Region:Middle East

Author(s):Dev

Product Code:KRAC2695

Pages:91

Published On:October 2025

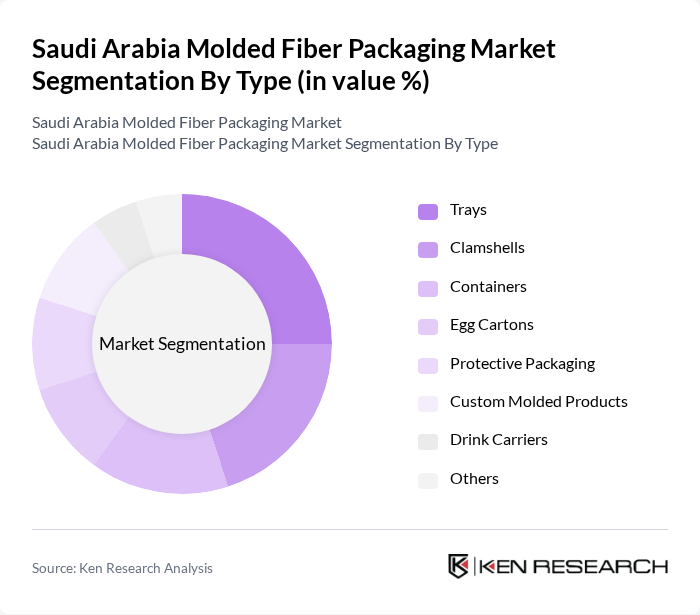

By Type:The molded fiber packaging market can be segmented into various types, including trays, clamshells, containers, egg cartons, protective packaging, custom molded products, drink carriers, and others. Among these, trays and clamshells are particularly popular due to their versatility and effectiveness in protecting products during transportation and storage. The demand for eco-friendly packaging solutions has led to a significant increase in the use of molded fiber products, as they are biodegradable and made from recycled materials. Trays are especially dominant in the food and beverage sector, while clamshells and containers are increasingly used for electronics and consumer goods packaging .

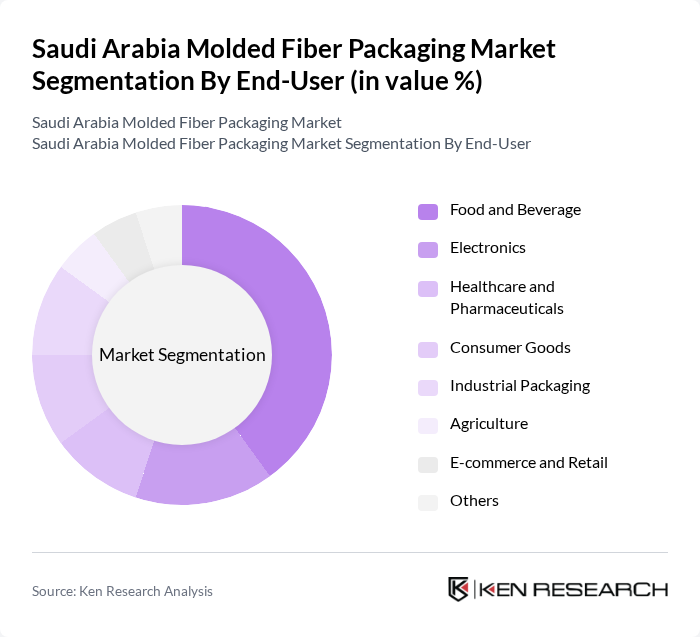

By End-User:The end-user segmentation includes food and beverage, electronics, healthcare and pharmaceuticals, consumer goods, industrial packaging, agriculture, e-commerce and retail, and others. The food and beverage sector is the largest consumer of molded fiber packaging, driven by the increasing demand for sustainable packaging solutions and the growing trend of takeout and delivery services. Additionally, the healthcare sector is also witnessing a rise in the use of molded fiber packaging for medical supplies and equipment. Electronics and e-commerce are also emerging as significant end-users due to the need for protective and sustainable packaging for shipping and product safety .

The Saudi Arabia Molded Fiber Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huhtamaki Saudi Arabia Ltd., Zain Pack, Saudi Paper Manufacturing Co., Napco National, Arabian Paper Products Co., International Paper, Pactiv Evergreen, Smurfit Kappa Group, DS Smith, Stora Enso, Sonoco Products Company, UFP Technologies, BioPak, Greiner Packaging International, Molded Fiber Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the molded fiber packaging market in Saudi Arabia appears promising, driven by increasing consumer awareness and government support for sustainable practices. As businesses adapt to changing regulations and consumer preferences, the market is expected to see innovations in production technologies and materials. Additionally, the integration of smart packaging solutions is likely to enhance product appeal, further aligning with the global shift towards sustainability and circular economy practices, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Trays Clamshells Containers Egg Cartons Protective Packaging Custom Molded Products Drink Carriers Others |

| By End-User | Food and Beverage Electronics Healthcare and Pharmaceuticals Consumer Goods Industrial Packaging Agriculture E-commerce and Retail Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distributors Retail Outlets Others |

| By Material Type | Recycled Paper Pulp Virgin Fiber Mixed Pulp Biodegradable Composites Others |

| By Application | Protective Packaging Food Service Packaging Electronics Packaging Cosmetic and Personal Care Packaging Agricultural Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 100 | Packaging Managers, Supply Chain Coordinators |

| Consumer Electronics Packaging | 70 | Product Managers, Logistics Directors |

| Retail Packaging Solutions | 60 | Retail Operations Managers, Procurement Specialists |

| Industrial Applications | 50 | Manufacturing Engineers, Quality Assurance Managers |

| Sustainability Initiatives in Packaging | 80 | Sustainability Managers, Corporate Social Responsibility Officers |

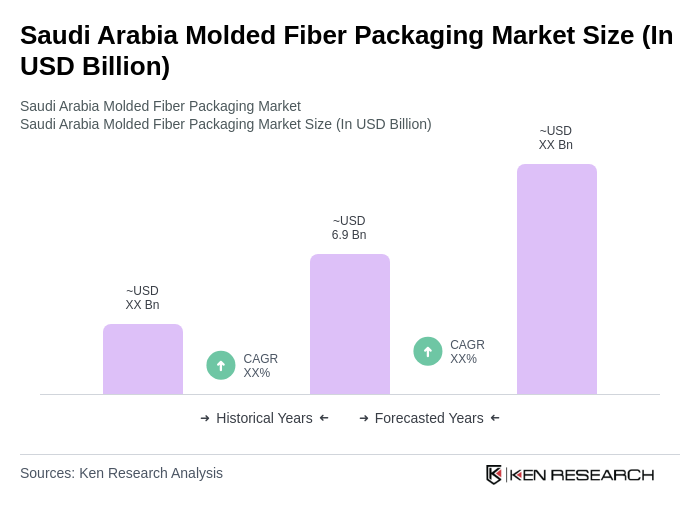

The Saudi Arabia Molded Fiber Packaging Market is valued at approximately USD 6.9 billion, reflecting a significant growth trend driven by the demand for sustainable packaging solutions, particularly in the food and beverage sector.