Region:Middle East

Author(s):Dev

Product Code:KRAD0503

Pages:83

Published On:August 2025

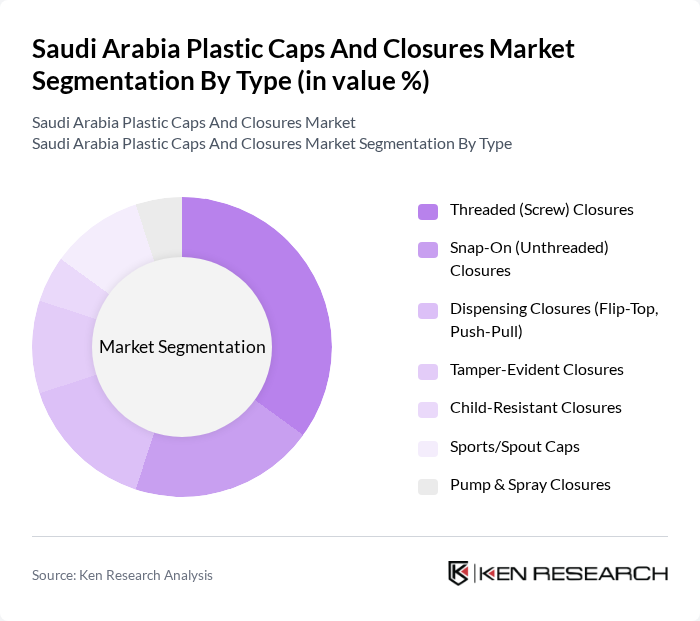

By Type:The market is segmented into various types of closures, including Threaded (Screw) Closures, Snap-On (Unthreaded) Closures, Dispensing Closures (Flip-Top, Push-Pull), Tamper-Evident Closures, Child-Resistant Closures, Sports/Spout Caps, and Pump & Spray Closures. Among these, Threaded (Screw) Closures dominate the market due to their widespread use in beverage and food packaging, offering secure sealing and ease of use. The increasing consumer preference for convenience and safety in packaging further drives the demand for these closures .

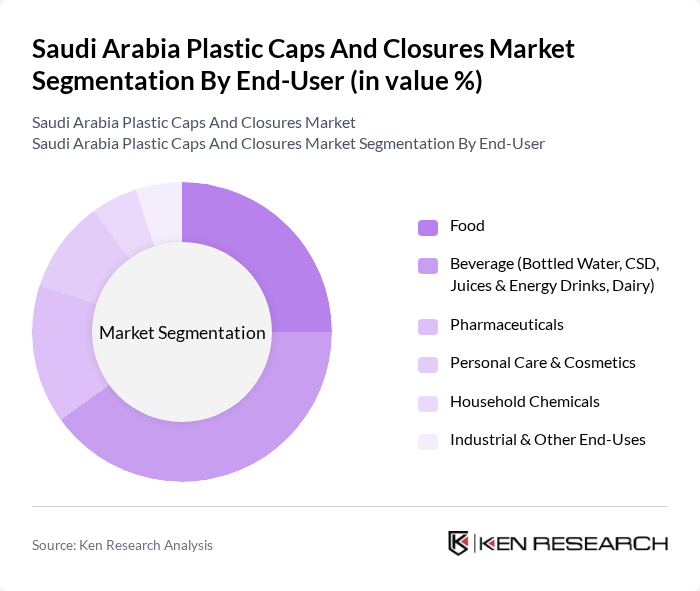

By End-User:The market is segmented by end-user industries, including Food, Beverage (Bottled Water, CSD, Juices & Energy Drinks, Dairy), Pharmaceuticals, Personal Care & Cosmetics, Household Chemicals, and Industrial & Other End-Uses. The Beverage segment is the largest end-user, driven by the increasing consumption of bottled water and soft drinks; expanding functional beverages and dairy also support closure demand. Localized closure production for beverages has accelerated with new facilities enhancing regional supply for high-volume beverage lines .

The Saudi Arabia Plastic Caps and Closures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takween Advanced Industries (Savola Packaging legacy), Napco National, Zahid Group – Arabian Plastic Manufacturing Co. Ltd. (APM), Almarai Company – Riyadh Plastic Factory (in-house caps), Jeddah Plastic Factory Co. (JPF), Al Watania Plastics Co., Bericap Arabia Ltd. (BERICAP KSA), Aptar Riyadh Packaging Systems, Closure Systems International (CSI) – Saudi Operations, National Plastic Factory (NPF), Dammam, Arabian Gulf Manufacturers Ltd. (AGM), First Gulf Plastic (FGP), Al-Jazira Factory for Plastic Products, Arabian Packaging Industry W.L.L. – Saudi Unit, Ras Al Khaimah Plastic Industries – KSA Distribution contribute to innovation, geographic expansion, and service delivery in this space .

The future of the plastic caps and closures market in Saudi Arabia appears promising, driven by ongoing innovations in sustainable packaging and the increasing demand for convenience products. As consumer preferences evolve, manufacturers are likely to invest in biodegradable materials and smart packaging technologies. Additionally, the expansion of the food and beverage sector, coupled with the growth of e-commerce, will create new opportunities for market players to enhance their product offerings and improve supply chain efficiencies.

| Segment | Sub-Segments |

|---|---|

| By Type | Threaded (Screw) Closures Snap-On (Unthreaded) Closures Dispensing Closures (Flip-Top, Push-Pull) Tamper-Evident Closures Child-Resistant Closures Sports/Spout Caps Pump & Spray Closures |

| By End-User | Food Beverage (Bottled Water, CSD, Juices & Energy Drinks, Dairy) Pharmaceuticals Personal Care & Cosmetics Household Chemicals Industrial & Other End-Uses |

| By Material | Polypropylene (PP) Polyethylene (PE: HDPE, LDPE) Polyethylene Terephthalate (PET) Other Plastics (PS, PVC, PC, etc.) |

| By Closure Function | Standard/Rigid Closures Tamper-Evident & Safety Closures Dispensing & Resealable Closures |

| By Distribution Channel | Direct (OEM/Brand) Sales Industrial Distributors E-commerce/B2B Platforms Retail/Wholesale for SMEs |

| By Region | Central Region (Riyadh) Eastern Region (Dammam/Jubail) Western Region (Jeddah/Makkah/Madinah) Southern Region (Asir/Jizan/Abha) |

| By Price Range | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Specialists |

| Pharmaceutical Packaging Solutions | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Personal Care Product Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Applications of Plastic Closures | 60 | Procurement Managers, Operations Directors |

| Sustainable Packaging Initiatives | 100 | Sustainability Officers, R&D Managers |

The Saudi Arabia Plastic Caps and Closures Market is valued at approximately USD 1.3 billion, reflecting strong demand driven by the packaged food and beverage sectors, as well as consumer preferences for safety and convenience in packaging solutions.