Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5823

Pages:96

Published On:December 2025

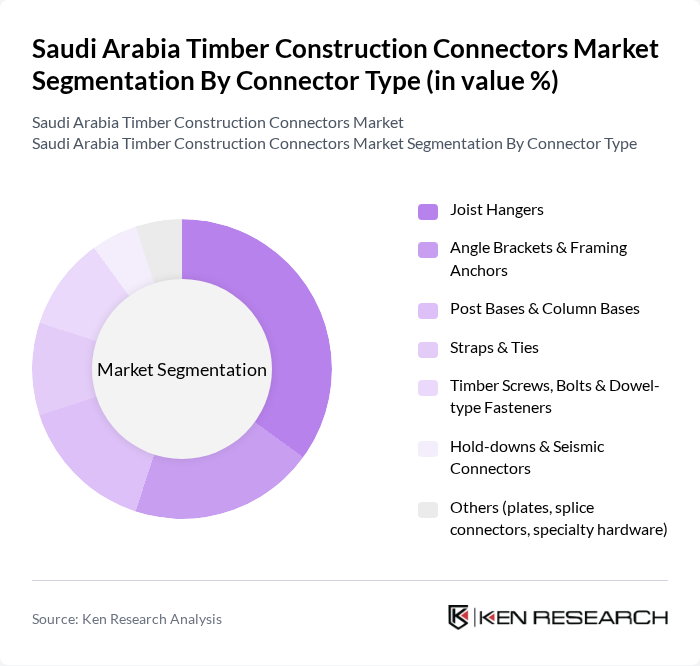

By Connector Type:

The connector type segment includes various subsegments such as Joist Hangers, Angle Brackets & Framing Anchors, Post Bases & Column Bases, Straps & Ties, Timber Screws, Bolts & Dowel-type Fasteners, Hold-downs & Seismic Connectors, and Others (plates, splice connectors, specialty hardware). Among these, Joist Hangers are leading the market due to their essential role in supporting floor joists and roof structures, which are critical in both residential and commercial buildings. The increasing trend towards modular construction and prefabricated timber systems has further bolstered the demand for Joist Hangers, making them a preferred choice among contractors and builders.

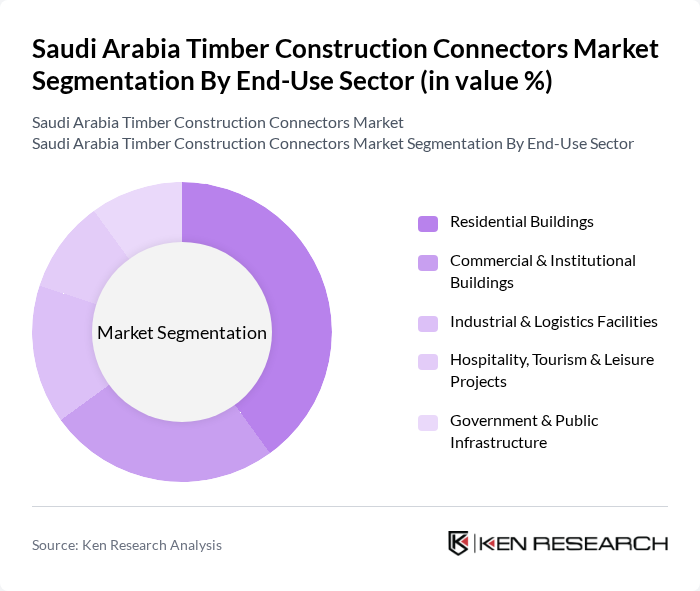

By End-Use Sector:

This segment encompasses Residential Buildings, Commercial & Institutional Buildings, Industrial & Logistics Facilities, Hospitality, Tourism & Leisure Projects, and Government & Public Infrastructure. The Residential Buildings sector is currently the dominant segment, driven by the increasing population and urbanization in Saudi Arabia. The demand for affordable housing and the government's initiatives to boost the real estate sector have led to a significant rise in construction activities, thereby increasing the need for timber construction connectors in residential projects.

The Saudi Arabia Timber Construction Connectors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Simpson Strong?Tie Company Inc., MiTek Inc. (A Berkshire Hathaway Company), SFS Group AG, Rothoblaas S.r.l., Würth Group (Adolf Würth GmbH & Co. KG), Hilti Corporation, Fischerwerke GmbH & Co. KG, ITW Construction Products (Illinois Tool Works Inc.), Al Bawardi Building Materials Co., Al Masaood Bergum, Al Fanar Timber Industries, Timberwolf Middle East Contracting LLC, Saudi Timber Company, Arabian Timber & Joinery Co., Red Sea Global (Timber & Modular Construction Initiatives) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia timber construction connectors market appears promising, driven by increasing government support and a shift towards sustainable building practices. As urbanization accelerates, the demand for innovative construction solutions will rise, particularly in eco-friendly projects. The integration of smart technologies in construction processes is expected to enhance efficiency and safety, further solidifying timber's role in the market. Stakeholders must adapt to evolving regulations and consumer preferences to capitalize on these trends effectively.

| Segment | Sub-Segments |

|---|---|

| By Connector Type | Joist Hangers Angle Brackets & Framing Anchors Post Bases & Column Bases Straps & Ties Timber Screws, Bolts & Dowel-type Fasteners Hold-downs & Seismic Connectors Others (plates, splice connectors, specialty hardware) |

| By End-Use Sector | Residential Buildings Commercial & Institutional Buildings Industrial & Logistics Facilities Hospitality, Tourism & Leisure Projects Government & Public Infrastructure |

| By Application | New-build Timber Structures Repair, Renovation & Retrofitting Modular & Prefabricated Timber Systems Hybrid Timber–Concrete/Steel Structures |

| By Material | Carbon Steel Stainless Steel Engineered Plastics & Composites Galvanized & Coated Alloys |

| By Distribution Channel | Direct Sales to Contractors & Developers Building Material Distributors & Dealers Specialized Fastener & Hardware Retailers Online & E-Procurement Platforms |

| By Region | Central Region (Riyadh & surroundings) Eastern Region (Dammam, Dhahran, Khobar) Western Region (Jeddah, Makkah, Madinah, Red Sea projects) Southern & Northern Regions |

| By Customer Type | Construction Contractors & EPC Firms Real Estate Developers Modular & Prefab Timber Solution Providers Government Bodies & Public Sector Clients Retail / Small Builders & Individual Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Timber Construction | 100 | Architects, Home Builders |

| Commercial Timber Projects | 80 | Project Managers, Construction Executives |

| Timber Connector Suppliers | 60 | Sales Managers, Product Development Leads |

| Regulatory Bodies and Standards | 50 | Policy Makers, Compliance Officers |

| Timber Industry Associations | 70 | Industry Analysts, Trade Association Leaders |

The Saudi Arabia Timber Construction Connectors Market is valued at approximately USD 15 million, reflecting a growing trend towards sustainable building materials and increased construction activities in the region.