Region:Middle East

Author(s):Dev

Product Code:KRAB7428

Pages:89

Published On:October 2025

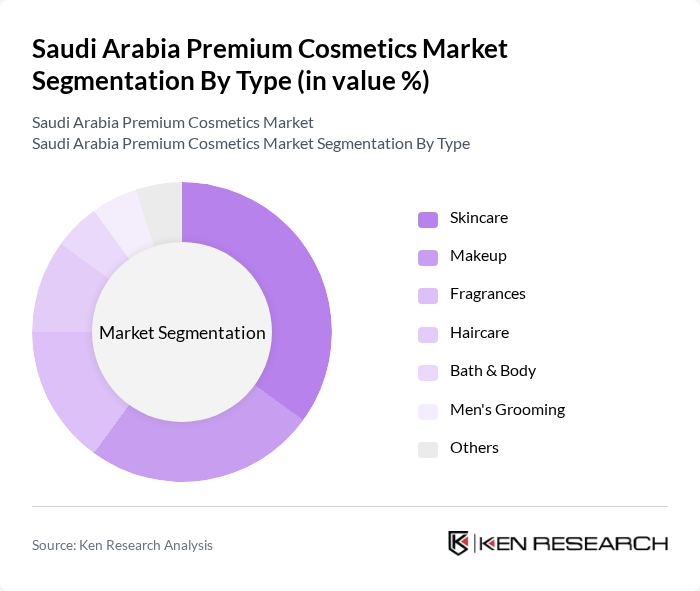

By Type:The market is segmented into various types including Skincare, Makeup, Fragrances, Haircare, Bath & Body, Men's Grooming, and Others. Among these, Skincare products are currently leading the market due to the increasing awareness of skincare routines and the demand for anti-aging and moisturizing products. The trend towards natural and organic ingredients is also driving growth in this segment, as consumers become more health-conscious and environmentally aware.

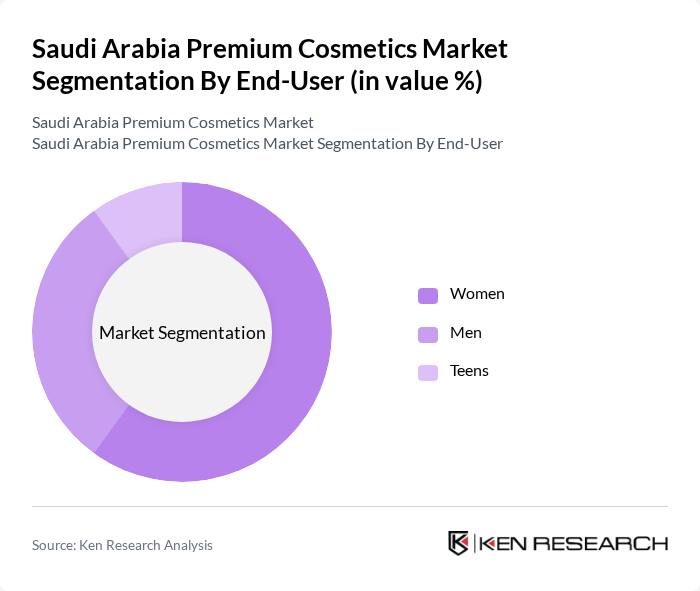

By End-User:The end-user segmentation includes Women, Men, and Teens. The Women segment dominates the market, driven by a higher inclination towards beauty and skincare products. Women are increasingly investing in premium cosmetics as part of their daily routines, influenced by social media trends and celebrity endorsements. The growing awareness of personal grooming among men is also contributing to the expansion of the Men segment.

The Saudi Arabia Premium Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal Middle East, Estée Lauder Companies Inc., Procter & Gamble, Unilever, Shiseido Company, Limited, Coty Inc., Revlon, Inc., Amway Corporation, Mary Kay Inc., Avon Products, Inc., Beiersdorf AG, Oriflame Cosmetics S.A., Clarins Group, Chanel S.A., Dior contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia premium cosmetics market is poised for significant evolution, driven by changing consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly practices is expected to shape product development, with brands prioritizing environmentally responsible sourcing and packaging. Additionally, the integration of augmented reality in online shopping experiences will enhance consumer engagement, allowing for personalized product trials. As the market matures, brands that adapt to these trends will likely capture a larger share of the growing consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Fragrances Haircare Bath & Body Men's Grooming Others |

| By End-User | Women Men Teens |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Supermarkets/Hypermarkets Direct Sales Others |

| By Price Range | Premium Super Premium Mid-Range |

| By Brand Origin | Local Brands International Brands |

| By Packaging Type | Bottles Jars Tubes |

| By Product Formulation | Organic Conventional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Products | 150 | Beauty Consultants, Skincare Specialists |

| High-End Makeup Brands | 120 | Makeup Artists, Retail Managers |

| Fragrance Market Insights | 100 | Perfume Retailers, Brand Ambassadors |

| Consumer Preferences in Premium Cosmetics | 130 | End Consumers, Beauty Enthusiasts |

| Online vs. Offline Purchasing Behavior | 110 | E-commerce Managers, Digital Marketing Experts |

The Saudi Arabia Premium Cosmetics Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising beauty consciousness among consumers.