Region:Middle East

Author(s):Shubham

Product Code:KRAA8613

Pages:98

Published On:November 2025

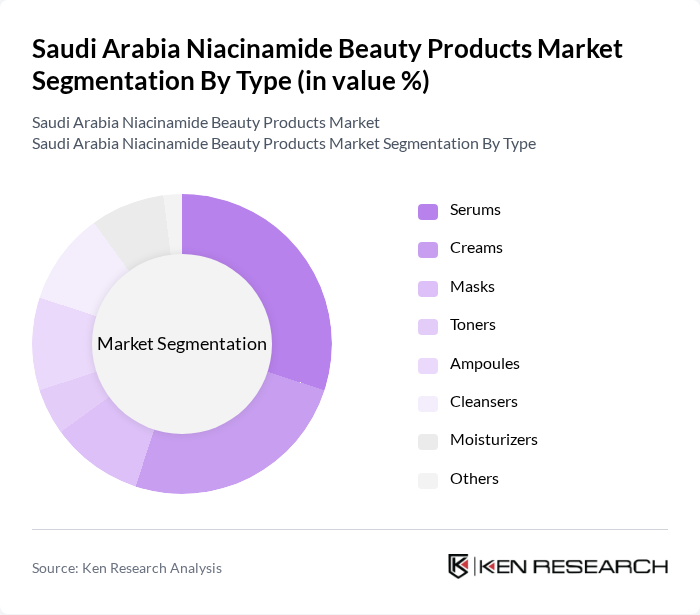

By Type:The market is segmented into various types of products, including serums, creams, masks, toners, ampoules, cleansers, moisturizers, and others. Among these, serums and moisturizers are particularly popular due to their concentrated formulations and effectiveness in delivering niacinamide benefits directly to the skin. The demand for these products is driven by consumer preferences for targeted skincare solutions that address specific skin issues. Serums, especially those with niacinamide concentrations between 6% and 10%, are favored for their balance of efficacy and skin tolerance, making them widely accepted across diverse consumer bases , .

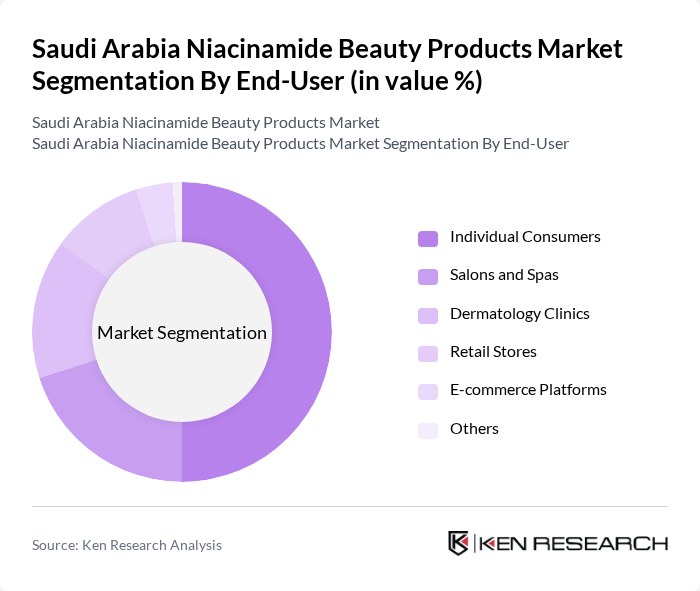

By End-User:The end-user segmentation includes individual consumers, salons and spas, dermatology clinics, retail stores, e-commerce platforms, and others. Individual consumers represent the largest segment, driven by the growing trend of personal skincare routines and the increasing availability of niacinamide products through various retail channels. Salons and dermatology clinics also contribute significantly, as they often recommend these products to clients seeking professional skincare solutions. The rise of online shopping and social commerce has further expanded access to niacinamide products, especially among younger demographics .

The Saudi Arabia Niacinamide Beauty Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Ordinary (DECIEM Inc.), Paula's Choice, Neutrogena (Johnson & Johnson), L'Oréal Paris, CeraVe (L'Oréal Group), La Roche-Posay (L'Oréal Group), SkinCeuticals (L'Oréal Group), Olay (Procter & Gamble), Bioderma (NAOS), Eucerin (Beiersdorf AG), Nivea (Beiersdorf AG), Kiehl's (L'Oréal Group), Clinique (Estée Lauder Companies), Vichy (L'Oréal Group), Garnier (L'Oréal Group), Huda Beauty, Shifa Cosmetics, Al Jamal Cosmetics, Faces (Chalhoub Group), Bath & Body Works (Saudi Franchise) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the niacinamide beauty products market in Saudi Arabia appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek multifunctional products, brands are likely to innovate with formulations that combine niacinamide with other beneficial ingredients. Additionally, the expansion of digital marketing strategies will enhance brand visibility, particularly among younger consumers who prioritize online shopping and social media engagement, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Serums Creams Masks Toners Ampoules Cleansers Moisturizers Others |

| By End-User | Individual Consumers Salons and Spas Dermatology Clinics Retail Stores E-commerce Platforms Others |

| By Skin Type | Oily Skin Dry Skin Combination Skin Sensitive Skin Normal Skin Others |

| By Distribution Channel | Online Retail Offline Retail Pharmacies & Drugstores Direct Sales Others |

| By Packaging Type | Bottles Tubes Jars Sachets Pumps & Droppers Others |

| By Price Range | Premium Mid-range Budget Others |

| By Brand Type | International Brands Local Brands Private Labels Halal-Certified Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Niacinamide Products | 100 | Beauty Retail Managers, Skincare Product Buyers |

| Consumer Preferences in Skincare | 120 | Skincare Enthusiasts, General Consumers |

| Expert Insights on Skincare Ingredients | 50 | Dermatologists, Cosmetic Chemists |

| Market Trends in E-commerce | 80 | E-commerce Managers, Digital Marketing Specialists |

| Brand Perception Studies | 60 | Brand Managers, Marketing Directors |

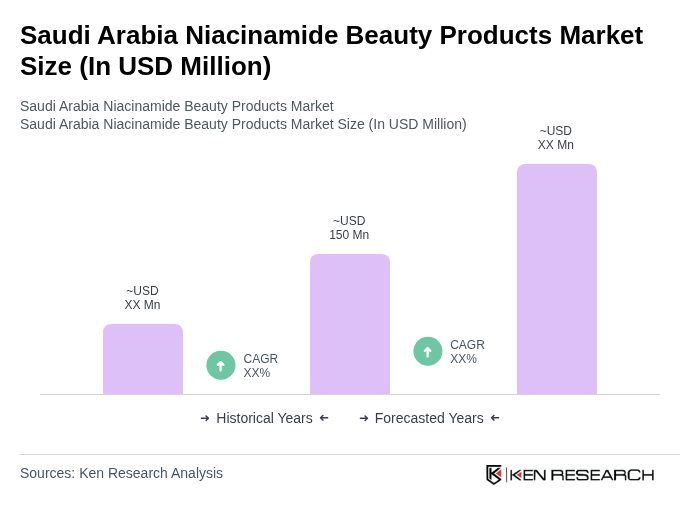

The Saudi Arabia Niacinamide Beauty Products Market is valued at approximately USD 150 million, reflecting a growing consumer interest in skincare solutions that address issues like hyperpigmentation, acne, and aging.