Region:Middle East

Author(s):Shubham

Product Code:KRAC4324

Pages:80

Published On:October 2025

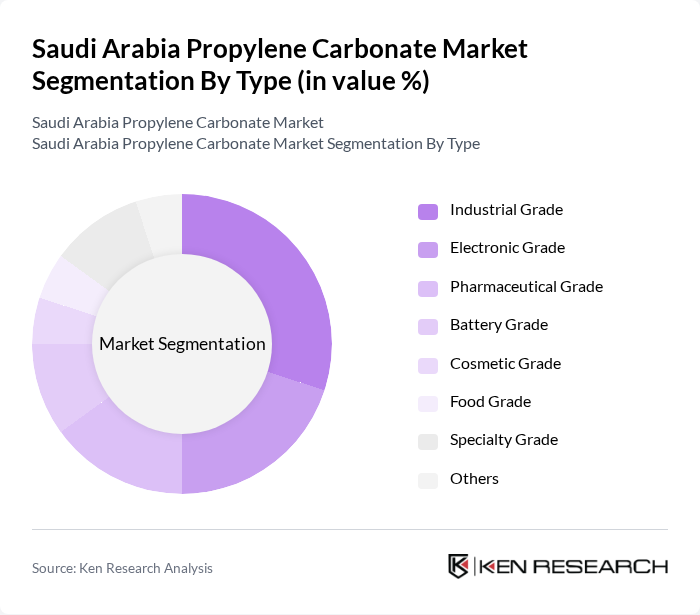

By Type:The market is segmented into various types of propylene carbonate, including Industrial Grade, Electronic Grade, Pharmaceutical Grade, Battery Grade, Cosmetic Grade, Food Grade, Specialty Grade, and Others. Each type serves distinct applications and industries, meeting specific quality and regulatory requirements for end-use sectors such as electronics, pharmaceuticals, batteries, cosmetics, and specialty chemicals .

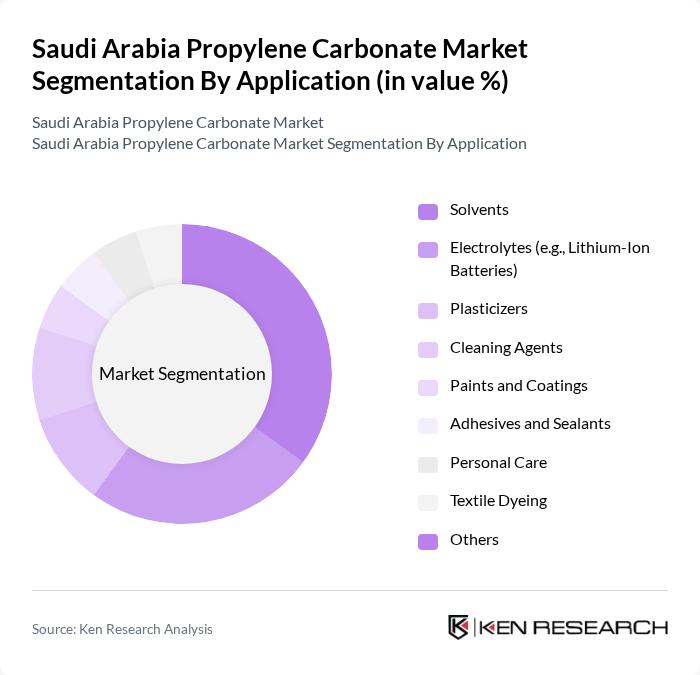

By Application:The applications of propylene carbonate include Solvents, Electrolytes (e.g., Lithium-Ion Batteries), Plasticizers, Cleaning Agents, Paints and Coatings, Adhesives and Sealants, Personal Care, Textile Dyeing, and Others. Each application leverages propylene carbonate for its high solvency, low toxicity, and stability, supporting its use in industrial cleaning, battery electrolytes, and specialty formulations .

The Saudi Arabia Propylene Carbonate Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, Mitsubishi Chemical Corporation, Solvay S.A., Dow Chemical Company, Eastman Chemical Company, LyondellBasell Industries N.V., SABIC (Saudi Basic Industries Corporation), Oxea GmbH, Shandong Shida Shenghua Chemical Group Co., Ltd., Shandong Haike Chemical Group Co., Ltd., Tongling Jintai Chemical Industrial Co., Ltd., Taixing Fengming Chemical Co., Ltd., Linyi Evergreen Chemical Co., Ltd., Kowa Company, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the propylene carbonate market in Saudi Arabia appears promising, driven by increasing applications across various industries. The automotive and electronics sectors are expected to lead growth, supported by government initiatives aimed at economic diversification. Additionally, the shift towards sustainable manufacturing practices will likely enhance the adoption of propylene carbonate as a green solvent. As companies invest in research and development, new applications for propylene carbonate are anticipated, further solidifying its market position in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Electronic Grade Pharmaceutical Grade Battery Grade Cosmetic Grade Food Grade Specialty Grade Others |

| By Application | Solvents Electrolytes (e.g., Lithium-Ion Batteries) Plasticizers Cleaning Agents Paints and Coatings Adhesives and Sealants Personal Care Textile Dyeing Others |

| By End-User | Automotive Electronics Pharmaceuticals Cosmetics & Personal Care Energy (Battery Manufacturers) Industrial & Chemical Processing Textile Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Packaging Type | Bulk Packaging Drum Packaging Bottle Packaging Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings Industry | 60 | Product Managers, Technical Directors |

| Battery Manufacturing | 50 | Manufacturing Engineers, R&D Specialists |

| Solvent Applications | 55 | Procurement Managers, Application Engineers |

| Pharmaceuticals and Cosmetics | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Research Institutions | 45 | Research Scientists, Industry Analysts |

The Saudi Arabia Propylene Carbonate Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various applications, including solvents and electrolytes, particularly in the automotive and electronics sectors.