Region:Middle East

Author(s):Dev

Product Code:KRAC2666

Pages:100

Published On:October 2025

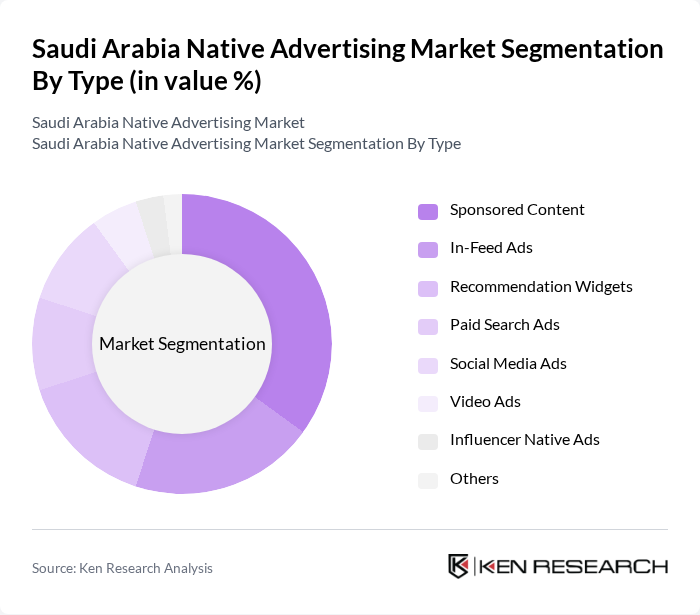

By Type:The native advertising market in Saudi Arabia is segmented into Sponsored Content, In-Feed Ads, Recommendation Widgets, Paid Search Ads, Social Media Ads, Video Ads, Influencer Native Ads, and Others. Among these, Sponsored Content is the leading sub-segment, driven by its ability to deliver informative branded content that resonates with audiences. Advertisers increasingly prefer this format for its high engagement rates and alignment with consumer interests .

By End-User:The end-user segmentation of the native advertising market includes Retail & E-commerce, Travel and Tourism, Technology, Automotive, Healthcare & Pharmaceuticals, Education, Government & Public Sector, Entertainment & Media, and Others. The Retail & E-commerce sector is the dominant segment, leveraging native advertising to drive online sales and enhance customer engagement through personalized and contextually relevant content. Healthcare and Technology sectors are also experiencing accelerated adoption due to increased digital transformation and regulatory support for digital outreach .

The Saudi Arabia Native Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Taboola, Outbrain, Sharethrough, Revcontent, Adyoulike, TripleLift, Nativo, Teads, StackAdapt, Bidtellect, Zemanta, Media.net, Criteo, Facebook Audience Network, Google AdSense, STC Media (Saudi Telecom Company), Al Arabiya Network, Mobily Digital Marketing, OMD Saudi Arabia (Omnicom Media Group), WPP Saudi Arabia, Publicis Groupe Middle East, Dentsu KSA, Havas Media Middle East, GroupM MENA, AdColony MENA, Snap Inc. MENA, Google Arabia, Meta Platforms (Facebook) MENA, TikTok MENA (ByteDance), LinkedIn MENA, Almarai Digital, Jarir Marketing Company, Accenture Song Middle East, Creative Waves Advertising, and Advertising Ways contribute to innovation, geographic expansion, and service delivery in this space.

The future of native advertising in Saudi Arabia appears promising, driven by technological advancements and changing consumer preferences. As brands increasingly leverage artificial intelligence to personalize content, the effectiveness of native ads is expected to improve significantly. Additionally, the expansion of e-commerce platforms will create new avenues for native advertising, allowing brands to integrate their messaging seamlessly into shopping experiences. This evolution will likely enhance consumer engagement and drive higher conversion rates in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sponsored Content In-Feed Ads Recommendation Widgets Paid Search Ads Social Media Ads Video Ads Influencer Native Ads Others |

| By End-User | Retail & E-commerce Travel and Tourism Technology Automotive Healthcare & Pharmaceuticals Education Government & Public Sector Entertainment & Media Others |

| By Industry | Consumer Goods Financial Services Telecommunications Media and Entertainment Real Estate Others |

| By Platform | Social Media Platforms (Instagram, Snapchat, TikTok, Twitter) News Websites Blogs Mobile Applications Video Streaming Services (YouTube, Shahid) Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Event Promotion Campaigns Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPI) Cost Per Acquisition (CPA) Flat Rate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Native Advertising Strategies | 100 | Marketing Managers, Brand Strategists |

| Travel and Tourism Native Ads | 60 | Digital Marketing Directors, Content Creators |

| Technology Sector Ad Campaigns | 50 | Product Marketing Managers, Advertising Analysts |

| Consumer Goods Native Advertising | 70 | Brand Managers, Media Buyers |

| Financial Services Digital Marketing | 40 | Chief Marketing Officers, Digital Strategy Leads |

The Saudi Arabia Native Advertising Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital marketing strategies, social media proliferation, and a preference for content that integrates seamlessly with user experiences.