Region:Middle East

Author(s):Dev

Product Code:KRAA9541

Pages:96

Published On:November 2025

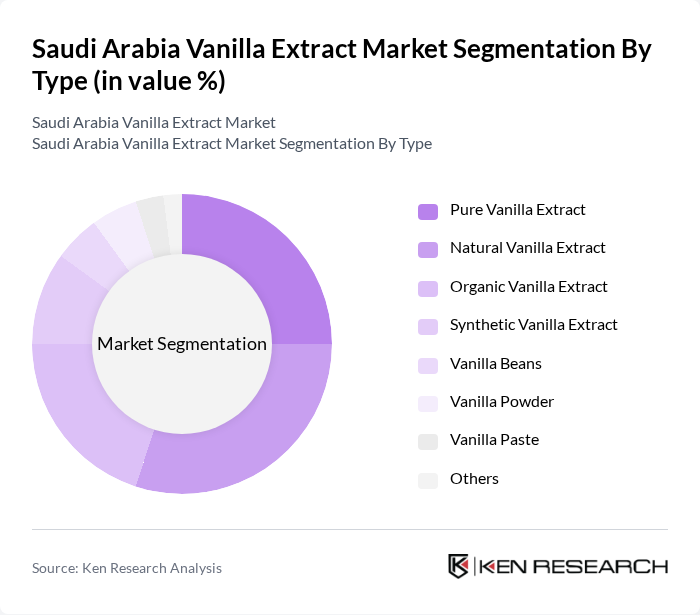

By Type:The market is segmented into various types of vanilla extracts, including Pure Vanilla Extract, Natural Vanilla Extract, Organic Vanilla Extract, Synthetic Vanilla Extract, Vanilla Beans, Vanilla Powder, Vanilla Paste, and Others. Each type caters to different consumer preferences and applications, with organic and natural extracts gaining significant traction due to health-conscious trends .

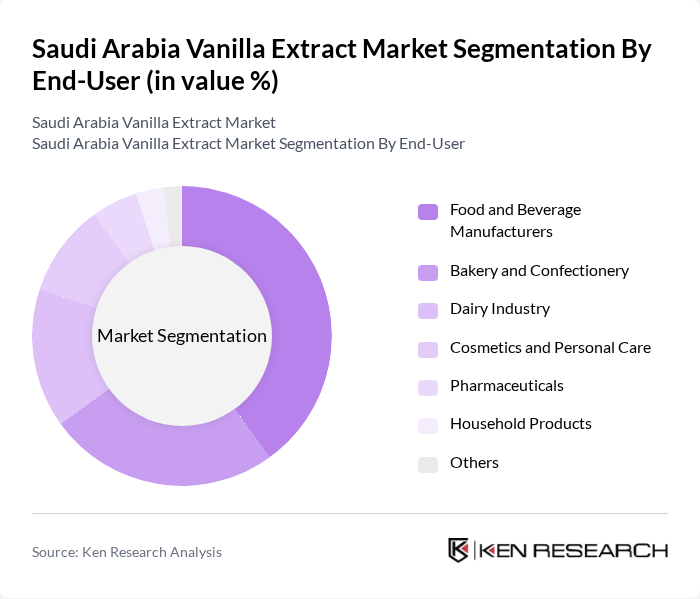

By End-User:The end-user segmentation includes Food and Beverage Manufacturers, Bakery and Confectionery, Dairy Industry, Cosmetics and Personal Care, Pharmaceuticals, Household Products, and Others. The food and beverage sector is the largest consumer of vanilla extract, driven by the growing trend of using natural flavors in products .

The Saudi Arabia Vanilla Extract Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prova SAS, Kerry Group plc, Archer Daniels Midland Company (ADM), Nielsen-Massey Vanillas Inc., McCormick & Company, Inc., Heilala Vanilla, Eurovanille, Vanilla Food Company, Al Alali (Basamh Trading & Industries Group), Almarai Company, Savola Group, United Food Industries Corporation Ltd., Natural Vanilla Pty Ltd, Symrise AG, Givaudan SA contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia vanilla extract market appears promising, driven by the increasing integration of vanilla in health and wellness products. As consumers continue to prioritize natural ingredients, the demand for high-quality vanilla extract is expected to rise. Additionally, advancements in sustainable sourcing practices will likely enhance the market's appeal, fostering collaborations between local producers and manufacturers. This synergy can lead to innovative product offerings, further solidifying vanilla's position in the food and beverage industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Pure Vanilla Extract Natural Vanilla Extract Organic Vanilla Extract Synthetic Vanilla Extract Vanilla Beans Vanilla Powder Vanilla Paste Others |

| By End-User | Food and Beverage Manufacturers Bakery and Confectionery Dairy Industry Cosmetics and Personal Care Pharmaceuticals Household Products Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Food Service Providers Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Glass Bottles Plastic Bottles Eco-Friendly Packaging Pouches Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Baking Confectionery Beverages Dairy Products Personal Care & Cosmetics Pharmaceuticals Others |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Purchasing Agents |

| Retail Sector (Supermarkets and Specialty Stores) | 80 | Category Managers, Store Buyers |

| Vanilla Farmers and Suppliers | 60 | Farm Owners, Supply Chain Managers |

| Consumer Insights (Households) | 150 | General Consumers, Cooking Enthusiasts |

| Food Service Industry (Restaurants and Cafés) | 70 | Chefs, Restaurant Owners |

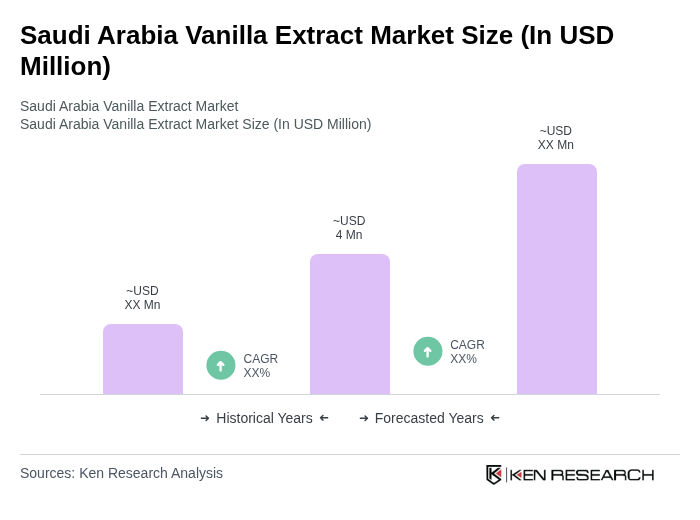

The Saudi Arabia Vanilla Extract Market is valued at approximately USD 4 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for natural flavors in the food and beverage industry, particularly for organic and premium products.