Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4031

Pages:100

Published On:December 2025

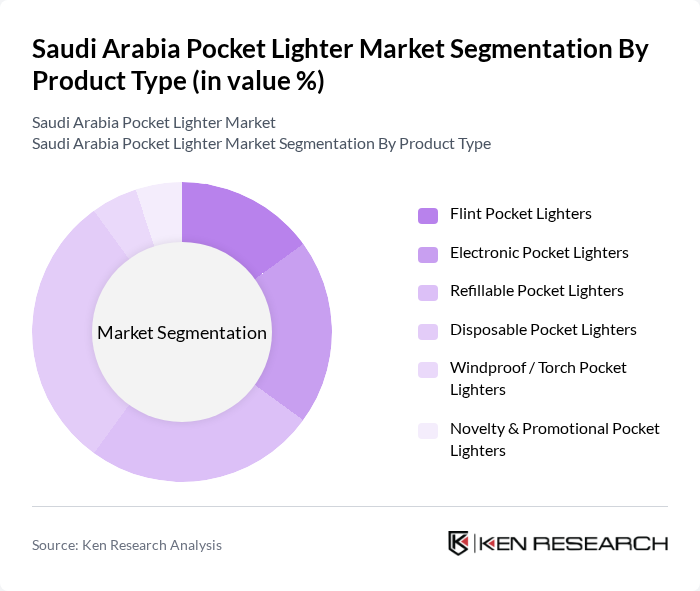

By Product Type:The product type segmentation includes various categories such as Flint Pocket Lighters, Electronic Pocket Lighters, Refillable Pocket Lighters, Disposable Pocket Lighters, Windproof / Torch Pocket Lighters, and Novelty & Promotional Pocket Lighters. Among these, the Disposable Pocket Lighters segment is currently leading the market due to their affordability and convenience. Consumers prefer these lighters for their ease of use and availability in various designs. The trend towards novelty lighters is also gaining traction, particularly among younger consumers who seek unique and personalized products.

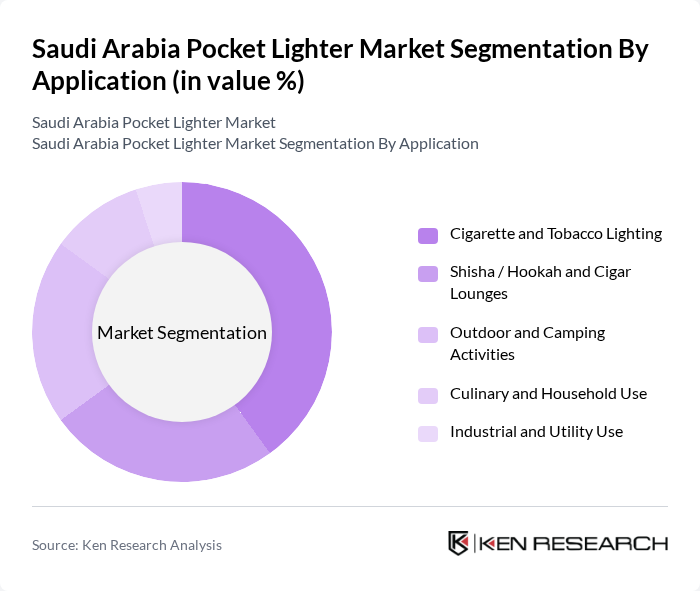

By Application:The application segmentation encompasses Cigarette and Tobacco Lighting, Shisha / Hookah and Cigar Lounges, Outdoor and Camping Activities, Culinary and Household Use, and Industrial and Utility Use. The Cigarette and Tobacco Lighting segment dominates the market, driven by the high prevalence of smoking in Saudi Arabia. Additionally, the growing popularity of shisha and hookah lounges has further boosted demand in this category. Outdoor activities are also contributing to the market, as consumers seek portable lighting solutions for camping and recreational purposes.

The Saudi Arabia Pocket Lighter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Société BIC S.A., Zippo Manufacturing Company, Flamagas S.A. (Clipper), Swedish Match AB (Cricket), Tokai Corporation, S.T. Dupont S.A., Colibri Group, IM Corona Co., Ltd., Lotus / Integral Logistics Group, Xikar Inc. (Quality Importers), RASTAR Group (Promotional & Licensed Lighters), Local Importers & Distributors in Saudi Arabia (e.g., tobacco & FMCG distributors), Private Label Pocket Lighter Brands of Key Retailers, Regional Asian OEM Lighter Manufacturers Supplying Saudi Market, Online-Only Pocket Lighter Brands Active in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Saudi Arabia pocket lighter market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for eco-friendly products increases, manufacturers are likely to focus on sustainable materials and designs. Additionally, the growth of e-commerce will facilitate direct-to-consumer sales, enhancing market reach. Innovations in smart technology and customization options will further attract consumers, positioning the market for robust growth in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flint Pocket Lighters Electronic Pocket Lighters Refillable Pocket Lighters Disposable Pocket Lighters Windproof / Torch Pocket Lighters Novelty & Promotional Pocket Lighters |

| By Application | Cigarette and Tobacco Lighting Shisha / Hookah and Cigar Lounges Outdoor and Camping Activities Culinary and Household Use Industrial and Utility Use |

| By Distribution Channel | Convenience Stores & Baqalas Supermarkets and Hypermarkets Tobacco Shops & Kiosks Petrol Stations Online Retail & Marketplaces |

| By Material | Plastic-Body Lighters Metal-Body Lighters Mixed / Composite Material Lighters Others |

| By Price Range | Economy Pocket Lighters (Impulse / Mass) Mid-Range Pocket Lighters Premium & Gift Pocket Lighters Collectible & Luxury Pocket Lighters |

| By Brand Origin | International Branded Lighters Regional and Asian Import Brands Private Label & In-Store Brands Unbranded / Generic Lighters |

| By Consumer Profile | Adult Smokers Outdoor Enthusiasts & Campers Hospitality & Foodservice Operators Gift Buyers & Collectors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Retail Buyers |

| Consumer Preferences | 150 | General Consumers, Brand Loyalists |

| Distribution Channel Analysis | 100 | Wholesalers, Distributors |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Regulatory Impact Assessment | 60 | Compliance Officers, Industry Regulators |

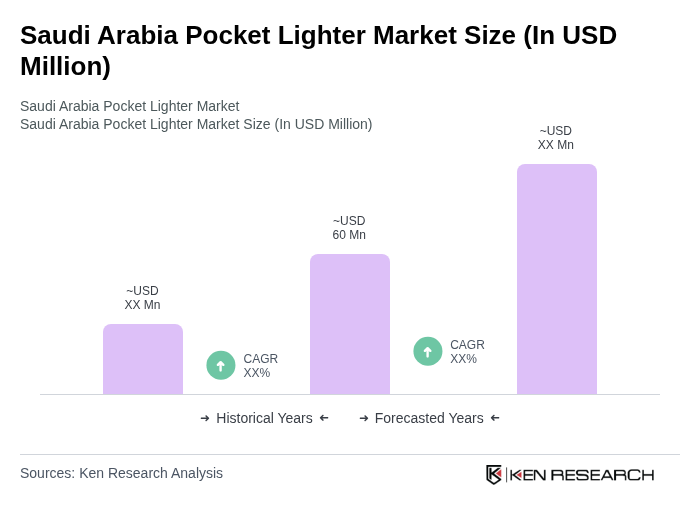

The Saudi Arabia Pocket Lighter Market is valued at approximately USD 60 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for smoking products and outdoor activities requiring portable lighting solutions.