Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0120

Pages:88

Published On:August 2025

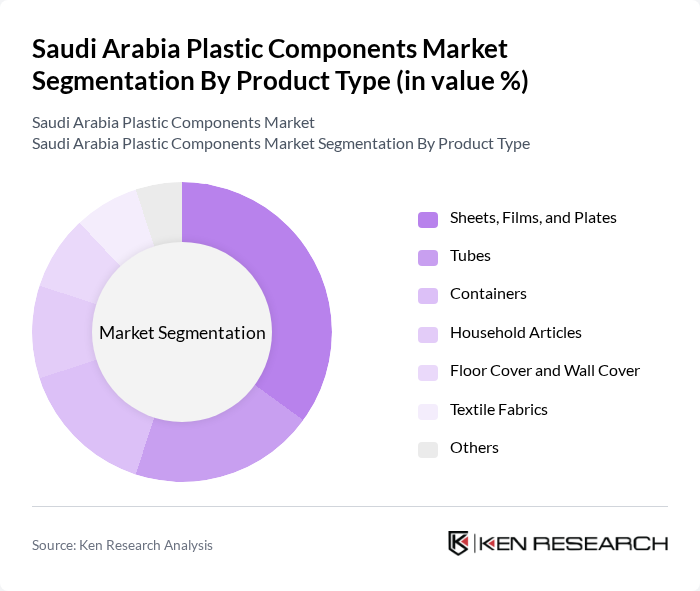

By Product Type:The product type segmentation includes categories such as sheets, films, and plates; tubes; containers; household articles; floor cover and wall cover; textile fabrics; and others. Among these, sheets, films, and plates lead the market due to their extensive applications in packaging, construction, and industrial sectors. Their versatility, lightweight nature, and adaptability for various uses make them highly preferred across industries, driving significant demand .

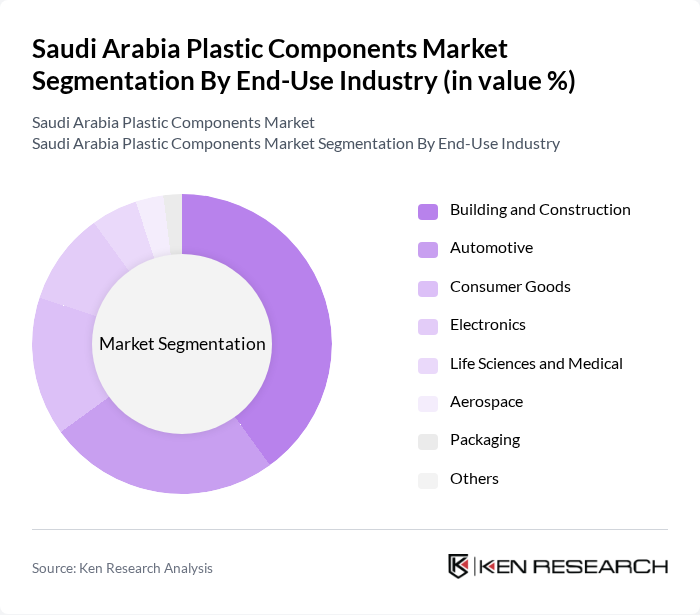

By End-Use Industry:The end-use industry segmentation encompasses building and construction, automotive, consumer goods, electronics, life sciences and medical, aerospace, packaging, and others. The building and construction sector is the dominant segment, driven by ongoing infrastructure projects and urban development initiatives. Increasing investment in construction activities and government-backed infrastructure programs have led to higher demand for plastic components, particularly in insulation, piping, and structural applications. Automotive and consumer goods remain significant contributors due to the versatility and cost-effectiveness of plastic components .

The Saudi Arabia Plastic Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Advanced Petrochemical Company, National Industrialization Company (Tasnee), Alujain Corporation, Saudi Plastic Products Company (SAPPCO), Saudi Arabian Amiantit Company, Al Watania Plastics, Arabian Plastic Industrial Company (APICO), Al Muhaidib Group, Al Jazira Factory for Plastic Products, Al Hokair Group, Al Qemam Plastic Factory, Al Mansour Plastic Industries, Al Suwaidi Industrial Services, and Al Babtain Group contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia plastic components market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt automation and smart technologies, production efficiency is expected to improve. Additionally, the growing emphasis on sustainable practices will likely lead to innovations in biodegradable plastics and recycling technologies, aligning with global environmental goals. This evolving landscape presents both challenges and opportunities for stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sheets, Films, and Plates Tubes Containers Household Articles Floor Cover and Wall Cover Textile Fabrics Others |

| By End-Use Industry | Building and Construction Automotive Consumer Goods Electronics Life Sciences and Medical Aerospace Packaging Others |

| By Resin Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polyethylene Terephthalate (PET) Polystyrene (PS) Engineering Plastics Bioplastics Others |

| By Sales Channel | Direct Sales Distributors Online Retail Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Medium High |

| By Material Source | Domestic Production Imported Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Plastic Components | 60 | Product Managers, Quality Assurance Engineers |

| Construction Material Suppliers | 50 | Procurement Managers, Project Engineers |

| Consumer Goods Manufacturers | 55 | Operations Managers, Supply Chain Analysts |

| Packaging Industry Stakeholders | 45 | Marketing Directors, Product Development Managers |

| Recycling and Waste Management Firms | 40 | Sustainability Managers, Operations Supervisors |

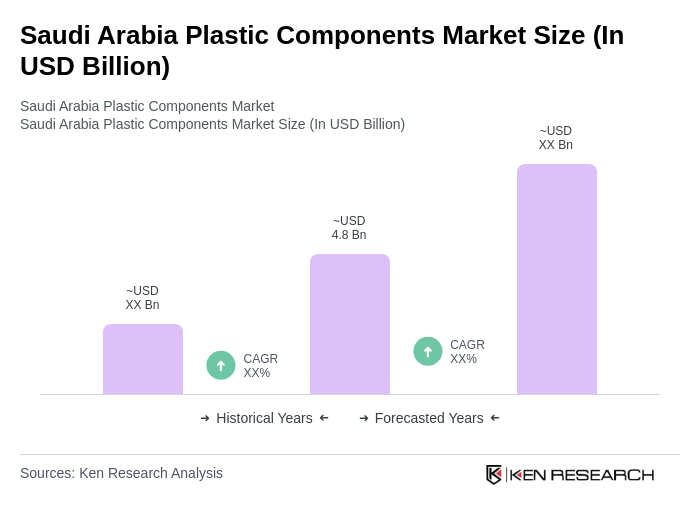

The Saudi Arabia Plastic Components Market is valued at approximately USD 4.8 billion, reflecting a robust growth trajectory driven by demand across various sectors, including automotive, construction, and consumer goods.