Region:Middle East

Author(s):Shubham

Product Code:KRAA8612

Pages:94

Published On:November 2025

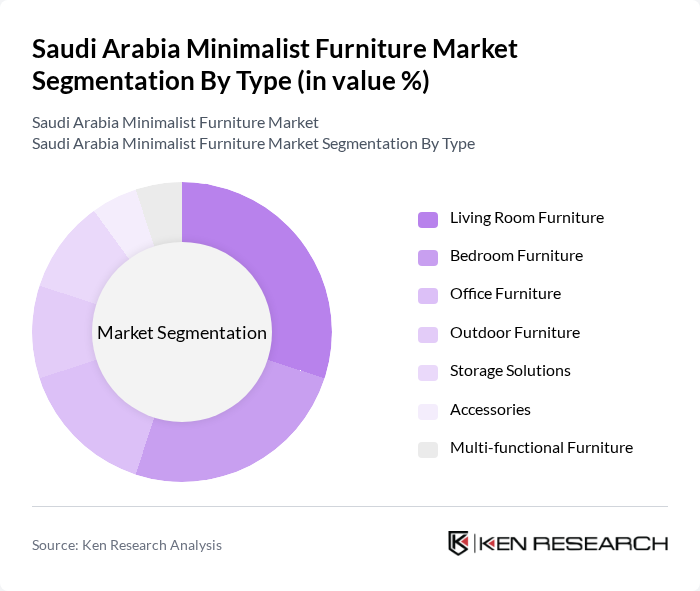

By Type:The market is segmented into living room furniture, bedroom furniture, office furniture, outdoor furniture, storage solutions, accessories, and multi-functional furniture. Living room and bedroom furniture remain the largest sub-segments, reflecting strong consumer demand for minimalist sofas, tables, beds, and storage units that combine clean lines with practical features. Office furniture is increasingly sought after due to the rise of remote and hybrid work models, driving demand for ergonomic, modular, and smart furniture solutions. Outdoor furniture and accessories are gaining popularity as consumers invest in minimalist designs for patios and balconies, while multi-functional furniture addresses the need for versatility in smaller urban homes.

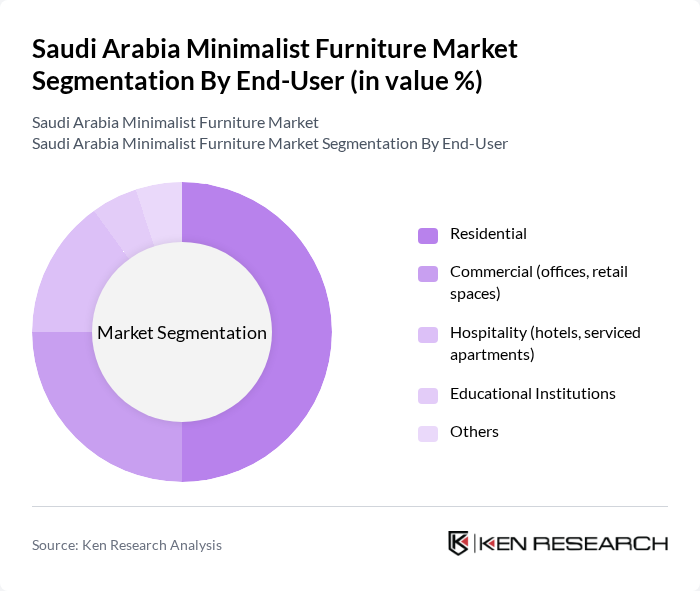

By End-User:The market is segmented based on end-users, including residential, commercial, hospitality, educational institutions, and others. Residential applications account for the largest share, driven by consumer preference for minimalist designs that enhance well-being and efficiency in homes. Commercial demand is fueled by the expansion of offices and retail spaces, with a focus on collaborative and flexible furniture solutions. Hospitality sector growth is supported by luxury hotel and serviced apartment developments, while educational institutions and other segments seek durable, space-saving furniture to optimize learning and communal environments.

The Saudi Arabia Minimalist Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Al-Futtaim Group, THE One, Muji, Habitat, JYSK, Royal Furniture, Danube Home, Home Box, Mamas & Papas, KARE Design, West Elm, Crate & Barrel, BoConcept, Vitra International AG, RIS Store KSA, Almutlaq Furniture, and Al Rugaib Furniture contribute to innovation, geographic expansion, and service delivery in this space. These companies are expanding their product portfolios to include eco-friendly and multi-functional minimalist designs, leveraging digital platforms and omnichannel strategies to enhance customer engagement and market reach.

The future of the Saudi Arabia minimalist furniture market appears promising, driven by increasing urbanization and a shift towards sustainable living. As disposable incomes rise, consumers are likely to invest more in stylish, functional furniture that aligns with modern design trends. Additionally, the growing influence of e-commerce platforms will facilitate access to minimalist furniture, allowing brands to reach a broader audience. Overall, the market is poised for growth as consumer preferences evolve towards contemporary and eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Storage Solutions (e.g., minimalist cabinets, shelves, modular storage) Accessories (e.g., minimalist lighting, décor, rugs) Multi-functional Furniture (e.g., sofa beds, extendable tables) |

| By End-User | Residential Commercial (offices, retail spaces) Hospitality (hotels, serviced apartments) Educational Institutions Others |

| By Material | Wood (solid wood, engineered wood) Metal (steel, aluminum) Plastic (polypropylene, recycled plastics) Fabric (upholstery, eco-fabrics) Glass & Stone (tempered glass, marble, ceramics) Others |

| By Design Style | Scandinavian Japanese Industrial Contemporary Modern Arabian Minimalism Others |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (showrooms, specialty stores) Direct Sales (B2B, project-based) Wholesale Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Customer Segment | Millennials Gen X Baby Boomers Families Expatriates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Minimalist Furniture | 120 | Homeowners, Renters, Interior Design Enthusiasts |

| Retail Insights from Furniture Stores | 80 | Store Managers, Sales Representatives, Marketing Managers |

| Architectural Trends in Minimalist Design | 60 | Architects, Interior Designers, Urban Planners |

| Online Shopping Behavior for Furniture | 100 | eCommerce Shoppers, Digital Marketing Analysts |

| Market Trends from Industry Experts | 40 | Market Analysts, Industry Consultants, Trade Association Members |

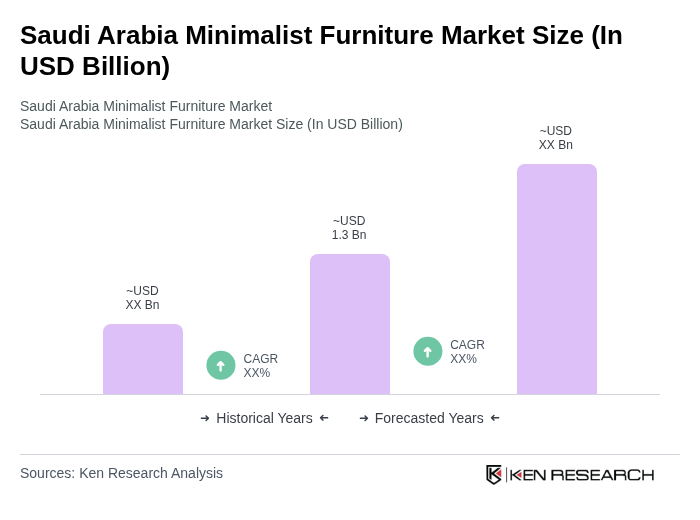

The Saudi Arabia Minimalist Furniture Market is valued at approximately USD 1.3 billion. This valuation is based on a five-year historical analysis and reflects the growing demand for space-efficient and aesthetically pleasing furniture solutions among urban consumers.