Region:Middle East

Author(s):Dev

Product Code:KRAD0521

Pages:92

Published On:August 2025

By Type:

The MICE market in Saudi Arabia is segmented into four main types: Meetings, Incentives, Conferences, and Exhibitions. Among these, the Conferences sub-segment is currently dominating the market due to the increasing number of international conferences being hosted in the country. The rise in corporate and academic interest in Saudi Arabia as a conference destination is driven by the government's efforts to attract global organizations and enhance knowledge sharing. Additionally, the growing trend of hybrid events, combining in-person and virtual participation, has further boosted the conference segment's growth. Evidence of increasing event volumes, international attendance, and large-scale conference platforms (e.g., Future Investment Initiative, International MICE Summit) supports this dynamic .

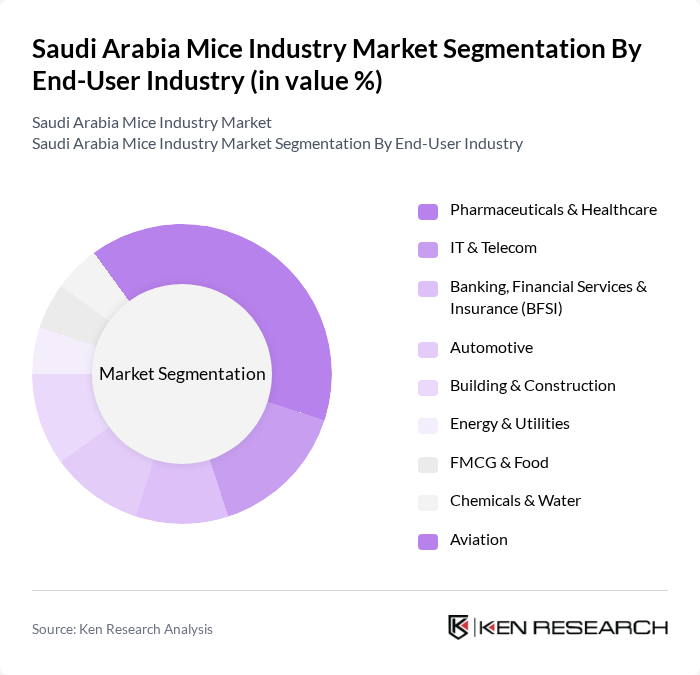

By End-User Industry:

The MICE market is further segmented by end-user industries, including Pharmaceuticals & Healthcare, IT & Telecom, Banking, Financial Services & Insurance (BFSI), Automotive, Building & Construction, Energy & Utilities, FMCG & Food, Chemicals & Water, and Aviation. The Pharmaceuticals & Healthcare sector is leading this segment, driven by the increasing number of medical conferences and exhibitions aimed at sharing advancements in healthcare. The sector's growth is supported by rising demand for healthcare services and innovations, as reflected by the increasing number of scientific and professional gatherings and sustained investment in health under Vision 2030’s quality-of-life and healthcare transformation pillars .

The Saudi Arabia Mice Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sela, Benchmark Events, 360LIVE, Enso Events, Masahaat, Riyadh International Convention & Exhibition Center (RICEC), Jeddah Superdome, Saudi Conventions & Exhibitions General Authority (SCEGA), Saudi Tourism Authority (STA), King Abdulaziz Center for World Culture (Ithra), Diriyah Gate Development Authority (DGDA) – Events, Riyadh Front Exhibition & Conference Center, Jeddah Center for Forums & Events, Hilton Riyadh Hotel & Residences – Events & MICE, Crowne Plaza Riyadh RDC Hotel & Convention Center contribute to innovation, geographic expansion, and service delivery in this space. Recent market analyses list several of these entities among key players and venues driving event volumes and international profile .

The future of the Saudi Arabia MICE industry appears promising, driven by ongoing government initiatives and a growing emphasis on international collaboration. As the country continues to enhance its infrastructure and promote tourism, the MICE sector is expected to flourish. The integration of advanced technologies and sustainable practices will likely shape the industry's evolution, making it more attractive to global organizers and participants. This transformation will position Saudi Arabia as a leading MICE destination in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Meetings Incentives Conferences Exhibitions |

| By End-User Industry | Pharmaceuticals & Healthcare IT & Telecom Banking, Financial Services & Insurance (BFSI) Automotive Building & Construction Energy & Utilities FMCG & Food Chemicals & Water Aviation |

| By Venue Type | Convention & Exhibition Centers Hotels & Resorts Unique Venues (Cultural, Heritage, Outdoor) Multi-purpose Arenas Others |

| By Region | Central West East South Others |

| By Revenue Source | Tickets & Registration Fees Accommodation Food & Beverage Advertising Exhibit Space Rental Sponsorships Transportation Others |

| By Duration | One-Day Events Multi-Day Events Ongoing Series |

| By Budget Range | Low Budget Mid Budget High Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Planners | 100 | Event Managers, Marketing Directors |

| Exhibition Organizers | 80 | Exhibition Managers, Sales Executives |

| Venue Operators | 70 | Facility Managers, Operations Directors |

| Travel and Hospitality Providers | 90 | Travel Agents, Hotel Managers |

| Government Tourism Officials | 60 | Policy Makers, Tourism Development Officers |

The Saudi Arabia MICE industry market is valued at approximately USD 2.62.9 billion, reflecting significant growth driven by government initiatives to diversify the economy and enhance tourism, alongside an increase in international events.