Region:Middle East

Author(s):Rebecca

Product Code:KRAB7047

Pages:85

Published On:October 2025

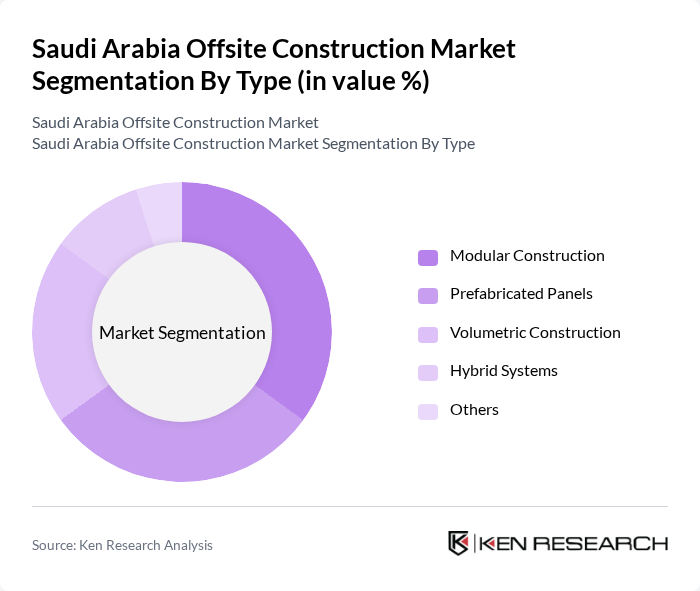

By Type:The offsite construction market can be segmented into various types, including Modular Construction, Prefabricated Panels, Volumetric Construction, Hybrid Systems, and Others. Modular Construction is gaining traction due to its efficiency and speed, while Prefabricated Panels are popular for their cost-effectiveness and ease of installation. Volumetric Construction is also emerging as a preferred choice for large-scale projects, offering significant time savings. Hybrid Systems combine traditional and modern techniques, catering to diverse project requirements. The "Others" category includes various innovative construction methods that are being explored in the market.

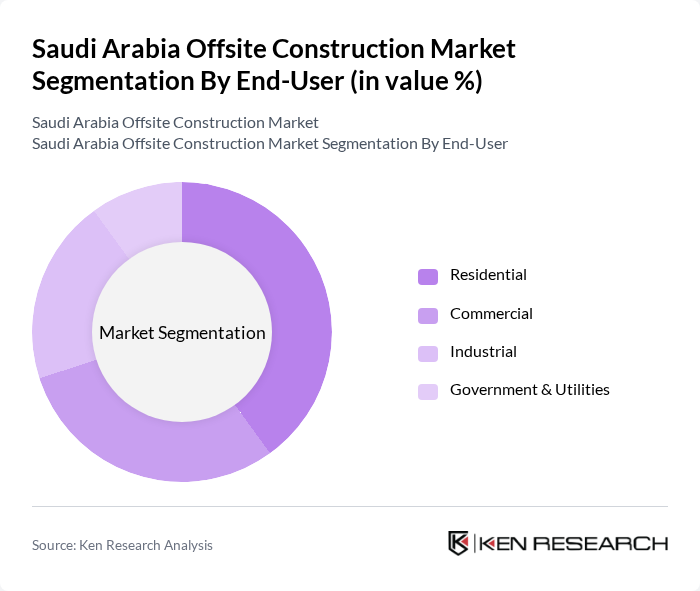

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities sectors. The Residential segment is the largest due to the growing population and housing demand. Commercial projects are also significant, driven by retail and office space requirements. The Industrial sector is expanding with the rise of manufacturing facilities, while Government & Utilities projects benefit from public funding and infrastructure initiatives. Each segment reflects the diverse applications of offsite construction methods in meeting specific needs.

The Saudi Arabia Offsite Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Binladin Group, El Seif Engineering Contracting Company, Al Habtoor Group, Al Arrab Contracting Company, Nesma & Partners Contracting Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the offsite construction market in Saudi Arabia appears promising, driven by ongoing government initiatives and technological advancements. As urbanization accelerates, the demand for efficient and sustainable building methods will likely increase. The integration of smart technologies and modular construction techniques will enhance project delivery and reduce costs. Furthermore, collaboration with international firms may introduce best practices and innovations, positioning Saudi Arabia as a leader in offsite construction within the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Construction Prefabricated Panels Volumetric Construction Hybrid Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Housing Projects Educational Institutions Healthcare Facilities Retail Spaces Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Construction Method | Traditional Construction Offsite Construction Hybrid Construction |

| By Material Used | Steel Concrete Wood Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Offsite Construction Projects | 100 | Project Managers, Architects |

| Commercial Building Prefabrication | 80 | Construction Managers, Design Engineers |

| Industrial Modular Construction | 70 | Operations Managers, Procurement Specialists |

| Supply Chain for Offsite Components | 60 | Logistics Coordinators, Material Suppliers |

| Regulatory Compliance in Offsite Construction | 50 | Compliance Officers, Legal Advisors |

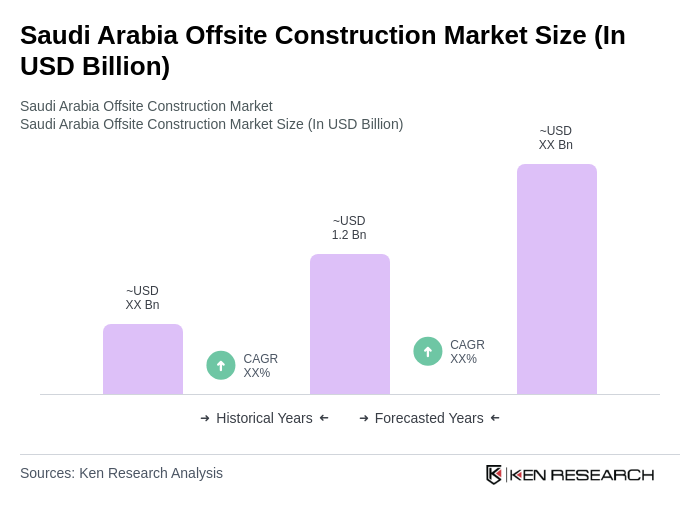

The Saudi Arabia Offsite Construction Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, government initiatives, and the demand for efficient construction methods.