Region:Middle East

Author(s):Dev

Product Code:KRAB3135

Pages:92

Published On:October 2025

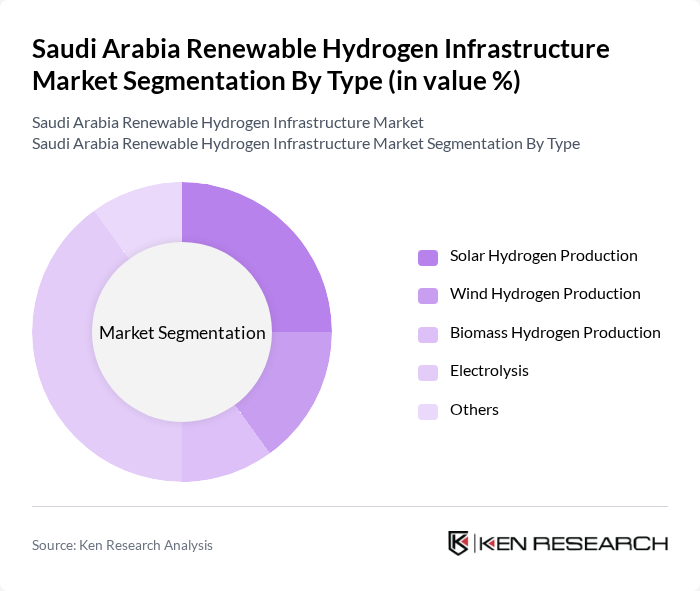

By Type:The market is segmented into various types of hydrogen production methods, including Solar Hydrogen Production, Wind Hydrogen Production, Biomass Hydrogen Production, Electrolysis, and Others. Among these, Electrolysis is currently the leading sub-segment due to its efficiency and the growing availability of renewable electricity sources. Solar Hydrogen Production is also gaining traction, driven by the country's abundant solar resources. The increasing focus on sustainable energy solutions is expected to further enhance the adoption of these technologies.

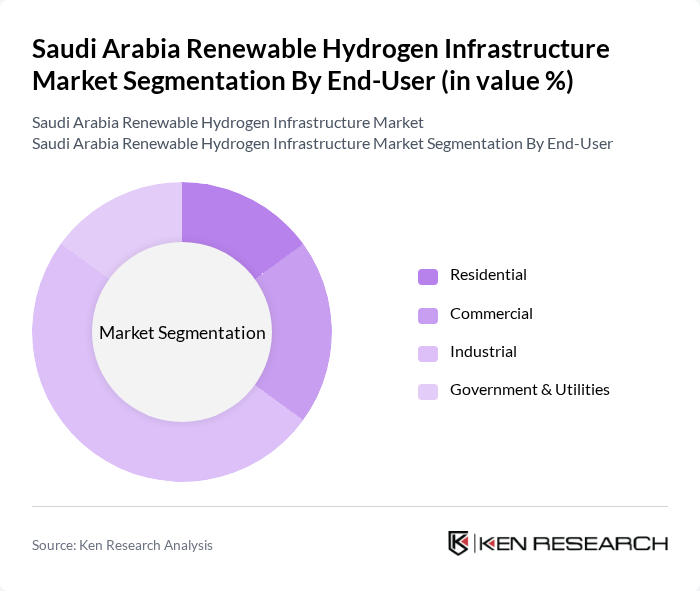

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment is the dominant player, driven by the need for clean energy solutions in manufacturing processes. The increasing adoption of hydrogen as a fuel source in various industries, including transportation and power generation, is propelling this segment's growth. Government initiatives to promote hydrogen use in public utilities are also contributing to the expansion of the Government & Utilities segment.

The Saudi Arabia Renewable Hydrogen Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Saudi Aramco, Air Products and Chemicals, Inc., Siemens Energy, Linde plc, Thyssenkrupp AG, ENGIE, TotalEnergies, Shell, Plug Power Inc., Ballard Power Systems, Nel ASA, H2U, Green Hydrogen Systems, Hydrogenics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable hydrogen infrastructure market in Saudi Arabia appears promising, driven by increasing global energy demands and a strong governmental push towards sustainability. By the future, the country aims to produce 4 million tons of hydrogen annually, positioning itself as a key player in the global hydrogen economy. Continued investments in technology and infrastructure, coupled with strategic international partnerships, will likely enhance the market's growth trajectory, fostering innovation and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Hydrogen Production Wind Hydrogen Production Biomass Hydrogen Production Electrolysis Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Power Generation Transportation Industrial Processes Energy Storage Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Regulatory Frameworks |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Policy Makers | 100 | Energy Policy Analysts, Regulatory Affairs Managers |

| Hydrogen Production Companies | 80 | Operations Managers, Technical Directors |

| Energy Sector Investors | 60 | Investment Analysts, Portfolio Managers |

| Research Institutions | 50 | Research Scientists, Energy Economists |

| End-Users in Transportation | 70 | Fleet Managers, Logistics Coordinators |

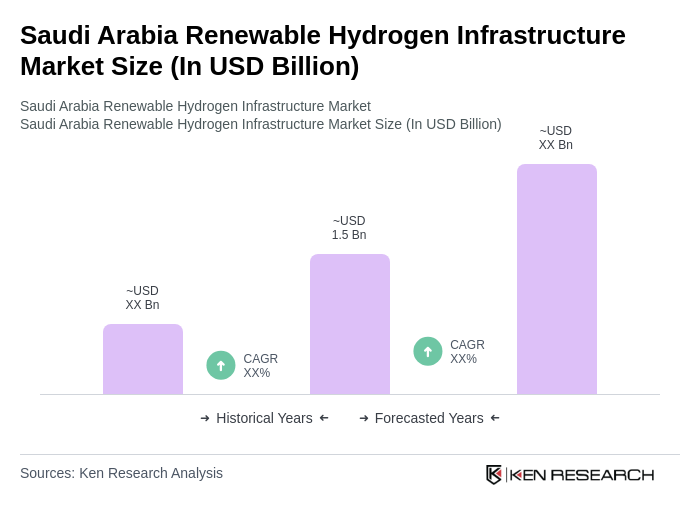

The Saudi Arabia Renewable Hydrogen Infrastructure Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the country's commitment to diversifying energy sources and reducing carbon emissions, alongside substantial investments in renewable technologies.