Region:Middle East

Author(s):Rebecca

Product Code:KRAD6208

Pages:81

Published On:December 2025

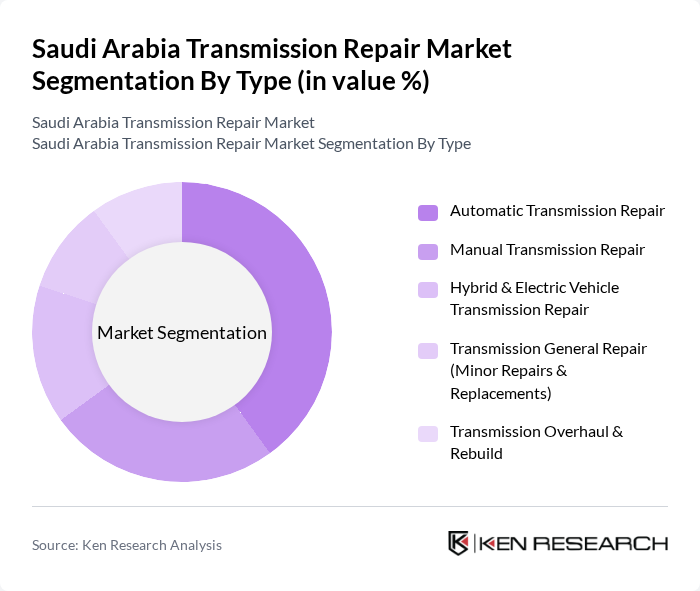

By Type:The market is segmented into various types of transmission repair services, including Automatic Transmission Repair, Manual Transmission Repair, Hybrid & Electric Vehicle Transmission Repair, Transmission General Repair (Minor Repairs & Replacements), and Transmission Overhaul & Rebuild. Each of these sub-segments caters to different vehicle types and customer needs, reflecting the diverse requirements of the automotive repair industry.

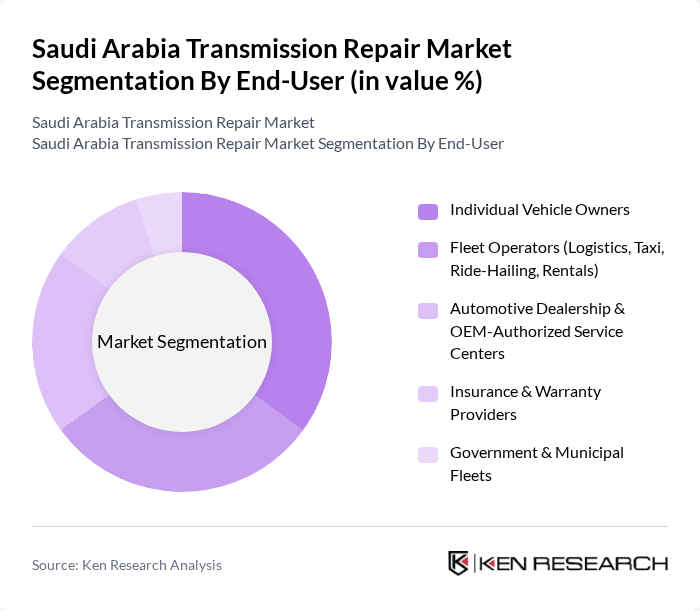

By End-User:The end-user segmentation includes Individual Vehicle Owners, Fleet Operators (Logistics, Taxi, Ride-Hailing, Rentals), Automotive Dealership & OEM-Authorized Service Centers, Insurance & Warranty Providers, and Government & Municipal Fleets. This segmentation highlights the diverse customer base that drives demand for transmission repair services across different sectors.

The Saudi Arabia Transmission Repair Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petromin Corporation, Abdul Latif Jameel Motors, Al Jazirah Vehicles Agencies Co. Ltd., Aljomaih Automotive Company, United Motors Group, Mohamed Yousuf Naghi Motors Co., Haji Husein Alireza & Co. Ltd., Gulf Advantage Automobiles LLC, Carefer International Company, Bin-Shihon Group, AUTOFIX (Petromin Express & Related Service Formats), Fast Auto Technic Co. (FAST Auto Technic), Almajdouie Motors, Al Saeed Trading & Auto Maintenance (regional workshop chain), and Local Independent Transmission Specialists & Garages contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia transmission repair market appears promising, driven by technological advancements and evolving consumer preferences. As electric vehicles gain traction, the demand for specialized transmission services will likely increase, necessitating the adaptation of repair techniques. Additionally, the growing trend of preventive maintenance will encourage vehicle owners to seek regular transmission check-ups, further boosting service demand. Overall, the market is poised for growth, supported by ongoing investments in automotive infrastructure and training programs for technicians.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Transmission Repair Manual Transmission Repair Hybrid & Electric Vehicle Transmission Repair Transmission General Repair (Minor Repairs & Replacements) Transmission Overhaul & Rebuild |

| By End-User | Individual Vehicle Owners Fleet Operators (Logistics, Taxi, Ride-Hailing, Rentals) Automotive Dealership & OEM-Authorized Service Centers Insurance & Warranty Providers Government & Municipal Fleets |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles & Buses Off-Highway & Special-Purpose Vehicles |

| By Service Type | Diagnostic & Inspection Services Repair & Component Replacement Services Preventive & Periodic Maintenance Services Remanufacturing & Reconditioning Services |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Repair Technology | Conventional Mechanical Repair Techniques Electronic & Computerized Diagnostic Tools OEM-Authorized Calibration & Programming Automated & Specialized EV/Hybrid Transmission Systems |

| By Customer Segment | Retail Customers Corporate & Fleet Clients Government & Public Sector Contracts Leasing & Rental Companies Ride-Hailing & Mobility Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transmission Repair Shops | 100 | Shop Owners, Lead Technicians |

| Automotive Service Centers | 80 | Service Managers, Customer Service Representatives |

| Vehicle Manufacturers | 40 | Product Development Engineers, Aftermarket Managers |

| Automotive Parts Suppliers | 70 | Sales Managers, Technical Support Staff |

| Consumer Insights | 90 | Vehicle Owners, Fleet Managers |

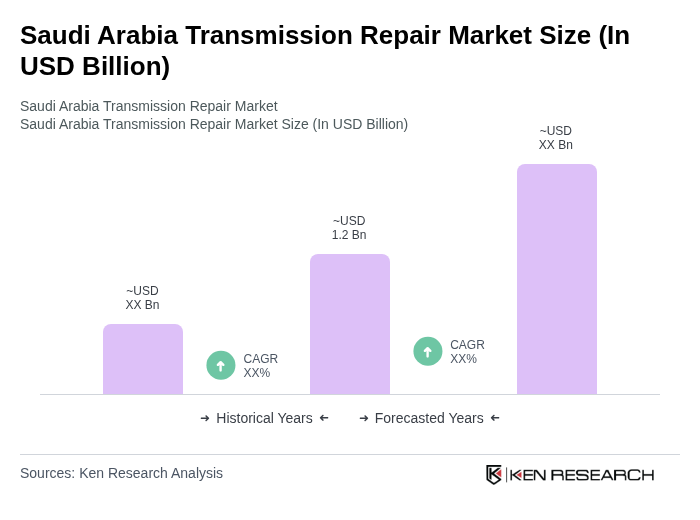

The Saudi Arabia Transmission Repair Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing vehicle ownership and demand for specialized maintenance and repair services.