Region:Middle East

Author(s):Rebecca

Product Code:KRAD4984

Pages:100

Published On:December 2025

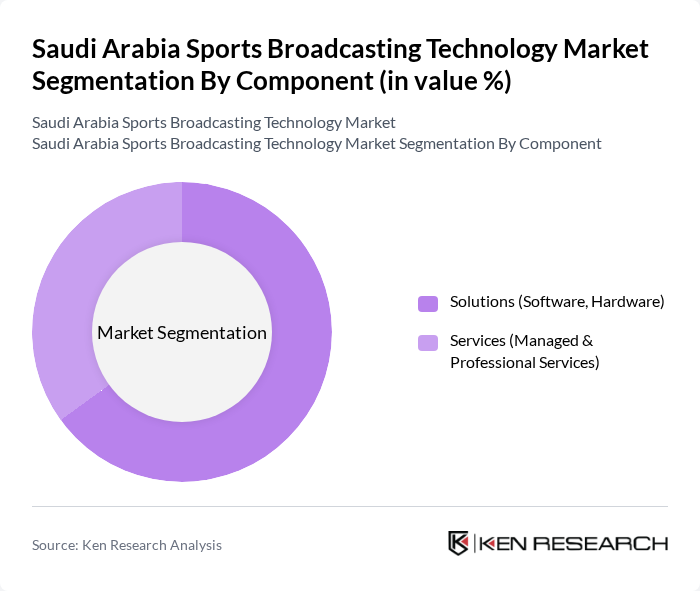

By Component:

The components of the market include Solutions (Software, Hardware) and Services (Managed & Professional Services). The Solutions segment is currently leading the market, supported by industry data indicating that solution offerings generate the largest share of revenue, driven by the increasing demand for advanced contribution, production, and distribution technologies that enhance viewer experience and operational efficiency. Software solutions, particularly those that support high-definition, 4K, and IP?based broadcasting, OTT delivery, and cloud production workflows, are gaining traction as broadcasters and streaming platforms seek to provide superior content quality and personalized, multi?screen viewing experiences. The Services segment, while growing, is primarily driven by the need for professional expertise in systems integration, managed playout, cloud operations, and end?to?end management of complex live sports broadcasting and OTT platforms.

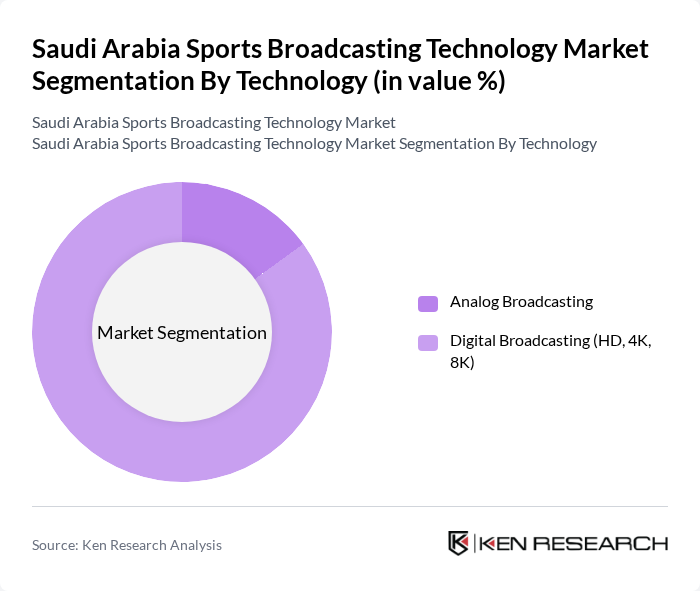

By Technology:

The technology segment encompasses Analog Broadcasting and Digital Broadcasting (HD, 4K, 8K). Digital Broadcasting is the dominant technology in the market, reflecting the broader transition from traditional linear and SD signals to IP-based, high-definition and ultra?high?definition workflows, driven by increasing consumer preference for high?quality video and interactive features on smart TVs, mobiles, and connected devices. The shift towards digital and OTT platforms has led to a steady decline in analog broadcasting infrastructure, which is being phased out in favor of more flexible, software?defined and cloud?enabled delivery models. The demand for 4K content, and early pilots of 8K and advanced formats such as HDR and immersive audio, is on the rise as rights holders and platforms in Saudi Arabia seek to differentiate live sports coverage and align with global best practices in premium sports production.

The Saudi Arabia Sports Broadcasting Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Sports Company (SSC), Saudi Broadcasting Authority (SBA) / KSA Sports, Saudi Telecom Company (stc) – including stc tv, Shahid (MBC Group), OSN (Orbit Showtime Network), beIN SPORTS (beIN Media Group), Intigral (Jawwy TV), Arabsat, Rotana Media Group, YouTube (sports channels and creators ecosystem), DAZN Group Ltd., StarzPlay Arabia, Snap Inc. (Snapchat sports content in KSA), Muvi Cinemas / Muvi Studios (sports and live events distribution), and Eutelsat Communications (satellite capacity for sports broadcasting) contribute to innovation, geographic expansion, and service delivery in this space through investments in rights acquisition, OTT platforms, satellite capacity, and next?generation production technologies.

The future of the Saudi Arabia sports broadcasting technology market appears promising, driven by ongoing technological innovations and increasing consumer demand for diverse content. The rise of mobile broadcasting solutions and the integration of artificial intelligence in content personalization are expected to enhance viewer engagement. Additionally, the government's continued investment in sports infrastructure will likely create new opportunities for broadcasters to expand their reach and improve service delivery, fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions (Software, Hardware) Services (Managed & Professional Services) |

| By Technology | Analog Broadcasting Digital Broadcasting (HD, 4K, 8K) |

| By Platform | Television (Satellite, Cable, IPTV, DTT) OTT / Online Streaming Platforms Radio & Audio Streaming |

| By Application | Live Sports Production & Transmission Remote / Cloud Production Replay, Graphics & Data Visualization Content Distribution & Playout Fan Engagement & Interactivity |

| By End-User | Broadcasters & TV Networks OTT Platforms & Telcos Sports Clubs, Leagues & Federations Production Houses & Studios Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region (Within Saudi Arabia) | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Khobar) Northern & Southern Regions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Technology Providers | 100 | CTOs, Product Managers |

| Sports Event Organizers | 80 | Event Managers, Marketing Directors |

| Media Rights Holders | 70 | Legal Advisors, Business Development Managers |

| Advertising Agencies in Sports | 60 | Account Executives, Media Planners |

| Telecommunications Companies | 90 | Network Engineers, Sales Directors |

The Saudi Arabia Sports Broadcasting Technology Market is valued at approximately USD 1.0 billion, reflecting a significant growth driven by increased sports popularity, government investments in infrastructure, and the rise of digital platforms enhancing viewer engagement.