Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5864

Pages:97

Published On:December 2025

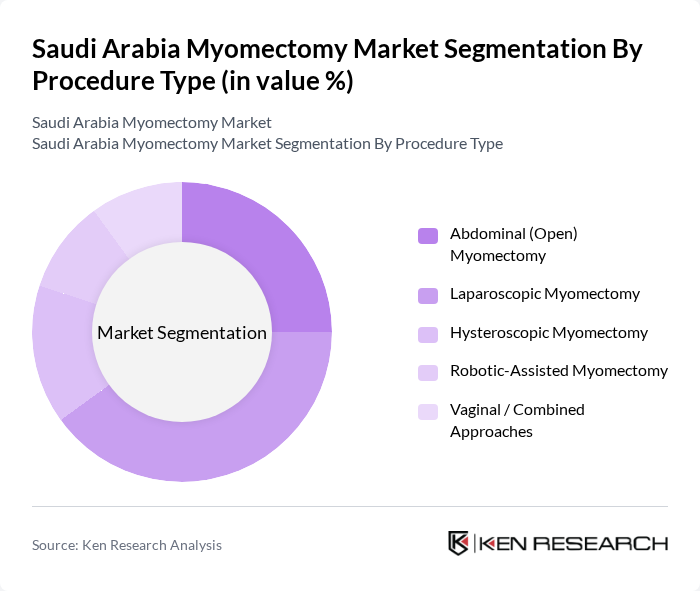

By Procedure Type:The procedure type segmentation includes various surgical methods employed for myomectomy, each catering to different patient needs and clinical scenarios. The subsegments include Abdominal (Open) Myomectomy, Laparoscopic Myomectomy, Hysteroscopic Myomectomy, Robotic-Assisted Myomectomy, and Vaginal / Combined Approaches. Laparoscopic Myomectomy is increasingly preferred as part of a broader global shift toward minimally invasive surgery, supported by evidence of reduced blood loss, shorter hospital stay, and faster return to normal activities, with global data indicating that laparoscopic approaches account for the largest single share of myomectomy procedures.

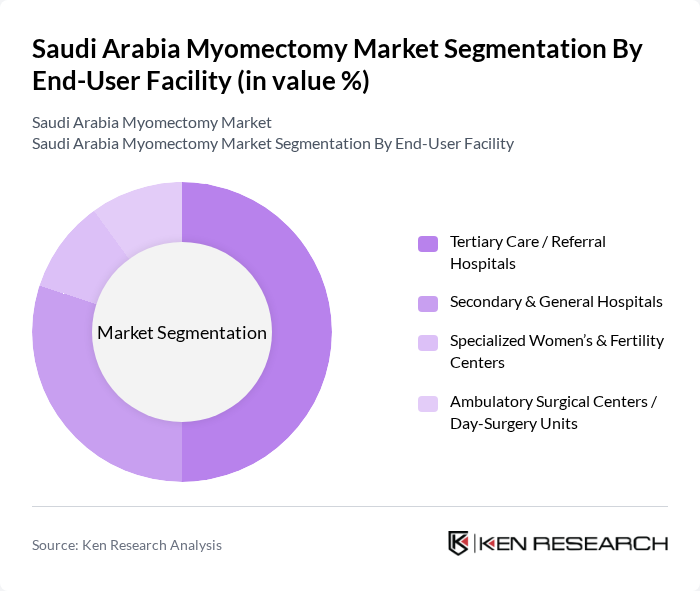

By End-User Facility:This segmentation focuses on the types of healthcare facilities where myomectomy procedures are performed. The subsegments include Tertiary Care / Referral Hospitals, Secondary & General Hospitals, Specialized Women’s & Fertility Centers, and Ambulatory Surgical Centers / Day-Surgery Units. Tertiary Care Hospitals dominate this segment as they host advanced laparoscopic and robotic platforms, multidisciplinary gyne-oncology and reproductive medicine teams, and are typically the main referral points for complex fibroid cases, aligning with global patterns in which large hospitals account for the majority of myomectomy procedures while ambulatory and specialty centers grow in share.

The Saudi Arabia Myomectomy Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Faisal Specialist Hospital & Research Centre, Riyadh, King Abdulaziz Medical City (National Guard Health Affairs), Riyadh, King Saud University Medical City, Riyadh, Dr. Sulaiman Al Habib Medical Group, Saudi German Health (Saudi German Hospital, Riyadh & Jeddah), Mouwasat Medical Services Co., International Medical Center, Jeddah, Dallah Health Company (Dallah Hospital), Riyadh, Al Hammadi Hospitals Co., Al-Moosa Specialist Hospital, Al-Ahsa, King Fahd Medical City, Riyadh, Security Forces Hospital Program, Riyadh, King Abdullah Medical City, Makkah, Dr. Erfan & Bagedo General Hospital, Jeddah, Kingdom Hospital, Riyadh contribute to innovation, geographic expansion, and service delivery in this space.

The future of the myomectomy market in Saudi Arabia appears promising, driven by advancements in surgical technology and increasing patient awareness. The integration of robotic-assisted surgeries is expected to enhance precision and reduce recovery times, making procedures more appealing. Additionally, the growing trend of outpatient surgical options will likely lead to increased patient throughput, further supporting market growth. As healthcare infrastructure continues to improve, access to myomectomy procedures will expand, benefiting more women across the region.

| Segment | Sub-Segments |

|---|---|

| By Procedure Type | Abdominal (Open) Myomectomy Laparoscopic Myomectomy Hysteroscopic Myomectomy Robotic-Assisted Myomectomy Vaginal / Combined Approaches |

| By End-User Facility | Tertiary Care / Referral Hospitals Secondary & General Hospitals Specialized Women’s & Fertility Centers Ambulatory Surgical Centers / Day-Surgery Units |

| By Patient Demographics | Age Group (20–29, 30–39, 40–49, 50+ years) Parity Status (Nulliparous, Multiparous) Nationality (Saudi Nationals, Expatriates) Geographic Distribution (Riyadh, Makkah, Eastern Province, Others) |

| By Surgical Setting & Approach | Inpatient Surgery Day-Care / Outpatient Surgery Emergency vs Elective Procedures |

| By Clinical Complexity | Single Small Fibroid (<5 cm) Multiple / Large Fibroids (?5 cm) Recurrent Fibroids / Previous Myomectomy High-Risk Cases (Severe Anemia, Comorbidities) |

| By Reimbursement & Payer Type | Ministry of Health (Public Funding) Other Government & Military Providers Private Health Insurance Self-Pay / Out-of-Pocket |

| By Region | Central Region Western Region Eastern Region Northern & Southern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gynecological Surgeons | 60 | Consultant Gynecologists, Surgical Specialists |

| Hospital Administrators | 50 | Healthcare Facility Managers, Operations Directors |

| Patients Post-Myomectomy | 75 | Women who have undergone myomectomy in the last 2 years |

| Health Insurance Providers | 40 | Policy Analysts, Claims Managers |

| Healthcare Policy Experts | 40 | Health Economists, Policy Advisors |

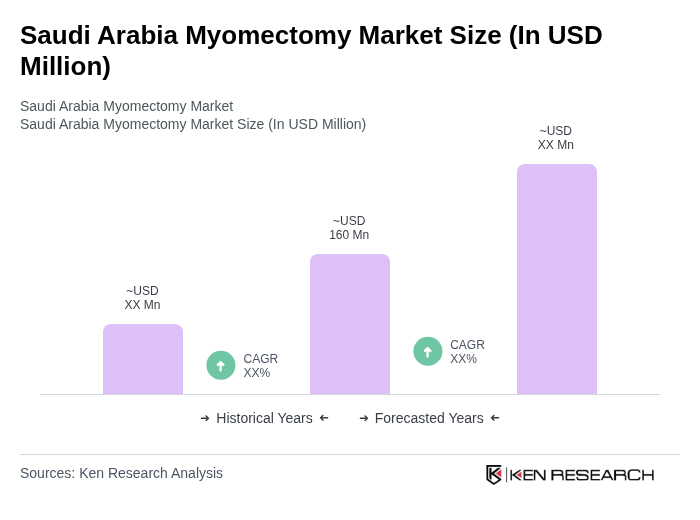

The Saudi Arabia Myomectomy Market is valued at approximately USD 160 million, reflecting a significant demand for myomectomy procedures driven by increasing awareness of women's health issues and the prevalence of uterine fibroids among women of reproductive age.