Region:Middle East

Author(s):Shubham

Product Code:KRAC0605

Pages:86

Published On:August 2025

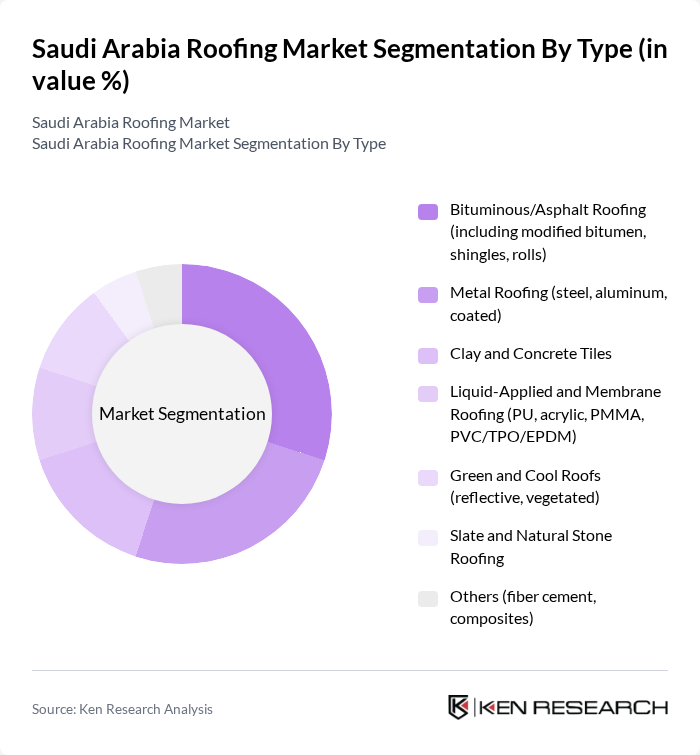

By Type:The roofing market in Saudi Arabia is segmented into various types, including Bituminous/Asphalt Roofing, Metal Roofing, Clay and Concrete Tiles, Liquid-Applied and Membrane Roofing, Green and Cool Roofs, Slate and Natural Stone Roofing, and Others. Each type serves different consumer needs and preferences, influenced by factors such as climate, durability, and aesthetic appeal. Industry sources indicate bituminous systems hold a notable share for cost-effectiveness in residential and commercial applications, while metal roofing is gaining traction for longevity and low maintenance; tiles remain important in residential segments and coastal aesthetics; and liquid-applied/membrane systems are widely used for waterproofing and energy efficiency upgrades on flat roofs .

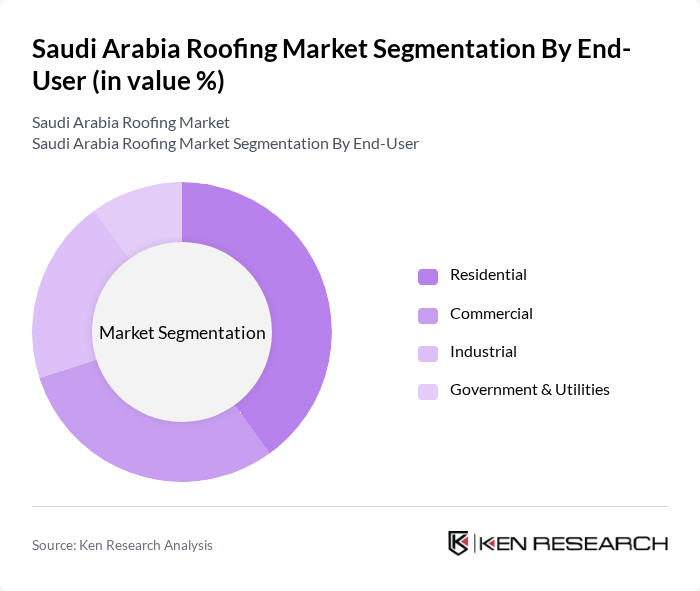

By End-User:The end-user segmentation of the roofing market includes Residential, Commercial, Industrial, and Government & Utilities sectors. Each sector has distinct requirements and preferences for roofing materials, influenced by factors such as building codes, budget constraints, and environmental considerations. Residential demand is supported by housing initiatives; commercial and hospitality pipelines connected to tourism investments are expanding; and industrial/government projects contribute steadily to flat-roof and metal system demand .

The Saudi Arabia Roofing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramic Company, SABIC (thermoplastics and sheets for roofing systems), Al Jazira Roofing & Bitumen Co. (AJRB), Saudi Waterproofing Co. (SASCO), Al Watania Gypsum Co. (roofing accessories and systems), Zamil Steel (pre-engineered buildings and metal roofing), RAK Ceramics (KSA) – roof tiles and accessories, Alfanar (building materials division), Owens Corning (insulation and roofing materials, KSA presence), Saint-Gobain (ISOVER, Weber, CertainTeed brands), BFG International (composites and roofing systems in GCC), Gulf Insulation Group (GIG), AlMuhaidib Group – Building Materials (roofing distribution), Al-Rashid Trading & Contracting Co. (RTCC) – building materials, Tamkeen Industrial & Trading Co. (roofing membranes and coatings) contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia roofing market is poised for significant growth, driven by urbanization, government infrastructure investments, and a shift towards sustainable solutions. As the population continues to urbanize, the demand for innovative roofing materials will increase. Additionally, the integration of smart technologies in construction and a focus on energy efficiency will shape future developments. Companies that adapt to these trends and invest in skilled labor will be well-positioned to capitalize on emerging opportunities in the roofing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Bituminous/Asphalt Roofing (including modified bitumen, shingles, rolls) Metal Roofing (steel, aluminum, coated) Clay and Concrete Tiles Liquid-Applied and Membrane Roofing (PU, acrylic, PMMA, PVC/TPO/EPDM) Green and Cool Roofs (reflective, vegetated) Slate and Natural Stone Roofing Others (fiber cement, composites) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation and Retrofitting Maintenance and Repair |

| By Distribution Channel | Direct Sales Distributors and Building Material Dealers Online/B2B E-Procurement |

| By Material Source | Domestic Production Imported Materials |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Green Building Incentives (LEED/Saudi green codes) Customs and Tariff Exemptions on Energy-Efficient Materials Grants/Rebates for Sustainable and Cool Roofing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Roofing Projects | 140 | Homeowners, Contractors, Architects |

| Commercial Roofing Solutions | 100 | Facility Managers, Project Managers, Developers |

| Roofing Material Suppliers | 80 | Sales Managers, Product Managers, Distributors |

| Construction Industry Insights | 120 | Construction Managers, Engineers, Procurement Officers |

| Regulatory and Compliance Perspectives | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Saudi Arabia Roofing Market is valued at approximately USD 0.8 billion, reflecting steady growth driven by various construction projects and urban development initiatives under the Vision 2030 program.