Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5845

Pages:92

Published On:December 2025

Business Headsets Market.png)

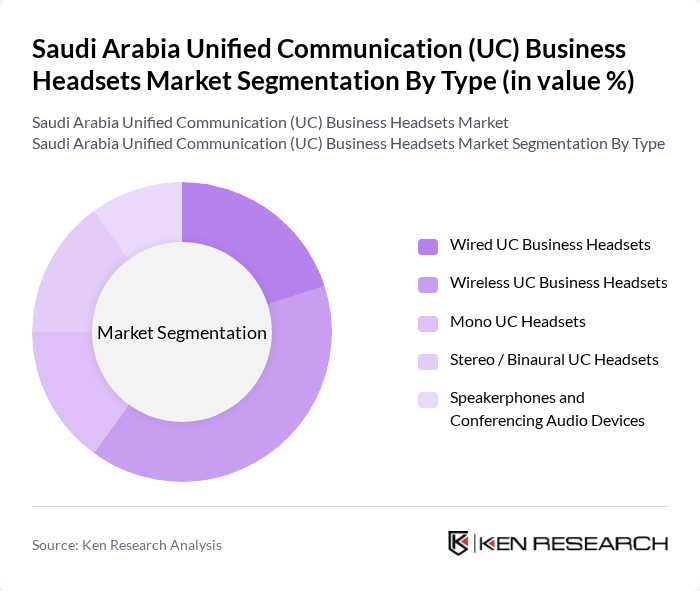

By Type:The market is segmented into various types of UC business headsets, including Wired UC Business Headsets, Wireless UC Business Headsets, Mono UC Headsets, Stereo / Binaural UC Headsets, and Speakerphones and Conferencing Audio Devices. Among these, Wireless UC Business Headsets are leading the market due to their convenience and flexibility, catering to the growing trend of remote and hybrid work environments. The demand for wireless solutions is driven by the need for mobility and ease of use in dynamic work settings.

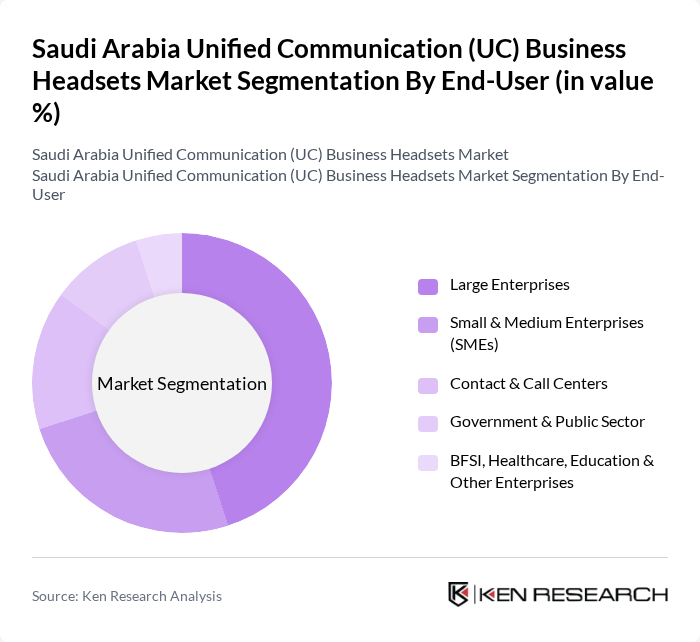

By End-User:The end-user segmentation includes Large Enterprises, Small & Medium Enterprises (SMEs), Contact & Call Centers, Government & Public Sector, and BFSI, Healthcare, Education & Other Enterprises. Large Enterprises dominate the market as they invest heavily in communication technologies to enhance collaboration and productivity across their teams. The increasing focus on digital transformation and remote work solutions has further accelerated the adoption of UC headsets in this segment.

The Saudi Arabia Unified Communication (UC) Business Headsets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jabra (GN Audio), Poly (HP Poly), Logitech, EPOS (Demant Group), Sennheiser, Cisco Systems, Avaya, Yealink, Microsoft, Lenovo, HP Inc., Dell Technologies, Anker Innovations (Soundcore), Razer, Alcatel-Lucent Enterprise contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi UC business headsets market appears promising, driven by technological advancements and evolving workplace dynamics. As remote work continues to solidify its presence, the demand for innovative audio solutions is expected to rise. Companies are likely to invest in integrated communication tools that enhance collaboration. Additionally, the focus on sustainability will push manufacturers to adopt eco-friendly practices, aligning with global trends and consumer preferences for responsible products.

| Segment | Sub-Segments |

|---|---|

| By Type | Wired UC Business Headsets Wireless UC Business Headsets Mono UC Headsets Stereo / Binaural UC Headsets Speakerphones and Conferencing Audio Devices |

| By End-User | Large Enterprises Small & Medium Enterprises (SMEs) Contact & Call Centers Government & Public Sector BFSI, Healthcare, Education & Other Enterprises |

| By Region | Central Region (Riyadh and surrounding areas) Western Region (Jeddah, Makkah, Madinah) Eastern Region (Dammam, Dhahran, Al Khobar) Southern & Northern Regions |

| By Application | Unified Communications & Collaboration (UCC) Platforms Contact Center and Customer Support Operations Enterprise VoIP & IP Telephony Remote Work, Hybrid Work & Virtual Meetings Training, Webinars and Other Enterprise Use Cases |

| By Connectivity | USB / USB-C Bluetooth DECT mm Jack & Other Interfaces |

| By Price Band | Entry-Level (Below USD 100) Mid-Range (USD 100–300) Premium (Above USD 300) Specialized / Industry-Specific Models |

| By Distribution Channel | IT & Telecom Resellers / System Integrators Enterprise Direct Sales Online Channels (E-commerce & Vendor Portals) Retail & Other Channels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector Users | 120 | IT Managers, Communication Directors |

| Healthcare Institutions | 100 | Healthcare IT Specialists, Procurement Managers |

| Educational Institutions | 80 | IT Coordinators, Administrative Heads |

| Small and Medium Enterprises (SMEs) | 70 | Business Owners, Office Managers |

| Telecommunications Providers | 60 | Product Managers, Sales Directors |

The Saudi Arabia Unified Communication (UC) Business Headsets Market is valued at approximately USD 35 million, reflecting a significant growth trend driven by the increasing adoption of remote work solutions and advancements in audio technology.