Region:Middle East

Author(s):Dev

Product Code:KRAC0530

Pages:98

Published On:August 2025

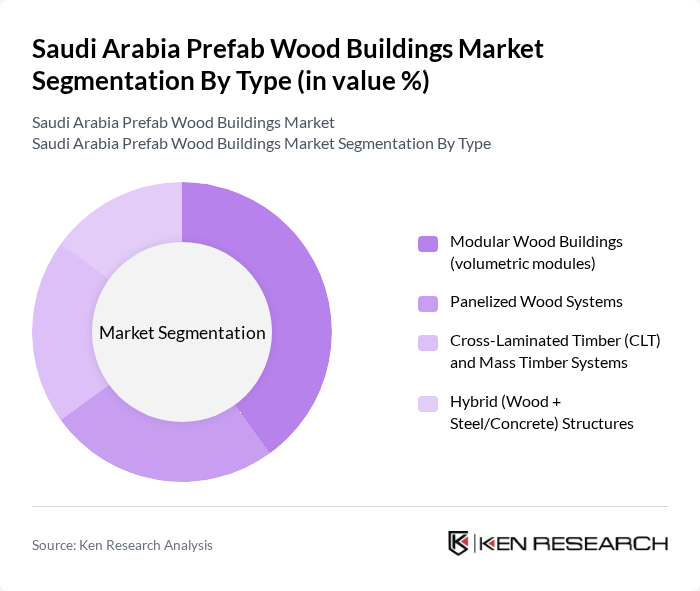

By Type:The market can be segmented into four main types: Modular Wood Buildings (volumetric modules), Panelized Wood Systems, Cross-Laminated Timber (CLT) and Mass Timber Systems, and Hybrid (Wood + Steel/Concrete) Structures. Among these, Modular Wood Buildings are gaining traction due to their efficiency and flexibility in design, making them a preferred choice for various construction projects.

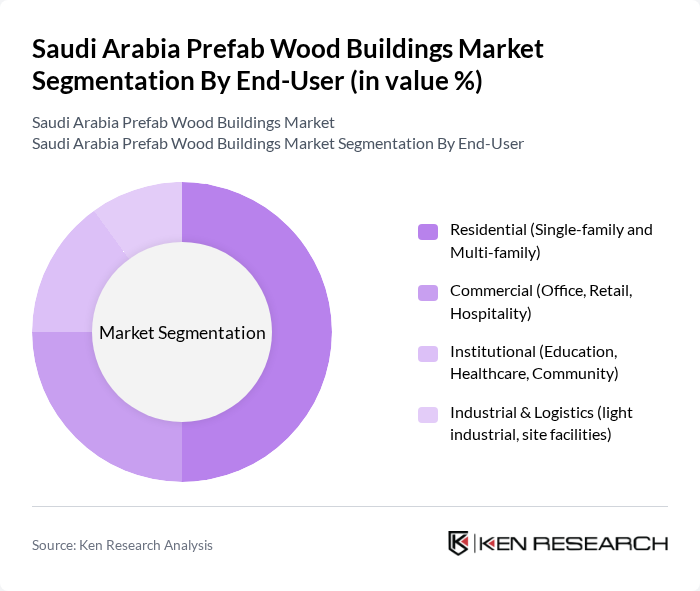

By End-User:The end-user segmentation includes Residential (Single-family and Multi-family), Commercial (Office, Retail, Hospitality), Institutional (Education, Healthcare, Community), and Industrial & Logistics (light industrial, site facilities). The Residential segment is currently leading the market, driven by population growth, affordable housing initiatives, and the speed advantages of offsite delivery.

The Saudi Arabia Prefab Wood Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Sea Global (modular and offsite construction programs), ROSHN (Public Investment Fund) Housing Company, Saudi Building Systems Manufacturing Company (SBSM), Katerra Saudi Arabia (legacy assets under local operators), Zamil Industrial Investment Co. (offsite solutions), Alfanar Construction (offsite and modular units), Saudi Pan Kingdom Company – SAPAC (prefab/site facilities), Saudi Prefab Houses Factory Co., Al Nahda Prefab Houses, United Arab Can (UAC) Modular Buildings, Mammut Building Systems KSA, Fakieh Timber and Wood Industries, JAFCO for Wood Industries, Al Sorayai Wood & Timber Trading, WEDIAN Prefab (Wedian Prefabricated Buildings Factory) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia prefab wood buildings market appears promising, driven by increasing urbanization and a strong push for sustainable construction practices. As the government continues to support prefabrication through financial incentives and regulatory reforms, the market is likely to see significant growth. Technological advancements in manufacturing processes will further enhance efficiency and customization, making prefab solutions more appealing to developers and consumers alike, thereby solidifying their role in the construction landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Wood Buildings (volumetric modules) Panelized Wood Systems Cross-Laminated Timber (CLT) and Mass Timber Systems Hybrid (Wood + Steel/Concrete) Structures |

| By End-User | Residential (Single-family and Multi-family) Commercial (Office, Retail, Hospitality) Institutional (Education, Healthcare, Community) Industrial & Logistics (light industrial, site facilities) |

| By Application | Housing Developments and Villas Educational Buildings (schools, training centers) Healthcare Facilities and Clinics Hospitality & Recreational Buildings |

| By Sales Channel | Direct (Project Tendering/Design-Build) Distributors and Local Agents Online/Configurable Kit Platforms EPC/General Contractor Partnerships |

| By Distribution Mode | B2B (Developers, Contractors, Government) B2C (Self-build and small developers) Turnkey (Design–Manufacture–Install) Component Supply (panels, beams, trusses) |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Green Building/ESG Certifications (e.g., Mostadam, LEED) Tax/Customs Incentives and Local Content Programs Public Housing and Social Infrastructure Programs R&D and Industrialization Grants/Financing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Prefab Wood Projects | 100 | Architects, Home Builders |

| Commercial Building Developments | 80 | Project Managers, Real Estate Developers |

| Industrial Wood Construction | 60 | Construction Engineers, Facility Managers |

| Prefab Wood Material Suppliers | 70 | Manufacturers, Sales Representatives |

| Regulatory and Compliance Experts | 50 | Policy Makers, Industry Consultants |

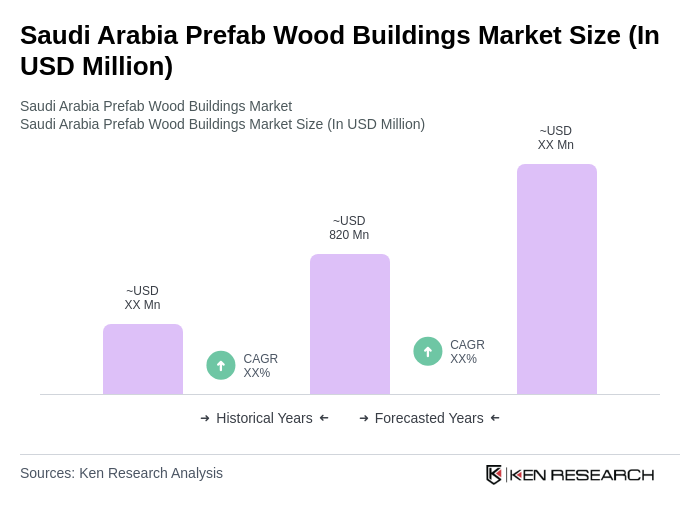

The Saudi Arabia Prefab Wood Buildings Market is valued at approximately USD 820 million, reflecting a growing trend towards sustainable construction and offsite efficiency in housing and social infrastructure.