Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2383

Pages:95

Published On:October 2025

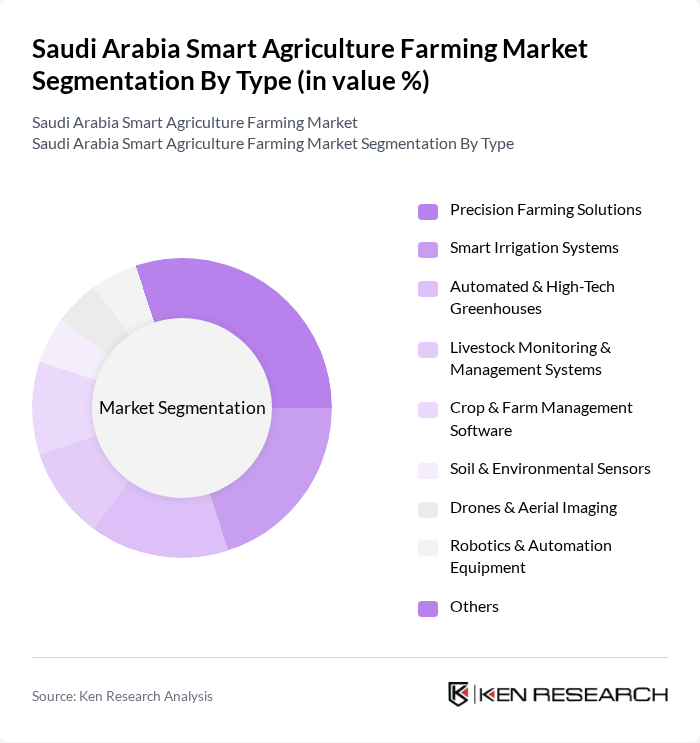

By Type:The market is segmented into various types of smart agriculture solutions, including Precision Farming Solutions, Smart Irrigation Systems, Automated & High-Tech Greenhouses, Livestock Monitoring & Management Systems, Crop & Farm Management Software, Soil & Environmental Sensors, Drones & Aerial Imaging, Robotics & Automation Equipment, and Others. Each of these segments plays a crucial role in enhancing agricultural efficiency and productivity. Precision farming and smart irrigation are particularly prominent due to the need for efficient water management and increased crop yields in arid regions .

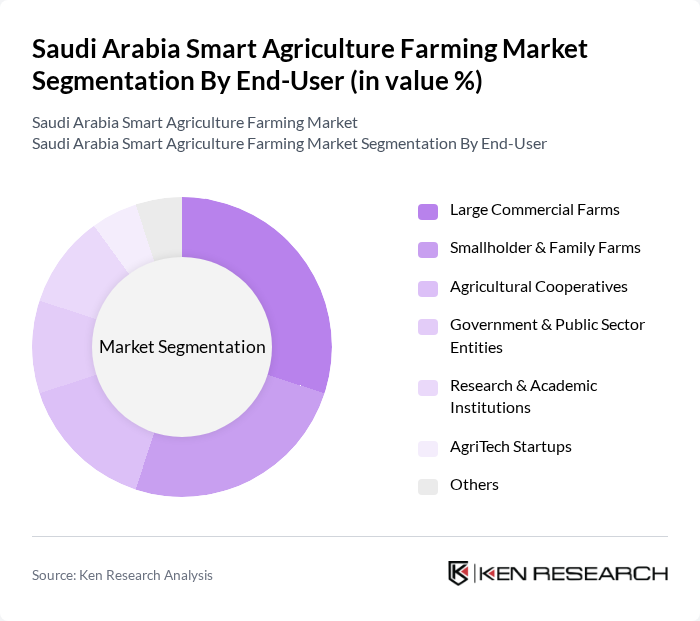

By End-User:The end-user segmentation includes Large Commercial Farms, Smallholder & Family Farms, Agricultural Cooperatives, Government & Public Sector Entities, Research & Academic Institutions, AgriTech Startups, and Others. Each segment has unique needs and contributes differently to the overall market dynamics. Large commercial farms lead adoption due to greater access to capital and technology, while government and public sector entities drive pilot projects and research .

The Saudi Arabia Smart Agriculture Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Faisaliah Group, National Agricultural Development Company (NADEC), Saudi Agricultural and Livestock Investment Company (SALIC), Al-Jazeera Agricultural Company, Al-Muhaidib Group, Red Sea Farms, United Farmers Holding Company, Mowreq Specialized Agriculture, Elite Agro Projects, Green Oasis Farms, AgriNex, Badir Program for Technology Incubators, King Abdullah Initiative for Saudi Agricultural Investment Abroad, iFarm Bather Smart Farm contribute to innovation, geographic expansion, and service delivery in this space.

The future of smart agriculture in Saudi Arabia appears promising, driven by increasing government support and technological advancements. In future, the integration of smart irrigation systems and AI technologies is expected to revolutionize farming practices, enhancing productivity and sustainability. As awareness grows, more farmers are likely to adopt these innovations, leading to improved food security. Collaborative efforts with research institutions will further accelerate the development of sustainable agricultural practices, positioning Saudi Arabia as a leader in smart agriculture in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Precision Farming Solutions Smart Irrigation Systems Automated & High-Tech Greenhouses Livestock Monitoring & Management Systems Crop & Farm Management Software Soil & Environmental Sensors Drones & Aerial Imaging Robotics & Automation Equipment Others |

| By End-User | Large Commercial Farms Smallholder & Family Farms Agricultural Cooperatives Government & Public Sector Entities Research & Academic Institutions AgriTech Startups Others |

| By Application | Precision Crop Production Livestock & Poultry Management Aquaculture & Fisheries Vertical & Indoor Farming Supply Chain & Post-Harvest Management Others |

| By Investment Source | Private Equity & Venture Capital Government Grants & Subsidies International Development Funds Corporate Investments Crowdfunding & Alternative Finance Others |

| By Distribution Channel | Direct B2B Sales Online Platforms & Marketplaces Distributors & System Integrators Agricultural Expos & Trade Shows Others |

| By Technology Integration | Internet of Things (IoT) Solutions Artificial Intelligence & Machine Learning Blockchain for Agri Supply Chain Data Analytics & Farm Management Tools Robotics & Automation Others |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives for AgriTech Research & Innovation Grants Training & Capacity Building Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Irrigation Systems | 100 | Agricultural Engineers, Farm Managers |

| Precision Farming Technologies | 60 | Technology Providers, Agronomists |

| Drone Applications in Agriculture | 50 | Drone Operators, Crop Consultants |

| Soil Monitoring Solutions | 40 | Soil Scientists, Agricultural Researchers |

| Farm Management Software | 70 | Farm Owners, IT Managers in Agriculture |

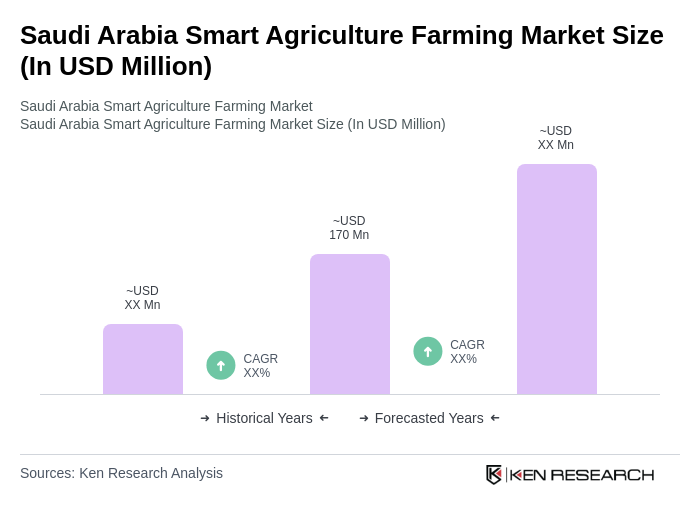

The Saudi Arabia Smart Agriculture Farming Market is valued at approximately USD 170 million, reflecting a significant growth driven by advanced agricultural technologies, government initiatives for food security, and sustainable farming practices.