Region:Middle East

Author(s):Rebecca

Product Code:KRAB8168

Pages:95

Published On:October 2025

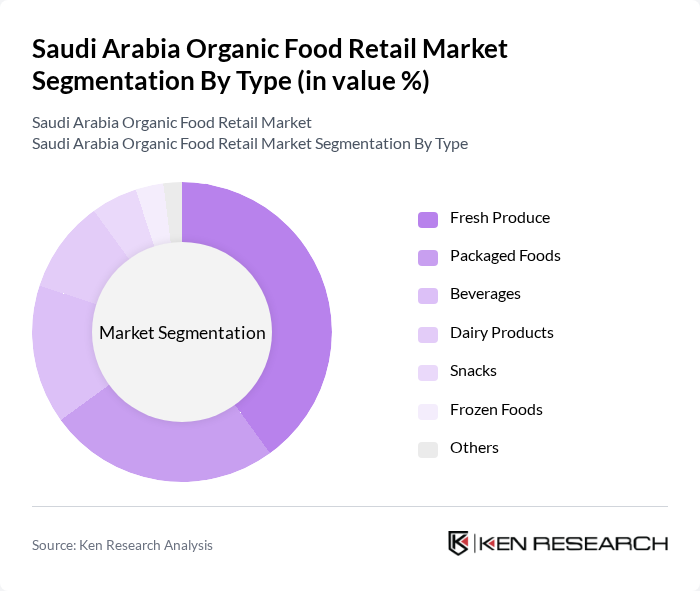

By Type:The organic food retail market can be segmented into various types, including Fresh Produce, Packaged Foods, Beverages, Dairy Products, Snacks, Frozen Foods, and Others. Among these, Fresh Produce is the leading sub-segment, driven by the increasing demand for fresh fruits and vegetables among health-conscious consumers. The trend towards clean eating and the preference for locally sourced organic produce have significantly contributed to its dominance.

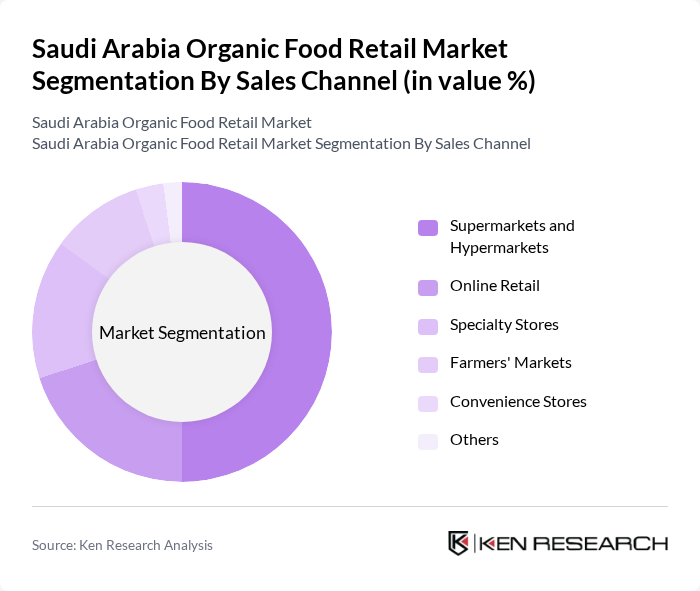

By Sales Channel:The market is also segmented by sales channels, including Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Farmers' Markets, Convenience Stores, and Others. Supermarkets and Hypermarkets dominate this segment due to their extensive reach and ability to offer a wide variety of organic products under one roof. The convenience and accessibility of these retail formats cater to the growing consumer preference for one-stop shopping experiences.

The Saudi Arabia Organic Food Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Othaim Markets, Tamimi Markets, Carrefour (Majid Al Futtaim), Lulu Hypermarket, Danube, Organic Foods and Café, Almarai, Nadec, Saco World, Al-Faisaliah Group, Al-Watania Poultry, Al-Jazeera Agricultural Company, Al-Muhaidib Group, Al-Hokair Group, Al-Safi Danone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian organic food retail market appears promising, driven by increasing health awareness and government initiatives. As disposable incomes rise, consumers are expected to prioritize organic products, leading to a more significant market presence. Additionally, the expansion of e-commerce platforms will facilitate access to organic foods, enhancing consumer convenience. Innovations in organic farming techniques will further support sustainable growth, ensuring that the market can meet the rising demand for healthier food options.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Foods Beverages Dairy Products Snacks Frozen Foods Others |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Farmers' Markets Convenience Stores Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Packaging Type | Eco-Friendly Packaging Plastic Packaging Glass Packaging |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Food Retailers | 150 | Store Managers, Owners, and Buyers |

| Consumers of Organic Products | 200 | Health-Conscious Shoppers, Families, and Young Professionals |

| Distributors and Wholesalers | 100 | Supply Chain Managers, Sales Representatives |

| Health and Wellness Experts | 50 | Nutritionists, Dietitians, and Fitness Coaches |

| Regulatory Bodies and Associations | 30 | Policy Makers, Industry Analysts |

The Saudi Arabia Organic Food Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of health and wellness, particularly among urban populations.