Region:Middle East

Author(s):Rebecca

Product Code:KRAC1780

Pages:99

Published On:October 2025

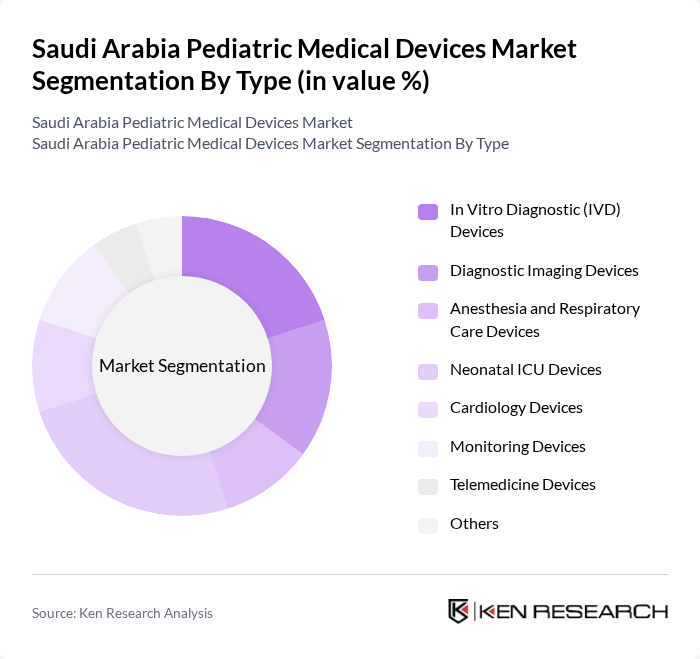

By Type:The market is segmented into various types of pediatric medical devices, including In Vitro Diagnostic (IVD) Devices, Diagnostic Imaging Devices, Anesthesia and Respiratory Care Devices, Neonatal ICU Devices, Cardiology Devices, Monitoring Devices, Telemedicine Devices, and Others. Each of these sub-segments plays a crucial role in addressing the unique healthcare needs of children. In Vitro Diagnostic (IVD) Devices represent the largest segment, driven by increasing demand for early disease detection and routine pediatric screening procedures. Anesthesia and Respiratory Care Devices demonstrate significant growth momentum due to the rising incidence of respiratory conditions among children and advancements in ventilation technologies.

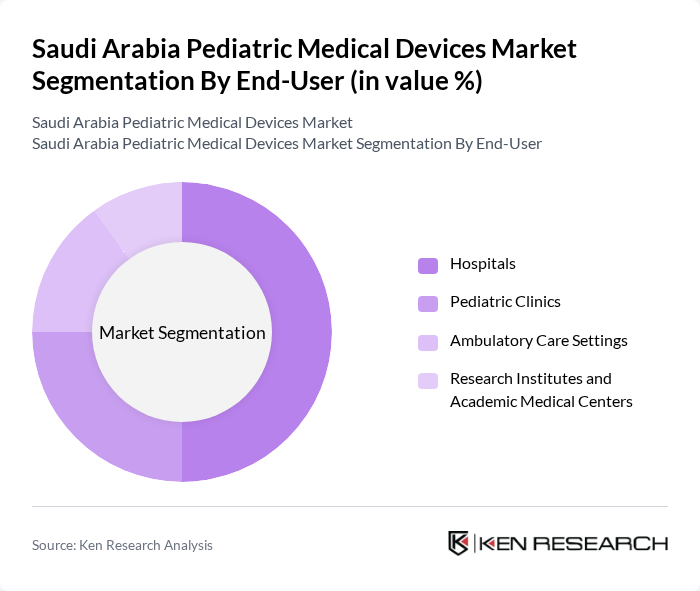

By End-User:The end-user segmentation includes Hospitals, Pediatric Clinics, Ambulatory Care Settings, and Research Institutes and Academic Medical Centers. Each of these segments utilizes pediatric medical devices to enhance patient care and treatment outcomes. Hospitals maintain the dominant position as primary end-users due to their comprehensive pediatric care facilities and availability of specialized pediatric departments. Pediatric Clinics demonstrate accelerating growth as standalone specialized facilities expand across major urban centers, offering focused care for child health conditions.

The Saudi Arabia Pediatric Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, GE HealthCare Technologies Inc., Medtronic plc, Johnson & Johnson (including Ethicon and DePuy Synthes), Abbott Laboratories, Becton, Dickinson and Company (BD), Stryker Corporation, Boston Scientific Corporation, Baxter International Inc., Terumo Corporation, Smith & Nephew plc, 3M Health Care, Hologic, Inc., Fresenius Kabi AG, Hamilton Medical AG, Novonate Inc., Atom Medical Corporation, Phoenix Medical Systems Pvt. Ltd., Ningbo David Medical Device Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pediatric medical devices market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As healthcare facilities expand and invest in modern equipment, the demand for innovative pediatric devices is expected to rise. Additionally, the integration of digital health technologies and telemedicine services will enhance patient care. These trends indicate a shift towards more personalized and accessible healthcare solutions for children, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | In Vitro Diagnostic (IVD) Devices Diagnostic Imaging Devices Anesthesia and Respiratory Care Devices Neonatal ICU Devices Cardiology Devices Monitoring Devices Telemedicine Devices Others |

| By End-User | Hospitals Pediatric Clinics Ambulatory Care Settings Research Institutes and Academic Medical Centers |

| By Application | Cardiology Neurology Orthopedics Respiratory Neonatology |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Range Mid Range High Range |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Digital Health Technologies Traditional Medical Devices Hybrid Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric Device Usage in Hospitals | 80 | Pediatricians, Hospital Administrators |

| Home Care Device Adoption | 60 | Parents, Caregivers, Home Health Providers |

| Market Trends in Pediatric Diagnostics | 50 | Medical Device Distributors, Healthcare Analysts |

| Feedback on Pediatric Therapeutic Devices | 40 | Child Health Specialists, Rehabilitation Experts |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Managers, Compliance Officers |

The Saudi Arabia Pediatric Medical Devices Market is valued at approximately USD 305 million, reflecting a significant growth driven by increased healthcare expenditure, awareness of pediatric health issues, and advancements in medical technology tailored for children.