Region:Middle East

Author(s):Shubham

Product Code:KRAC4269

Pages:98

Published On:October 2025

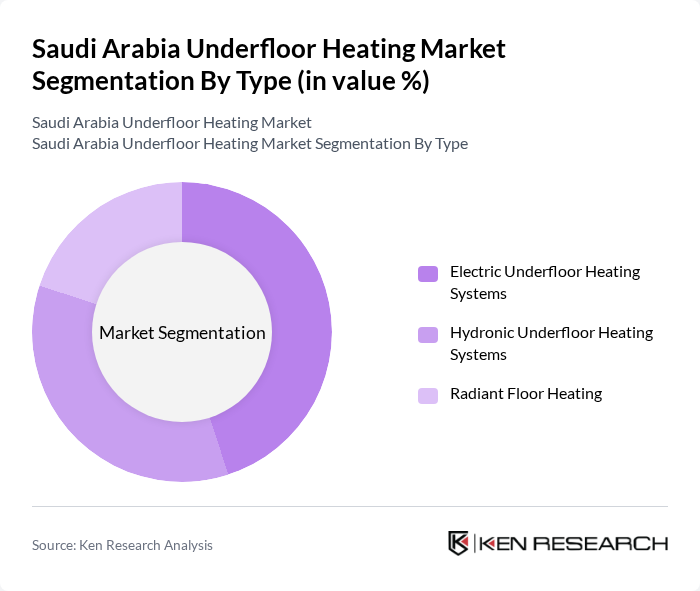

By Type:The market is segmented into Electric Underfloor Heating Systems, Hydronic Underfloor Heating Systems, and Radiant Floor Heating. Electric Underfloor Heating Systems are gaining traction due to their ease of installation and efficiency, while Hydronic systems are preferred for larger spaces due to their cost-effectiveness in heating. Radiant Floor Heating is also popular for its comfort and energy efficiency, particularly in high-end residential applications. The rising demand for electric underfloor heating systems is particularly notable in residential and smaller commercial spaces, driven by easier installation and lower maintenance requirements compared to traditional hydronic systems.

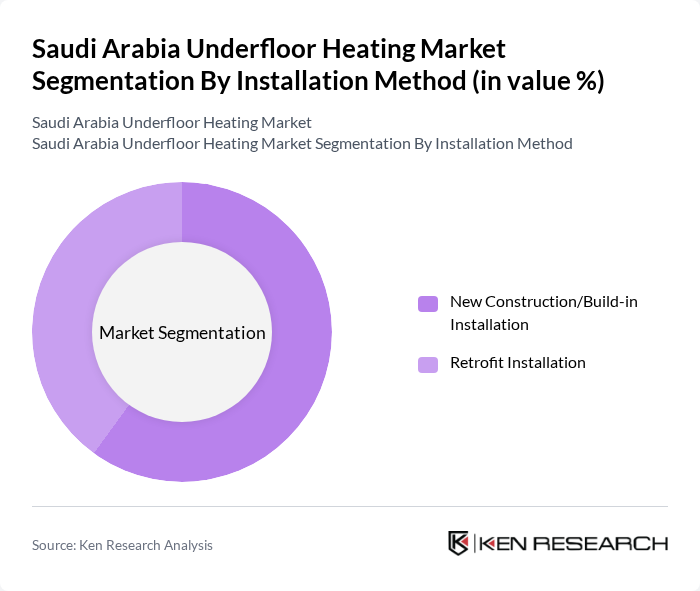

By Installation Method:The market is divided into New Construction/Build-in Installation and Retrofit Installation. New Construction installations dominate the market due to the ongoing construction boom in Saudi Arabia, driven by Vision 2030 initiatives. Retrofit installations are also gaining popularity as existing buildings seek to upgrade their heating systems for improved energy efficiency and comfort. The shift toward sustainable building practices has positioned underfloor heating as a key feature in new homes, hotels, and commercial properties across the region.

The Saudi Arabia Underfloor Heating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uponor Corporation, Warmup plc, REHAU SE & Co. KG, Danfoss A/S, Viega GmbH, nVent Electric plc, Nexans S.A., Schneider Electric SE, Honeywell International Inc., Polypipe Group plc, Bosch Thermotechnology, Siemens AG, Watts Water Technologies, Inc., Kermi GmbH, Fenix Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the underfloor heating market in Saudi Arabia appears promising, driven by increasing investments in sustainable construction and energy-efficient technologies. As the government continues to implement regulations favoring green building practices, the adoption of underfloor heating systems is expected to rise. Additionally, the integration of smart home technologies will enhance user experience, making these systems more appealing. Overall, the market is poised for growth as consumer awareness and acceptance improve, supported by favorable economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Underfloor Heating Systems Hydronic Underfloor Heating Systems Radiant Floor Heating |

| By Installation Method | New Construction/Build-in Installation Retrofit Installation |

| By Component | Heating Elements (Cables, Mats, Films, Pipes) Control Systems (Smart Thermostats, Zone Controllers) Insulation Materials |

| By End-User Application | Residential Commercial (Office Buildings, Retail Spaces, Hospitality) Industrial |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region |

| By Distribution Channel | Direct Sales to Contractors and Builders Authorized Distributors and Wholesalers Online Retail Platforms HVAC and Building Material Retailers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Underfloor Heating Installations | 120 | Homeowners, Property Developers |

| Commercial Heating Solutions | 90 | Facility Managers, Building Owners |

| Industrial Heating Applications | 60 | Operations Managers, Plant Engineers |

| HVAC Supplier Insights | 50 | Sales Managers, Product Development Heads |

| Energy Efficiency Policy Impact | 40 | Regulatory Affairs Specialists, Energy Consultants |

The Saudi Arabia Underfloor Heating Market is valued at approximately USD 185 million, driven by increasing demand for energy-efficient heating solutions and rising construction activities, particularly in urban centers like Riyadh, Jeddah, and Dammam.