Region:Middle East

Author(s):Rebecca

Product Code:KRAB7755

Pages:100

Published On:October 2025

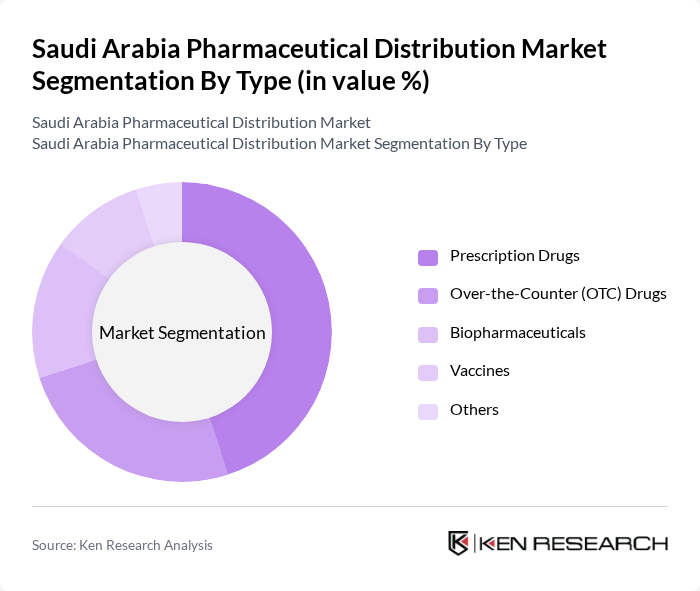

By Type:The pharmaceutical distribution market is segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biopharmaceuticals, Vaccines, and Others. Among these, Prescription Drugs hold a significant share due to the increasing prevalence of chronic diseases and the growing demand for specialized medications. The rise in healthcare awareness and the expansion of health insurance coverage have further fueled the demand for prescription medications.

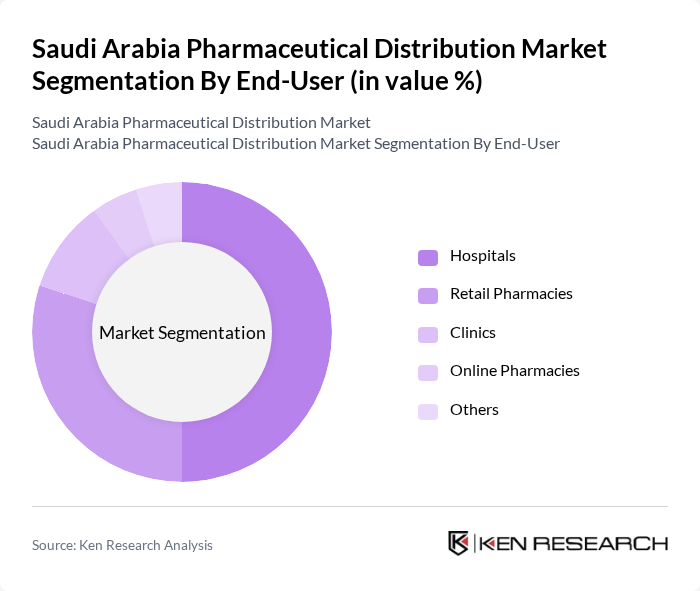

By End-User:The market is also segmented by end-users, which include Hospitals, Retail Pharmacies, Clinics, Online Pharmacies, and Others. Hospitals are the leading end-user segment, driven by the increasing number of healthcare facilities and the rising demand for advanced medical treatments. The trend towards outpatient care and the growing preference for online pharmacies are also contributing to the evolving landscape of pharmaceutical distribution.

The Saudi Arabia Pharmaceutical Distribution Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Al Nahdi Medical Company, United Pharmacies, Al-Dawaa Pharmacies, Gulf Pharmaceutical Industries (Julphar), Tabuk Pharmaceuticals, Riyadh Pharma, AJA Pharmaceutical Industries, Al-Muhaidib Group, Dar Al Dawa Development and Investment Company, Al-Hokair Group, Al-Faisaliah Group, Saudi International Trading Company (SITC), Al-Jazeera Pharmaceutical Company, Al-Muhaidib Pharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical distribution market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and a growing emphasis on digital transformation. As e-commerce continues to gain traction, distributors are likely to adopt advanced technologies to streamline operations and enhance customer engagement. Additionally, the increasing focus on personalized medicine will drive demand for specialized distribution services, creating a dynamic environment for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biopharmaceuticals Vaccines Others |

| By End-User | Hospitals Retail Pharmacies Clinics Online Pharmacies Others |

| By Distribution Channel | Direct Distribution Wholesalers Third-Party Logistics Others |

| By Product Category | Generic Medicines Branded Medicines Specialty Medicines Others |

| By Region | Central Region Western Region Eastern Region Southern Region Others |

| By Sales Channel | Online Sales Offline Sales Institutional Sales Others |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Wholesalers | 100 | Distribution Managers, Sales Directors |

| Retail Pharmacy Operations | 80 | Pharmacy Owners, Store Managers |

| Healthcare Providers | 70 | Doctors, Hospital Administrators |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Logistics and Supply Chain Experts | 60 | Supply Chain Managers, Operations Analysts |

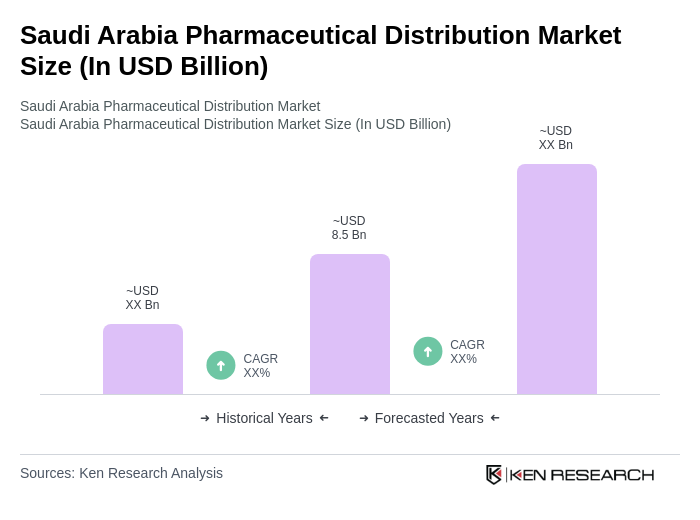

The Saudi Arabia Pharmaceutical Distribution Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by increased healthcare expenditure, a rising prevalence of chronic diseases, and a demand for innovative therapies.