consumer Goods Electronics Others |

| By Application | Engine Components Structural Components Decorative Components Electrical Components Others |

| By Region | Northern and Central Region Western Region Eastern Region Southern Region |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metal Casting | 120 | Production Managers, Quality Control Engineers |

| Aerospace Component Manufacturing | 90 | Design Engineers, Operations Directors |

| Construction Material Casting | 80 | Project Managers, Procurement Specialists |

| Industrial Equipment Foundries | 60 | Facility Managers, Supply Chain Coordinators |

| Metal Recycling and Recasting | 50 | Sustainability Managers, Process Engineers |

The Saudi Arabia Metal Casting Market is valued at approximately USD 1.6 billion, driven by increasing demand for lightweight and complex metal components across various industries, including automotive, construction, and machinery.