Region:Middle East

Author(s):Rebecca

Product Code:KRAD6181

Pages:97

Published On:December 2025

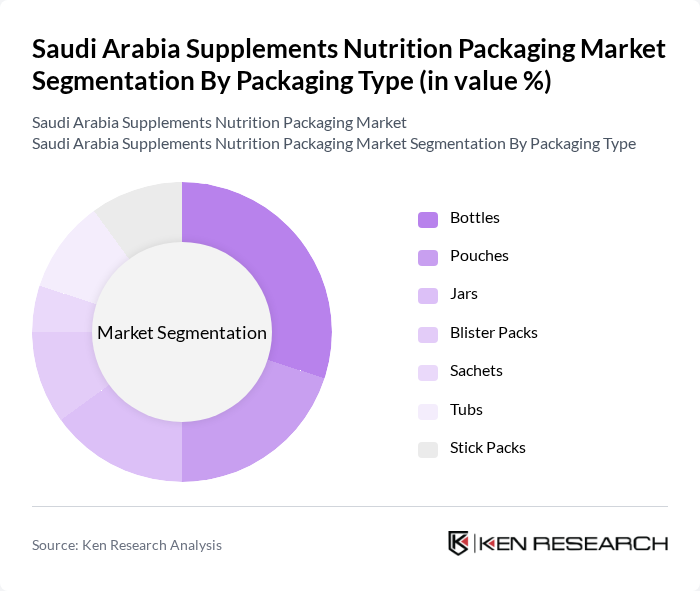

By Packaging Type:The packaging type segment includes various forms such as bottles, pouches, jars, blister packs, sachets, tubs, and stick packs. Each type serves different consumer needs and preferences, with specific advantages in terms of convenience, preservation, dosage control, and branding, and with flexible formats gaining share in sports nutrition and single-serve applications.

The bottles segment is currently dominating the market due to their versatility and consumer preference for solid-dose and liquid supplements in rigid containers that protect against moisture and contamination. Bottles are favored for their ease of use, resealability, compatibility with child-resistant closures, and ability to maintain product integrity throughout distribution. Additionally, the trend towards on-the-go nutrition has led to increased demand for small-format bottles and ready-to-drink supplements, particularly in urban areas where convenience is key, while sports nutrition brands increasingly use bottles and tubs for protein powders. The growth of e-commerce has also facilitated the distribution of bottled products, with shatter-resistant plastic bottles and high-barrier containers helping brands reduce damage and extend shelf life in parcel logistics, further solidifying their market leadership.

By End-Use Application:This segment encompasses various applications including vitamins and mineral supplements, sports nutrition and protein supplements, herbal and botanical supplements, probiotics and digestive health, weight management and energy supplements, and others. Each application targets specific consumer needs and health goals, with adult health, immunity, and lifestyle-related conditions being the dominant demand drivers.

The vitamins and mineral supplements segment leads the market, driven by a growing awareness of health and wellness among consumers and the large base of adults using daily multivitamins, immunity-boosting products, and condition-specific formulations. This segment benefits from a broad consumer base, including children, adults, and seniors, all seeking to enhance their nutritional intake, which in turn sustains demand for bottles, blister packs, and sachets tailored to tablets, capsules, and gummies. The increasing prevalence of lifestyle-related health issues, such as obesity, diabetes, and cardiovascular conditions, has also contributed to the demand for vitamins, minerals, and fortified products, making this segment a key player in the overall market and encouraging brands to invest in tamper-evident, clearly labeled, and premium-looking packaging.

The Saudi Arabia Supplements Nutrition Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global Group, Inc., Huhtamaki Oyj, Mondi plc, Constantia Flexibles Group GmbH, Gerresheimer AG, TricorBraun, ProAmpac LLC, Glenroy, Inc., Comar LLC, Saudi Arabian Packaging Industry WLL (SAPIN), Napco National, Arabian Plastic Manufacturing Company (APM), Middle East Specialized Cables Co. (MESC) – Packaging Division, Almarai Company – In-house Supplements and Nutrition Packaging Operations contribute to innovation, geographic expansion, and service delivery in this space, with global groups providing high-barrier flexible structures and rigid containers, and domestic converters supporting localization and shorter lead times.

The future of the Saudi Arabia supplements nutrition packaging market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, companies are likely to invest in innovative packaging solutions that enhance product appeal and sustainability. Additionally, the integration of digital technologies in marketing and distribution channels will facilitate better consumer engagement, leading to increased sales. The focus on eco-friendly materials will also shape packaging strategies, aligning with global sustainability trends and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Bottles Pouches Jars Blister Packs Sachets Tubs Stick Packs |

| By End-Use Application | Vitamins and Mineral Supplements Sports Nutrition and Protein Supplements Herbal and Botanical Supplements Probiotics and Digestive Health Weight Management and Energy Supplements Others |

| By Packaging Material | Plastic Glass Metal Paper & Paperboard Others |

| By Distribution Channel | Pharmacies and Drug Stores Supermarkets/Hypermarkets Specialty Nutrition Stores E-commerce Direct Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Tablets Capsules Powders Liquids Gummies and Soft Chews Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Lifestyle Segment (Athletes, Health-conscious, Clinical/Patients, Others) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutrition Supplements | 120 | Store Managers, Product Buyers |

| Consumer Preferences in Packaging | 150 | Health-Conscious Consumers, Fitness Enthusiasts |

| Manufacturers of Nutritional Products | 90 | Production Managers, Quality Assurance Officers |

| Distribution Channels Analysis | 70 | Logistics Coordinators, Supply Chain Managers |

| Health and Nutrition Experts | 50 | Dietitians, Nutritionists, Health Coaches |

The Saudi Arabia Supplements Nutrition Packaging Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing health consciousness, rising disposable incomes, and a growing trend towards preventive healthcare among consumers.