Region:Middle East

Author(s):Dev

Product Code:KRAD0371

Pages:90

Published On:August 2025

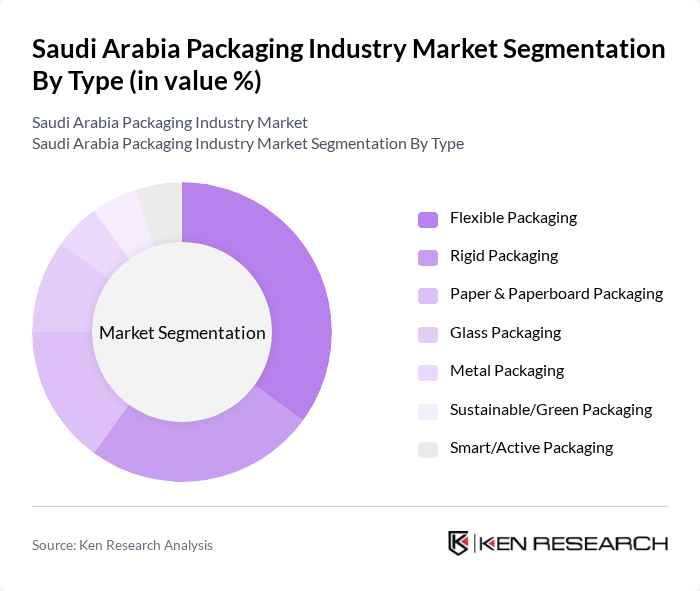

By Type:The packaging market in Saudi Arabia is segmented into various types, including Flexible Packaging, Rigid Packaging, Paper & Paperboard Packaging, Glass Packaging, Metal Packaging, Sustainable/Green Packaging, and Smart/Active Packaging. Each of these segments caters to different consumer needs and preferences, with flexible packaging currently leading the market due to its versatility and cost-effectiveness.

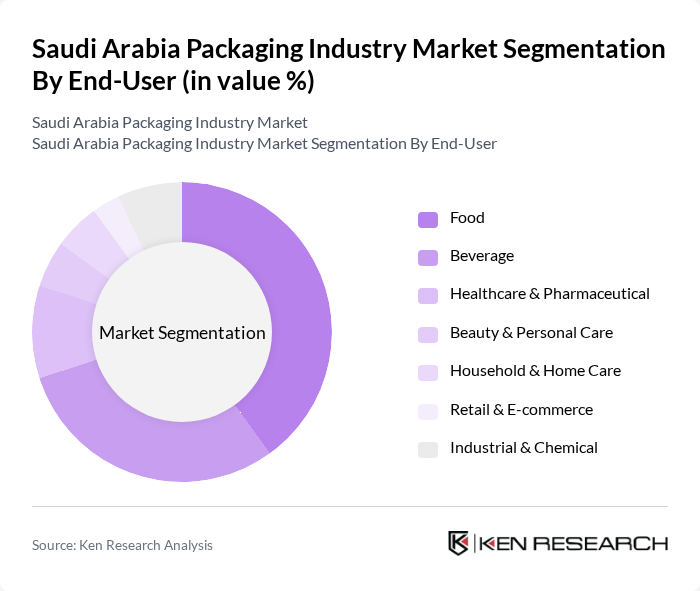

By End-User:The end-user segmentation of the packaging market includes Food, Beverage, Healthcare & Pharmaceutical, Beauty & Personal Care, Household & Home Care, Retail & E-commerce, and Industrial & Chemical sectors. The food and beverage segments are the largest consumers of packaging solutions, supported by population growth, modern retail and HORECA expansion, and convenience foods; glass packaging remains relevant in beverages while plastics and paperboard dominate food, and healthcare packaging demand is rising with local pharma manufacturing scale-up.

The Saudi Arabia Packaging Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Obeikan Investment Group (OIG) – Obeikan Paper Industries, Obeikan Folding Carton, Obeikan Glass, Napco National, Saudi Paper Manufacturing Company (SPM), Savola Packaging (Tasdeer/Plastico) – legacy units, Al Watania for Industries (Watania Plastic, Watania Paper Products), United Carton Industries Company (UCIC), Middle East Paper Company (MEPCO), Saudi Arabian Packaging Industry W.L.L. (SAPI), National Industrialization Company – Tasnee Packaging (rigid/plastics affiliates), Arabian Packaging Company Ltd., International Printing and Packaging Co. Ltd. (IPPC), Zamil Plastic Industries Co., Takween Advanced Industries (including Savola Plastics Company legacy assets), ULMA Packaging Saudi Arabia, Al Bayader International – Saudi operations contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian packaging industry appears promising, driven by increasing consumer awareness of sustainability and technological advancements. As the market adapts to evolving consumer preferences, innovations in biodegradable materials and smart packaging solutions are expected to gain traction. Additionally, the expansion into emerging markets presents significant growth potential, allowing local manufacturers to diversify their offerings and enhance their competitive edge in the global landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Paper & Paperboard Packaging Glass Packaging Metal Packaging Sustainable/Green Packaging Smart/Active Packaging |

| By End-User | Food Beverage Healthcare & Pharmaceutical Beauty & Personal Care Household & Home Care Retail & E-commerce Industrial & Chemical |

| By Application | Primary Packaging Secondary Packaging Transit/Logistics Packaging Aseptic & Sterile Packaging Tamper-evident & Child-resistant Packaging Others |

| By Distribution Channel | Direct/B2B Sales Distributors Wholesalers Online B2B Platforms Others |

| By Material | Plastic (PE, PP, PET, PVC, Others) Paper & Paperboard Metal (Aluminum, Steel) Glass Bioplastics & Compostables |

| By Price Range | Economy Mid-Range Premium Value/Private Label |

| By Region | Central Region (Riyadh) Eastern Region (Dammam/Al Khobar) Western Region (Jeddah/Makkah/Madinah) Southern Region (Asir/Jazan/Abha) Northern Region (Tabuk/Al-Jouf/Hail) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 90 | Regulatory Affairs Managers, Production Supervisors |

| Consumer Goods Packaging | 110 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 80 | Operations Managers, Procurement Specialists |

| Sustainable Packaging Innovations | 70 | R&D Managers, Sustainability Officers |

The Saudi Arabia Packaging Industry Market is valued at approximately USD 4.1 billion, reflecting a significant growth trend driven by increasing demand for packaged goods, regulatory focus on material safety, and a shift towards sustainable packaging solutions.