Region:Middle East

Author(s):Rebecca

Product Code:KRAD2910

Pages:89

Published On:November 2025

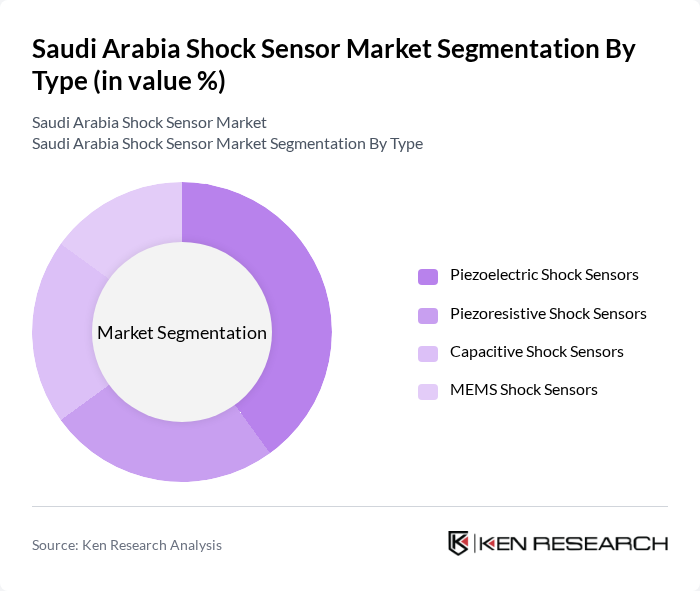

By Type:The market is segmented into various types of shock sensors, including Piezoelectric Shock Sensors, Piezoresistive Shock Sensors, Capacitive Shock Sensors, and MEMS Shock Sensors. Each type serves distinct applications and industries, contributing to the overall market dynamics.

The Piezoelectric Shock Sensors segment is currently dominating the market due to their high sensitivity and reliability in detecting vibrations and impacts. These sensors are widely used in various applications, including automotive safety systems and industrial machinery monitoring. The increasing focus on safety regulations and the need for precise monitoring in critical applications have further propelled the demand for piezoelectric sensors, making them the leading choice among consumers and industries alike. The segment is also benefiting from advancements in material science and miniaturization, which enhance sensor performance and reduce costs .

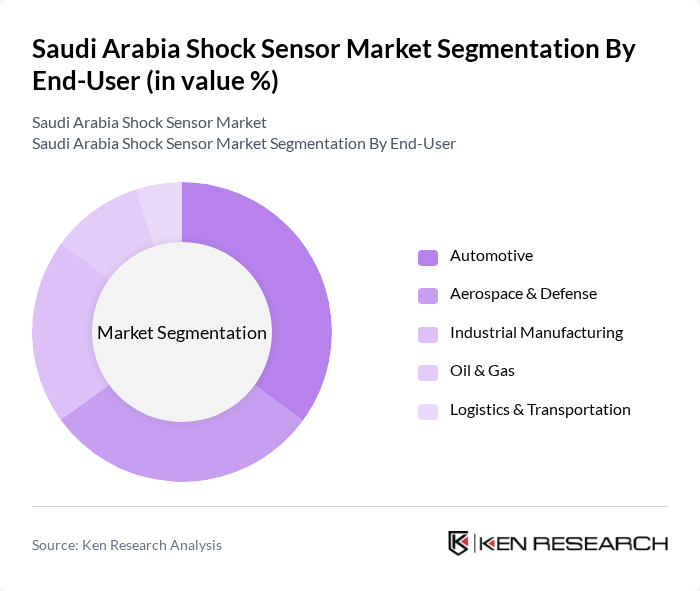

By End-User:The market is segmented based on end-users, including Automotive, Aerospace & Defense, Industrial Manufacturing, Oil & Gas, and Logistics & Transportation. Each sector has unique requirements for shock sensors, influencing their adoption rates and market growth.

The Automotive sector is the leading end-user of shock sensors, driven by the increasing demand for advanced safety features in vehicles. With the rise of electric and autonomous vehicles, the need for reliable shock sensors has surged, as they play a crucial role in monitoring vehicle dynamics and ensuring passenger safety. Additionally, stringent safety regulations in the automotive industry further enhance the adoption of these sensors, solidifying their position as the dominant segment. The aerospace and defense sector is also witnessing strong growth, supported by investments in national security and modernization programs .

The Saudi Arabia Shock Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Bosch Security Systems, TE Connectivity Ltd., Analog Devices, Inc., STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG, Murata Manufacturing Co., Ltd., Omron Corporation, Microchip Technology Inc., Maxim Integrated, Vishay Intertechnology, Inc., Kyocera Corporation, Saudi Advanced Electronics Company (SAEC), Alfanar Group, Saudi Arabian Military Industries (SAMI), Al Rajhi Industrial Investment Company, Al-Murjan Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia shock sensor market appears promising, driven by ongoing technological advancements and increasing government support for infrastructure projects. As the nation progresses towards its Vision 2030 goals, the integration of smart technologies and IoT solutions will likely enhance the functionality and appeal of shock sensors. Furthermore, the growing emphasis on predictive maintenance and real-time data analytics will create new avenues for market growth, ensuring that shock sensors remain integral to various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Piezoelectric Shock Sensors Piezoresistive Shock Sensors Capacitive Shock Sensors MEMS Shock Sensors |

| By End-User | Automotive Aerospace & Defense Industrial Manufacturing Oil & Gas Logistics & Transportation |

| By Application | Structural Health Monitoring Security & Tamper Detection Impact & Vibration Monitoring Cargo & Asset Protection Others |

| By Material | Quartz Tourmaline Gallium Phosphate Salts Others |

| By Technology | Analog Output Sensors Digital Output Sensors Smart & IoT-Enabled Sensors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Shock Sensor Applications | 100 | Automotive Engineers, Product Development Managers |

| Industrial Equipment Monitoring | 90 | Maintenance Managers, Operations Supervisors |

| Consumer Electronics Integration | 80 | Product Managers, R&D Engineers |

| Smart Home Devices | 60 | IoT Specialists, Home Automation Experts |

| Research Institutions and Academia | 40 | Academic Researchers, Technology Analysts |

The Saudi Arabia Shock Sensor Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for advanced sensing technologies across various sectors, including automotive, aerospace, and industrial applications.