Region:Middle East

Author(s):Dev

Product Code:KRAB7084

Pages:82

Published On:October 2025

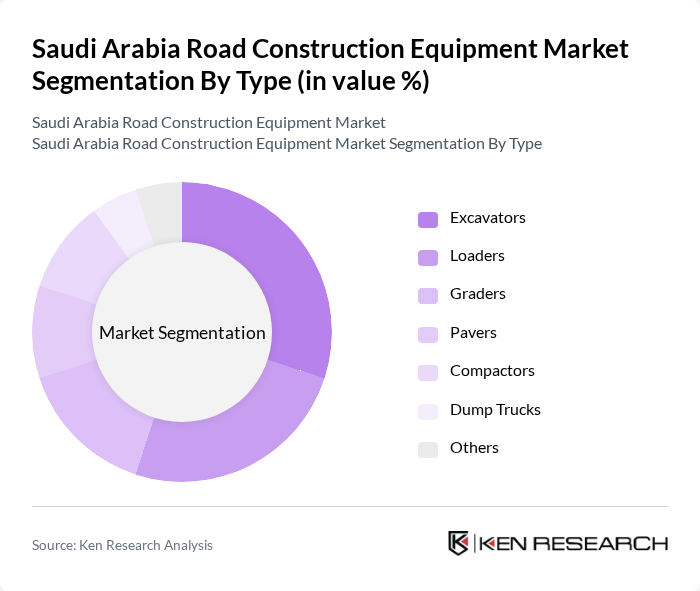

By Type:The market is segmented into various types of road construction equipment, including excavators, loaders, graders, pavers, compactors, dump trucks, and others. Each type serves specific functions in the construction process, with excavators and loaders being the most commonly used due to their versatility and efficiency in handling various tasks.

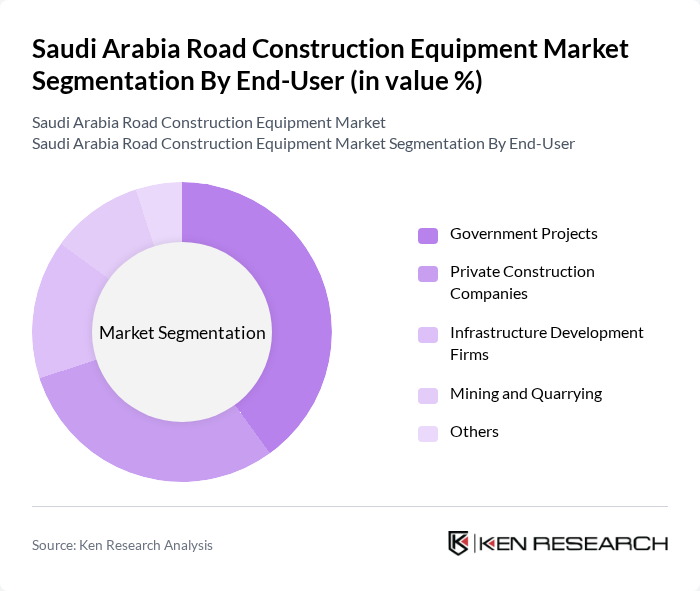

By End-User:The end-user segmentation includes government projects, private construction companies, infrastructure development firms, mining and quarrying, and others. Government projects are the leading segment, driven by substantial public investments in infrastructure and urban development initiatives.

The Saudi Arabia Road Construction Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, JCB, Liebherr Group, Doosan Infracore, Terex Corporation, SANY Group, XCMG Group, Hyundai Construction Equipment, CASE Construction Equipment, Wirtgen Group, Manitowoc Company, and Bobcat Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia road construction equipment market appears promising, driven by ongoing infrastructure investments and urbanization trends. As the government continues to prioritize transportation projects, the demand for advanced and eco-friendly construction equipment is expected to rise. Additionally, the integration of digital technologies and automation in equipment management will enhance operational efficiency, positioning the market for sustainable growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Excavators Loaders Graders Pavers Compactors Dump Trucks Others |

| By End-User | Government Projects Private Construction Companies Infrastructure Development Firms Mining and Quarrying Others |

| By Application | Road Construction Bridge Construction Airport Runway Development Urban Development Others |

| By Sales Channel | Direct Sales Distributors Online Sales Rental Services Others |

| By Distribution Mode | Retail Outlets Wholesale Online Platforms Direct Delivery Others |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment Others |

| By Brand | International Brands Local Brands Emerging Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Manufacturers | 100 | Product Managers, Sales Directors |

| Construction Project Managers | 80 | Site Managers, Project Coordinators |

| Equipment Rental Companies | 70 | Operations Managers, Rental Fleet Supervisors |

| Government Infrastructure Officials | 50 | Policy Makers, Urban Planners |

| Construction Industry Consultants | 60 | Market Analysts, Industry Experts |

The Saudi Arabia Road Construction Equipment Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by government infrastructure initiatives and urbanization efforts as part of the Vision 2030 initiative.