Region:Middle East

Author(s):Rebecca

Product Code:KRAD4951

Pages:82

Published On:December 2025

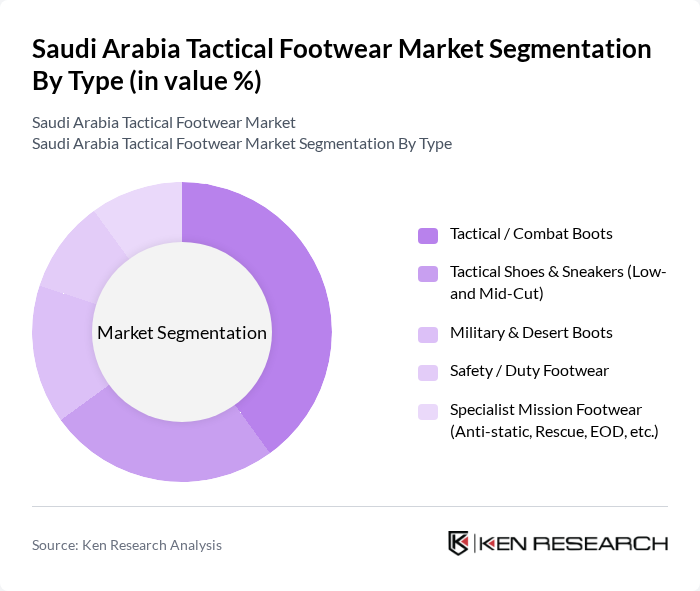

By Type:The tactical footwear market can be segmented into various types, including Tactical / Combat Boots, Tactical Shoes & Sneakers (Low- and Mid-Cut), Military & Desert Boots, Safety / Duty Footwear, and Specialist Mission Footwear (Anti-static, Rescue, EOD, etc.). This structure is consistent with the broader global tactical footwear classification, where boots and shoes form the core product groups for military, law enforcement, and outdoor users. Among these, Tactical / Combat Boots are the most popular due to their durability, ankle support, and versatility, making them suitable for both military and civilian use in harsh climates such as deserts and rocky terrains. The increasing demand for high-performance footwear in challenging environments, driven by defense modernization and the need for enhanced traction, shock absorption, and protective features, has led to a significant rise in the sales of Tactical / Combat Boots, which are favored for their protective features and comfort.

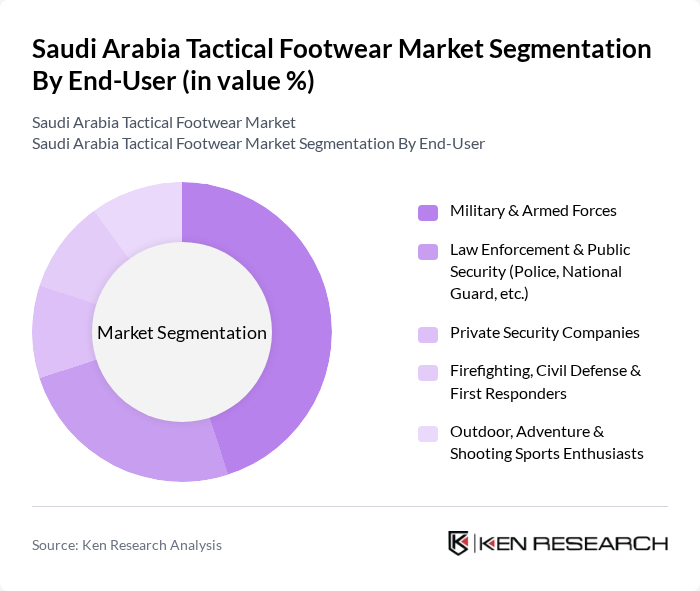

By End-User:The end-user segmentation includes Military & Armed Forces, Law Enforcement & Public Security (Police, National Guard, etc.), Private Security Companies, Firefighting, Civil Defense & First Responders, and Outdoor, Adventure & Shooting Sports Enthusiasts. This segmentation reflects the main global demand clusters for tactical footwear, where military and law enforcement remain the largest institutional buyers. The Military & Armed Forces segment leads the market in Saudi Arabia due to continuous investment in defense and security, participation in regional operations, and ongoing modernization of soldier systems, including footwear designed for desert, urban, and mountainous environments. The increasing focus on enhancing the operational capabilities and comfort of military personnel and public security forces has driven the demand for specialized tactical footwear that offers superior protection, breathability, and comfort in high-temperature conditions and varied terrains.

The Saudi Arabia Tactical Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as 5.11 Tactical, Bates Footwear (Wolverine Worldwide), Magnum Boots, Lowa Boots, Danner (LaCrosse Footwear), Salomon (Salomon Group), Merrell (Wolverine Worldwide), Under Armour, Nike, Adidas, Reebok, Columbia Sportswear, Rocky Brands, Hi?Tec, Al?Majd Shoes Factory (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia tactical footwear market is poised for significant growth, driven by increasing investments in security and outdoor activities. As consumer preferences shift towards high-performance and eco-friendly products, manufacturers are likely to innovate and adapt their offerings. The rise of e-commerce will further enhance market accessibility, allowing brands to reach diverse consumer segments. Additionally, collaborations with local influencers and brands can strengthen market presence, creating a dynamic environment for tactical footwear in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tactical / Combat Boots Tactical Shoes & Sneakers (Low- and Mid-Cut) Military & Desert Boots Safety / Duty Footwear Specialist Mission Footwear (Anti-static, Rescue, EOD, etc.) |

| By End-User | Military & Armed Forces Law Enforcement & Public Security (Police, National Guard, etc.) Private Security Companies Firefighting, Civil Defense & First Responders Outdoor, Adventure & Shooting Sports Enthusiasts |

| By Distribution Channel | Institutional / Contract Procurement Specialty Tactical & Military Stores Sports & Outdoor Retail Chains Online Retail (Brand E?commerce & Marketplaces) Hypermarkets, Department Stores & Others |

| By Material | Full?Grain & Top?Grain Leather Synthetic Materials (e.g., Nylon, Microfiber) Rubber & TPU Textile / Mesh & Technical Fabrics Composite & Hybrid Constructions |

| By Price Range | Economy / Budget Tactical Footwear Mid?Range Tactical Footwear Premium Tactical Footwear Professional / Contract?Grade Footwear Luxury & Lifestyle Tactical Footwear |

| By Gender | Men Women Unisex Youth |

| By Region | Riyadh & Central Region Eastern Province (Dammam, Dhahran, Al Khobar) Western Region (Makkah, Madinah, Jeddah) Southern & South?Western Region (Asir, Jazan, Najran) Northern Region & Emerging Defense Hubs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Personnel Usage | 120 | Active Duty Soldiers, Procurement Officers |

| Law Enforcement Footwear Preferences | 90 | Police Officers, Tactical Unit Leaders |

| Outdoor Enthusiasts Insights | 80 | Hikers, Campers, Adventure Sports Participants |

| Retailer Feedback on Tactical Footwear | 60 | Store Managers, Product Buyers |

| Consumer Purchase Behavior | 100 | General Consumers, Online Shoppers |

The Saudi Arabia Tactical Footwear Market is valued at approximately USD 120 million, representing a small share of the global tactical footwear market, which is valued at around USD 2.05 billion. This market is driven by increasing defense budgets and security concerns.