Region:Middle East

Author(s):Shubham

Product Code:KRAD6716

Pages:81

Published On:December 2025

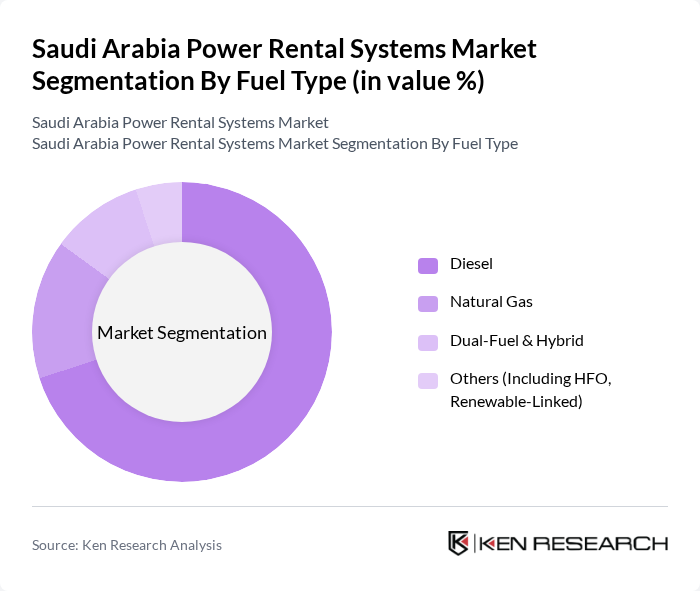

By Fuel Type:The market is segmented into Diesel, Natural Gas, Dual-Fuel & Hybrid, and Others (Including HFO, Renewable-Linked). Diesel remains the most widely used fuel type due to its availability and reliability, particularly in remote areas. Natural gas is gaining traction due to its lower emissions and cost-effectiveness. Dual-fuel systems are increasingly popular for their flexibility, while renewable-linked options are emerging as part of the government's sustainability initiatives.

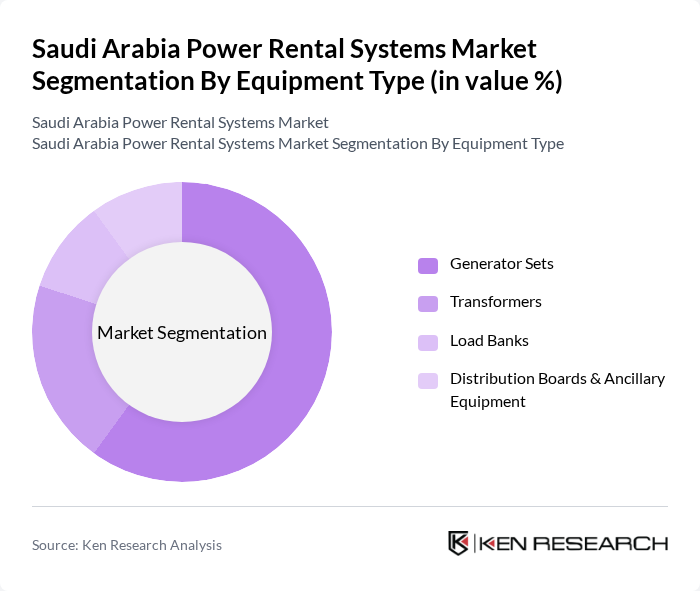

By Equipment Type:The equipment segment includes Generator Sets, Transformers, Load Banks, and Distribution Boards & Ancillary Equipment. Generator sets dominate the market due to their essential role in providing temporary power solutions across various applications. Transformers are crucial for voltage regulation, while load banks are used for testing and commissioning. Distribution boards and ancillary equipment support the overall power distribution process.

The Saudi Arabia Power Rental Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aggreko plc (Aggreko Middle East, Saudi Arabia), Altaaqa Alternative Solutions Company (Xylem Group, Saudi Arabia), Rental Solutions & Services (RSS Power, Saudi Arabia), Zahid Tractor & Heavy Machinery Co. Ltd. (CAT Rental Store, Saudi Arabia), Abdul Latif Jameel Energy & Environmental Services (Power Solutions), Byrne Equipment Rental (Byrne Saudi Arabia), Atlas Copco Power Technique, Cummins Arabia (Cummins Inc.), Jubaili Bros (Jubaili Bros Energy, Saudi Arabia), Saudi Diesel Equipment Co. Ltd., Tamimi Energy (A.TCO Group), Al-Fanar Electrical Systems (Temporary Power Solutions), JCB Power Products (via Local Rental Partners), Doosan Portable Power (via Regional Distributors), Wärtsilä Corporation (Large-Scale Temporary Power Projects) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia power rental systems market appears promising, driven by ongoing urbanization and government initiatives aimed at diversifying energy sources. As the country invests heavily in infrastructure and renewable energy projects, the demand for flexible power solutions is expected to rise. Furthermore, advancements in technology and a growing emphasis on sustainability will likely shape the market landscape, encouraging innovation and efficiency in power rental systems.

| Segment | Sub-Segments |

|---|---|

| By Fuel Type | Diesel Natural Gas Dual-Fuel & Hybrid Others (Including HFO, Renewable-Linked) |

| By Equipment Type | Generator Sets Transformers Load Banks Distribution Boards & Ancillary Equipment |

| By Power Rating (kVA) | Up to 50 kVA –500 kVA –2,500 kVA Above 2,500 kVA |

| By Application | Peak Shaving Standby / Emergency Power Base Load / Continuous Power Others (Testing, Commissioning, Planned Outages) |

| By End-Use Industry | Utilities & Power Oil & Gas Construction & Infrastructure Events & Entertainment Mining & Quarrying Data Centers & Telecom Others (Manufacturing, Healthcare, etc.) |

| By Region | Central Region (Including Riyadh) Eastern Region (Including Dammam, Jubail) Western Region (Including Jeddah, Makkah, Madinah) Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Power Rentals | 100 | Project Managers, Site Engineers |

| Event Management Power Solutions | 80 | Event Coordinators, Technical Directors |

| Industrial Power Rental Applications | 70 | Operations Managers, Facility Managers |

| Telecommunications Backup Power | 60 | Network Engineers, IT Managers |

| Renewable Energy Integration | 90 | Energy Consultants, Sustainability Officers |

The Saudi Arabia Power Rental Systems Market is valued at approximately USD 1.5 billion, driven by increasing demand for temporary power solutions across sectors such as construction, oil and gas, and events, particularly during peak demand periods and emergencies.