Region:Middle East

Author(s):Dev

Product Code:KRAB6116

Pages:85

Published On:October 2025

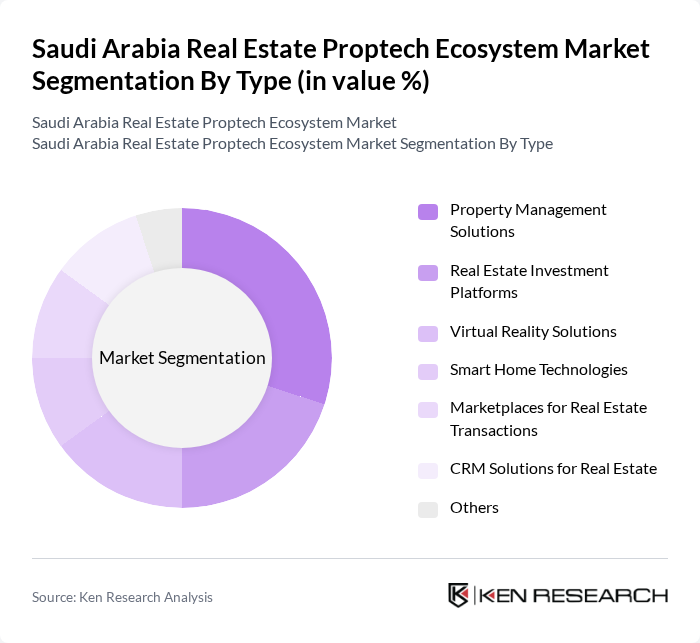

By Type:The market is segmented into various types, including Property Management Solutions, Real Estate Investment Platforms, Virtual Reality Solutions, Smart Home Technologies, Marketplaces for Real Estate Transactions, CRM Solutions for Real Estate, and Others. Among these, Property Management Solutions are currently leading the market due to the increasing need for efficient property management and tenant engagement. The rise in rental properties and the demand for streamlined operations have made this segment particularly attractive to investors and service providers.

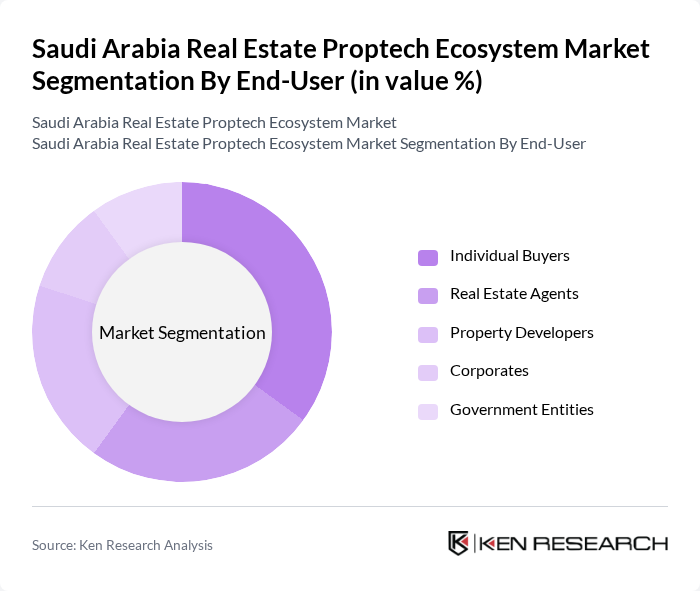

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, Corporates, and Government Entities. Among these, Individual Buyers are the dominant segment, driven by the increasing trend of home ownership and investment in residential properties. The growing population and urbanization in Saudi Arabia have led to a surge in demand for housing, making this segment crucial for the overall market growth.

The Saudi Arabia Real Estate Proptech Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, JLL, RE/MAX, Knight Frank, Savills, Prologis, Colliers International, CBRE, Emaar Properties, Aldar Properties, Dar Al Arkan, Meraas, Redfin, and Zillow contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Real Estate Proptech ecosystem appears promising, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for innovative real estate solutions will continue to rise. Additionally, the integration of AI and big data analytics is expected to enhance decision-making processes in property management and investment. Collaborations between Proptech firms and traditional real estate companies will likely foster innovation, creating a more dynamic and responsive market landscape that meets the needs of a diverse clientele.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Solutions Real Estate Investment Platforms Virtual Reality Solutions Smart Home Technologies Marketplaces for Real Estate Transactions CRM Solutions for Real Estate Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Corporates Government Entities |

| By Application | Residential Real Estate Commercial Real Estate Industrial Real Estate Mixed-Use Developments |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agencies |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| By Technology Integration | AI and Machine Learning Blockchain Technology Internet of Things (IoT) Big Data Analytics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Directors |

| Commercial Property Investors | 80 | Investment Analysts, Portfolio Managers |

| Proptech Solution Providers | 70 | Product Managers, Technology Officers |

| Real Estate Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| End-users of Proptech Solutions | 90 | Real Estate Agents, Property Managers |

The Saudi Arabia Real Estate Proptech Ecosystem Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital transformation, innovative property management solutions, and smart home technologies, alongside supportive government initiatives.