Region:Middle East

Author(s):Dev

Product Code:KRAC8630

Pages:98

Published On:November 2025

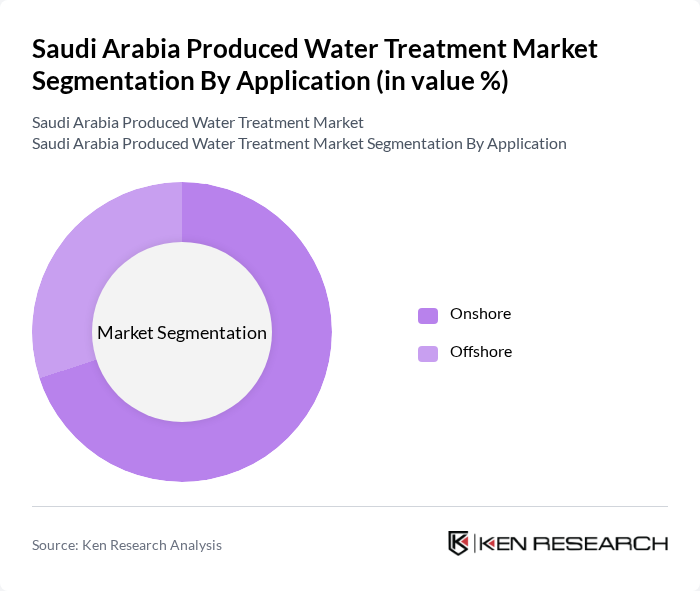

By Application:The market is segmented into onshore and offshore applications. The onshore segment continues to dominate the market, attributed to the higher volume of produced water generated from land-based oil extraction and industrial activities. Onshore facilities require comprehensive treatment processes to manage large quantities of produced water, making this segment critical for service providers. Offshore operations, while technologically advanced and significant for the sector, generate less produced water comparatively, resulting in a smaller market share .

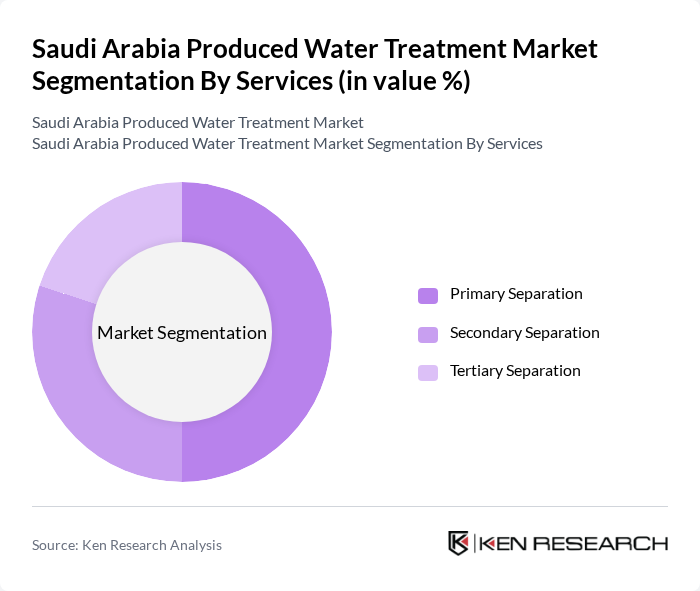

By Services:The services segment includes primary separation, secondary separation, and tertiary separation. Primary separation remains the leading service type, as it is the initial step in the treatment process, focusing on the removal of large solids and free oil from produced water. This step is essential for ensuring the efficiency and cost-effectiveness of subsequent treatment stages. Secondary and tertiary separations provide further purification and are increasingly adopting advanced membrane and chemical treatment technologies to meet stricter discharge and reuse standards .

The Saudi Arabia Produced Water Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger, Halliburton, Veolia Water Technologies, SUEZ Water Technologies & Solutions, Baker Hughes, Aquatech International, Metito, Xylem Inc., Dow Water & Process Solutions, Ecolab, Pentair, IDE Technologies, Biwater, Al-Kawther Water Treatment, and ACWA Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the produced water treatment market in Saudi Arabia appears promising, driven by increasing investments in sustainable water management and technological innovations. As the government intensifies its focus on water reuse and environmental protection, the market is expected to expand significantly. Companies are likely to adopt smart water management systems and integrate AI and IoT technologies, enhancing operational efficiency and treatment effectiveness. This trend will foster a more sustainable approach to water resource management in the region.

| Segment | Sub-Segments |

|---|---|

| By Application | Onshore Offshore |

| By Services | Primary Separation Secondary Separation Tertiary Separation |

| By End-User Industry | Oil & Gas Industrial Power Generation Government Others |

| By Region | Western Region Northern & Central Region Eastern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Water Management | 100 | Environmental Managers, Operations Directors |

| Water Treatment Technology Providers | 60 | Product Managers, Technical Sales Representatives |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Compliance Officers |

| Research Institutions Focused on Water Treatment | 50 | Research Scientists, Academic Professors |

| End-users of Treated Water in Industrial Applications | 50 | Plant Managers, Procurement Specialists |

The Saudi Arabia Produced Water Treatment Market is valued at approximately USD 1.3 billion, driven by the increasing demand for water recycling and advanced treatment solutions in the oil and gas sector, along with significant investments in sustainability initiatives.