Region:Middle East

Author(s):Shubham

Product Code:KRAD0730

Pages:91

Published On:August 2025

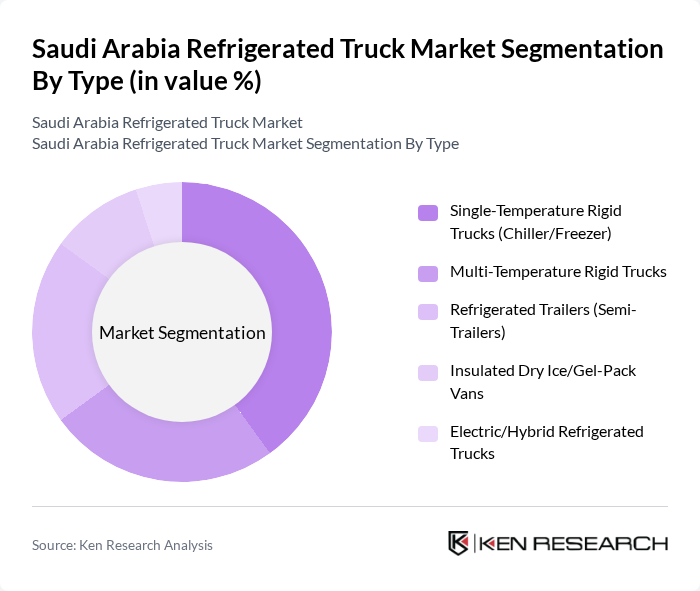

By Type:The market is segmented into various types of refrigerated trucks, each serving specific needs and applications. The subsegments include Single-Temperature Rigid Trucks (Chiller/Freezer), Multi-Temperature Rigid Trucks, Refrigerated Trailers (Semi-Trailers), Insulated Dry Ice/Gel-Pack Vans, and Electric/Hybrid Refrigerated Trucks. Among these, Single-Temperature Rigid Trucks are the most widely used due to their efficiency in transporting perishable goods at a consistent temperature, making them a preferred choice for food and beverage companies .

By End-User:The end-user segmentation includes Food & Beverage, Healthcare & Pharmaceuticals, Agriculture & Horticulture, Retail & E-grocery/Quick Commerce, and HoReCa (Hotels, Restaurants, Catering). The Food & Beverage sector is the leading end-user, driven by the rising demand for fresh and frozen products, which necessitates reliable refrigerated transport solutions to maintain product quality and safety during distribution. Growth is further supported by Saudi Arabia’s expanding retail and e-grocery channels and sustained demand for temperature-sensitive pharmaceuticals .

The Saudi Arabia Refrigerated Truck Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naqel Express, ColdStores Group of Saudi Arabia (CGS), Almajdouie Logistics, BaFarat Logistics, Tamer Logistics, Al-Jabr Logistics, Agility Logistics Parks Saudi Arabia, Bahri Logistics, Al Khomayyes Logistics, Haji Husein Alireza & Co. (HHA) – Thermo King Saudi Arabia, Zamil CoolCare (Zamil Air Conditioners & Ref. for transport bodies), Arabian Thermal Air-Conditioning Co. (ATAC) – Carrier Transicold dealer, United Yousef M. Naghi Co. (Daikin Transport Refrigeration distributor), Isuzu Motors Saudi Arabia (Commercial vehicle OEM), SA Truck Bodies (Saudi body builders for reefers) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the refrigerated truck market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer demand for fresh products. The integration of electric refrigerated trucks is expected to gain traction, aligning with global sustainability trends. Additionally, the expansion of cold chain logistics infrastructure will enhance operational efficiency. As the government continues to invest in logistics improvements, the market is poised for significant growth, addressing both current challenges and emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Temperature Rigid Trucks (Chiller/Freezer) Multi-Temperature Rigid Trucks Refrigerated Trailers (Semi-Trailers) Insulated Dry Ice/Gel-Pack Vans Electric/Hybrid Refrigerated Trucks |

| By End-User | Food & Beverage (Meat, Dairy, Bakery, Frozen, Produce) Healthcare & Pharmaceuticals (Vaccines, Biologics) Agriculture & Horticulture Retail & E-grocery/Quick Commerce HoReCa (Hotels, Restaurants, Catering) |

| By Payload Capacity | Less than 3.5 tons (LCV/Van) to 10 tons (MCV) to 20 tons (HCV) More than 20 tons (HCV/Trailer) |

| By Distribution Channel | OEM Sales (Truck OEM + Body Builder) Fleet/Leasing & Rental Companies Dealer/Distributor Sales Online/Direct Tenders |

| By Application | Chilled (0°C to 8°C) Frozen (-18°C and below) Ambient Controlled (8°C to 25°C) Hazardous/Controlled Substances |

| By Fleet Size | Small Fleet (1-10 trucks) Medium Fleet (11-50 trucks) Large Fleet (51+ trucks) |

| By Region | Riyadh (Central) Eastern Province (Dammam/Khobar/Jubail) Western Province (Jeddah/Makkah/Madinah) Southern Province (Asir/Jizan/Najran) Northern Province (Tabuk/Al-Jawf/Hail) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 120 | Logistics Managers, Supply Chain Managers |

| Pharmaceutical Cold Chain Management | 100 | Operations Managers, Quality Assurance Managers |

| Retail Refrigerated Transport | 80 | Procurement Managers, Distribution Managers |

| Government Regulatory Compliance | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Technology Adoption in Cold Chain | 70 | IT Managers, Innovation Leads |

The Saudi Arabia Refrigerated Truck Market is valued at approximately USD 260 million, reflecting its significance within the cold chain and logistics ecosystem, as supported by various industry analyses.