Region:Middle East

Author(s):Dev

Product Code:KRAD0488

Pages:94

Published On:August 2025

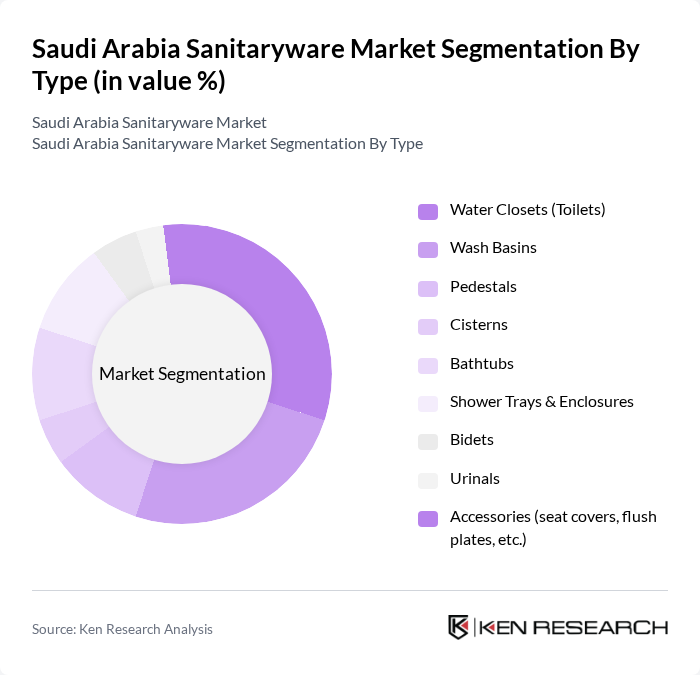

By Type:The market is segmented into various types of sanitaryware products, including water closets, wash basins, pedestals, cisterns, bathtubs, shower trays & enclosures, bidets, urinals, and accessories. Among these, water closets and wash basins are the most popular due to their essential role in modern bathrooms. The increasing trend towards luxury and designer bathrooms has also led to a rise in demand for high-end products like bathtubs and shower enclosures.

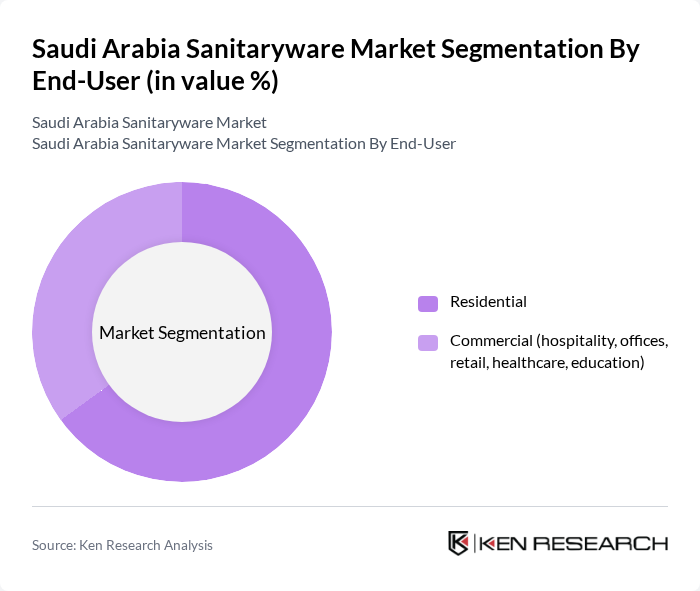

By End-User:The sanitaryware market is divided into residential and commercial segments. The residential segment is the largest, driven by the increasing number of housing projects and renovations. The commercial segment, which includes hospitality, offices, retail, healthcare, and education, is also growing due to the rise in commercial construction and the need for modern facilities. The demand for high-quality sanitaryware in both segments is influenced by consumer preferences for aesthetics, functionality, and water efficiency.

The Saudi Arabia Sanitaryware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramic Company, RAK Ceramics PJSC, Al-Muhaidib Group (Building Materials Division), Al-Jomaih Holding Company (bathroom/kitchen distribution), Duravit AG, Kohler Co., TOTO Ltd., Ideal Standard International, Villeroy & Boch AG, Laufen Bathrooms AG, Geberit AG, American Standard (LIXIL Corporation), Roca Sanitario S.A., Cera Sanitaryware Limited, Jaquar Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia sanitaryware market is poised for significant growth driven by urbanization, rising incomes, and government infrastructure initiatives. As consumers increasingly prioritize hygiene and sustainability, manufacturers are expected to innovate with eco-friendly and technologically advanced products. The integration of smart technologies in sanitaryware will likely enhance user experience, while e-commerce platforms will facilitate broader market access, making it easier for consumers to purchase high-quality products conveniently.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Closets (Toilets) Wash Basins Pedestals Cisterns Bathtubs Shower Trays & Enclosures Bidets Urinals Accessories (seat covers, flush plates, etc.) |

| By End-User | Residential Commercial (hospitality, offices, retail, healthcare, education) |

| By Distribution Channel | Home Centers (e.g., ACE, Danube Home, IKEA) Specialty Stores/Showrooms Online Other Channels (dealer franchisees, distributors) |

| By Material | Ceramic/Vitreous China Metal (stainless steel, cast iron) Plastic (uPVC, acrylic) Other Materials (porcelain, composite) |

| By Price Range | Economy Mid-range Premium |

| By Brand | Local/National Brands International Brands Private Labels (retailer/distributor brands) |

| By Application | New Construction Renovation/Remodeling Replacement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Sanitaryware | 60 | Production Managers, Quality Control Officers |

| Retailers and Distributors | 80 | Store Managers, Sales Executives |

| Architects and Interior Designers | 70 | Lead Architects, Design Consultants |

| Construction Companies | 90 | Project Managers, Procurement Officers |

| Consumers (Homeowners and Renters) | 150 | Homeowners, Renters, Renovators |

The Saudi Arabia Sanitaryware Market is valued at approximately USD 290 million, reflecting growth driven by urbanization, increased construction activities, and a rising demand for modern bathroom fixtures.