Region:Middle East

Author(s):Rebecca

Product Code:KRAD4310

Pages:81

Published On:December 2025

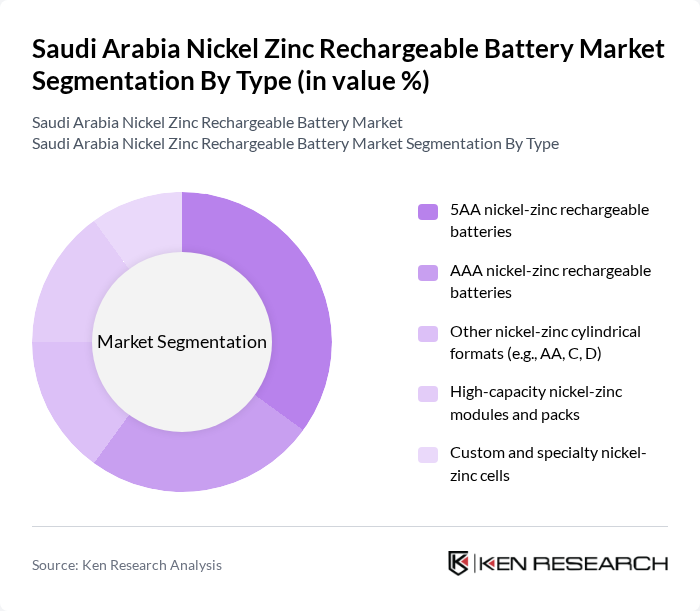

By Type:The market is segmented into various types of nickel-zinc rechargeable batteries, including 5AA nickel-zinc rechargeable batteries, AAA nickel-zinc rechargeable batteries, other nickel-zinc cylindrical formats (e.g., AA, C, D), high-capacity nickel-zinc modules and packs, and custom and specialty nickel-zinc cells. Among these, the 5AA nickel-zinc rechargeable batteries are leading the market due to their widespread application in consumer electronics and electric mobility solutions. The growing trend towards sustainable energy storage solutions is also boosting the demand for high-capacity modules and packs, which are increasingly being adopted in commercial and industrial applications.

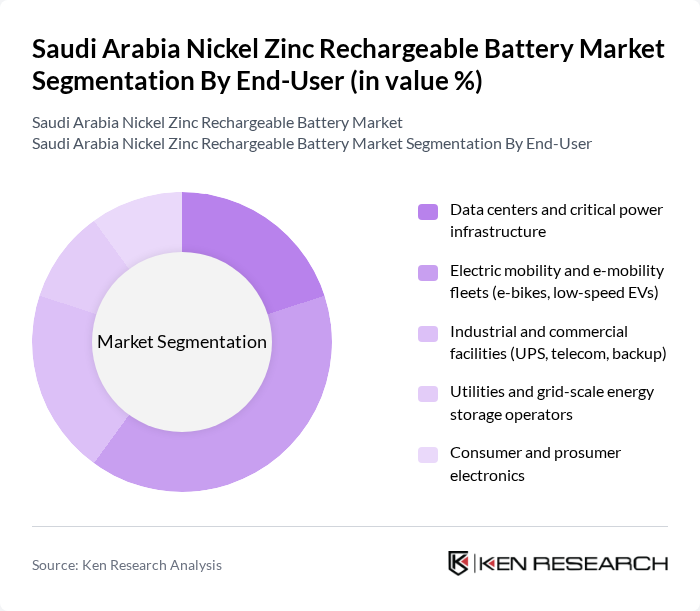

By End-User:The end-user segmentation includes data centers and critical power infrastructure, electric mobility and e-mobility fleets (e-bikes, low-speed EVs), industrial and commercial facilities (UPS, telecom, backup), utilities and grid-scale energy storage operators, and consumer and prosumer electronics. The electric mobility sector is currently the dominant end-user, driven by the increasing adoption of electric vehicles and the need for efficient energy storage solutions. Data centers are also significant consumers, as they require reliable backup power systems to ensure uninterrupted operations.

The Saudi Arabia Nickel Zinc Rechargeable Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZincFive, Inc., ZAF Energy Systems, Inc., Saft Groupe S.A., Panasonic Corporation, Duracell Inc., Energizer Holdings, Inc., BetterPower Battery Co., Ltd., EverZinc, VARTA AG, Samsung SDI Co., Ltd., LG Energy Solution, Ltd., Contemporary Amperex Technology Co., Limited (CATL), Northvolt AB, Farasis Energy, Inc., and local and regional energy storage integrators active in nickel-zinc solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia nickel zinc rechargeable battery market appears promising, driven by increasing investments in renewable energy and electric vehicle infrastructure. As the government continues to implement policies supporting sustainable energy, the demand for efficient energy storage solutions is expected to rise. Additionally, advancements in battery technology will likely enhance performance and reduce costs, making nickel zinc batteries more attractive to consumers and businesses alike, fostering a more sustainable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | AA nickel-zinc rechargeable batteries AAA nickel-zinc rechargeable batteries Other nickel-zinc cylindrical formats (e.g., AA, C, D) High-capacity nickel-zinc modules and packs Custom and specialty nickel-zinc cells |

| By End-User | Data centers and critical power infrastructure Electric mobility and e-mobility fleets (e-bikes, low-speed EVs) Industrial and commercial facilities (UPS, telecom, backup) Utilities and grid-scale energy storage operators Consumer and prosumer electronics |

| By Application | Uninterruptible power supply (UPS) and backup systems Telecom base stations and mission?critical sites Renewable energy integration and BESS Transportation and motive power (rail, material handling, auxiliary) Portable and consumer applications |

| By Market Channel | Direct sales to utilities, EPCs, and large industrial customers Local industrial and electrical distributors OEM partnerships and project-based channels Online and retail channels System integrators and value-added resellers |

| By Technology | Nickel-zinc batteries for stationary storage Nickel-zinc batteries for motive and transportation use Hybrid systems (nickel-zinc with other chemistries) Emerging and advanced nickel-zinc formulations |

| By Investment Source | Public Investment Fund (PIF) and sovereign-backed projects Private domestic investors and family offices Foreign Direct Investment (FDI) and joint ventures Government programs and strategic initiatives (e.g., Vision 2030) Multilateral, development finance, and other sources |

| By Policy Support | Renewable and storage procurement programs Local content and industrial localization incentives R&D, innovation, and pilot?project support schemes Environmental, recycling, and circular-economy initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Battery Manufacturers | 45 | Production Managers, R&D Directors |

| Renewable Energy Storage Solutions | 40 | Project Managers, Energy Analysts |

| Consumer Electronics Battery Suppliers | 35 | Product Development Managers, Supply Chain Coordinators |

| Government Regulatory Bodies | 30 | Policy Makers, Environmental Compliance Officers |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Consultants |

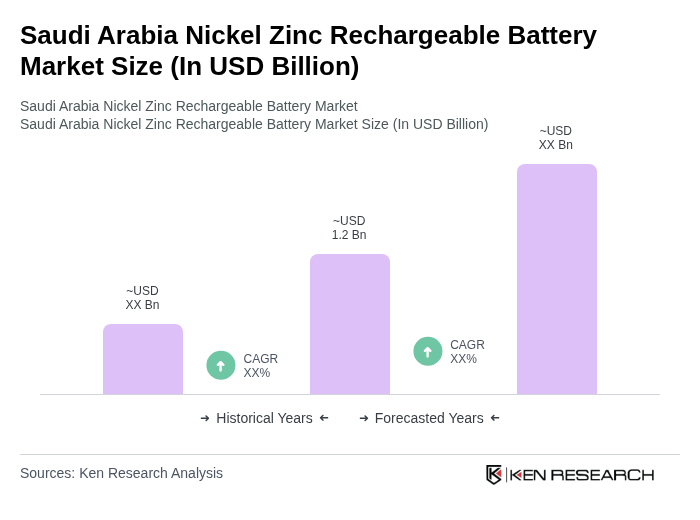

The Saudi Arabia Nickel Zinc Rechargeable Battery Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for energy storage solutions, particularly in renewable energy and electric mobility applications.