Region:Middle East

Author(s):Rebecca

Product Code:KRAC0166

Pages:88

Published On:August 2025

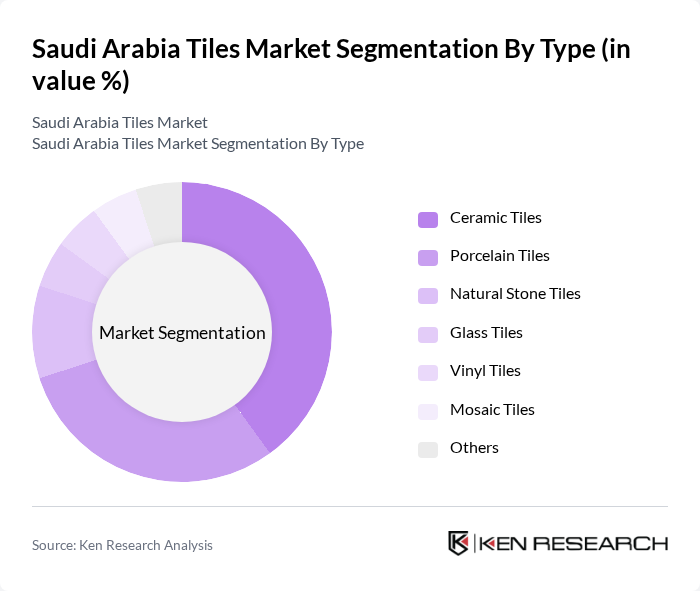

By Type:The market is segmented into various types of tiles, including Ceramic Tiles, Porcelain Tiles, Natural Stone Tiles, Glass Tiles, Vinyl Tiles, Mosaic Tiles, and Others. Ceramic and porcelain tiles are the most popular due to their durability, design versatility, and suitability for both residential and commercial applications. Natural stone and mosaic tiles are preferred for premium and decorative uses, while glass and vinyl tiles cater to niche and specialized requirements .

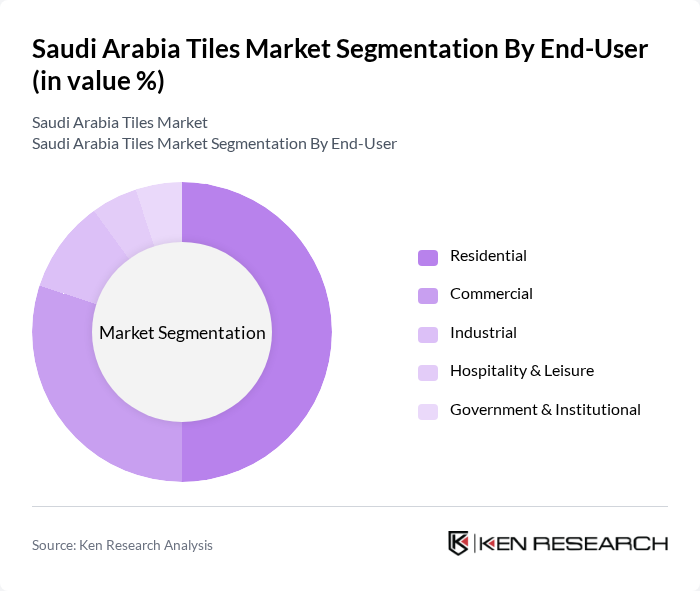

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Hospitality & Leisure, and Government & Institutional sectors. The residential segment is the largest, driven by increasing home renovations, new housing developments, and a growing focus on modern interiors. The commercial sector is also significant, supported by the expansion of retail, office, and hospitality spaces, while industrial and institutional demand is rising due to infrastructure and public sector investments .

The Saudi Arabia Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramic Company, Arabian Tile Company Ltd. (ARTIC), RAK Ceramics PJSC, Al-Jazira Factory for Ceramic Tiles, Saudi Marble & Granite Factory Company, Future Ceramic Company, Alfanar Ceramics, Al Forsan Global Industrial Complex, Al Maha Ceramics, Mohawk Industries Inc., Al Sorayai Group, Al Omran Group, Al Rajhi Construction, Al Mansourah Tiles, and Al Saad Group contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia tiles market is poised for significant growth, driven by urbanization and government infrastructure initiatives. As the population continues to migrate to urban areas, the demand for aesthetically pleasing and functional tiles will increase. Additionally, the focus on sustainable practices and eco-friendly materials will shape product offerings. Companies that adapt to these trends and invest in technology will likely capture a larger market share, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ceramic Tiles Porcelain Tiles Natural Stone Tiles Glass Tiles Vinyl Tiles Mosaic Tiles Others |

| By End-User | Residential Commercial Industrial Hospitality & Leisure Government & Institutional |

| By Application | Flooring Wall Cladding Backsplashes Outdoor Spaces Facades |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Design | Traditional Contemporary Rustic Modern/Minimalist |

| By Material | Clay Stone Composite Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 80 | Homeowners, Interior Designers |

| Commercial Tile Applications | 60 | Facility Managers, Architects |

| Tile Export Market | 40 | Export Managers, Trade Analysts |

| Retail Distribution Channels | 50 | Retail Managers, Sales Executives |

| Construction Industry Stakeholders | 45 | Contractors, Project Managers |

The Saudi Arabia Tiles Market is valued at approximately USD 1.8 billion, driven by factors such as rapid urbanization, a booming construction sector, and increasing consumer preferences for durable and aesthetically pleasing home interiors.