Region:Middle East

Author(s):Shubham

Product Code:KRAA8676

Pages:84

Published On:November 2025

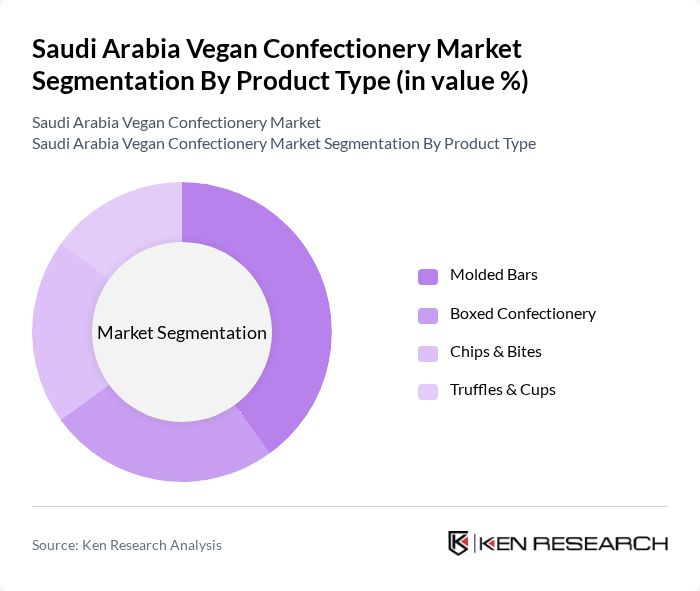

By Product Type:The product type segmentation includes Molded Bars, Boxed Confectionery, Chips & Bites, and Truffles & Cups. Molded Bars have emerged as the leading subsegment, driven by their convenience, variety, and the premiumization trend featuring artisanal formats and exotic inclusions. Boxed Confectionery holds a significant share, often purchased for gifting and special occasions. The demand for Chips & Bites is rising as consumers seek healthier, portion-controlled snacking options, while Truffles & Cups cater to the premium and gourmet segment, appealing to consumers willing to spend more for unique experiences .

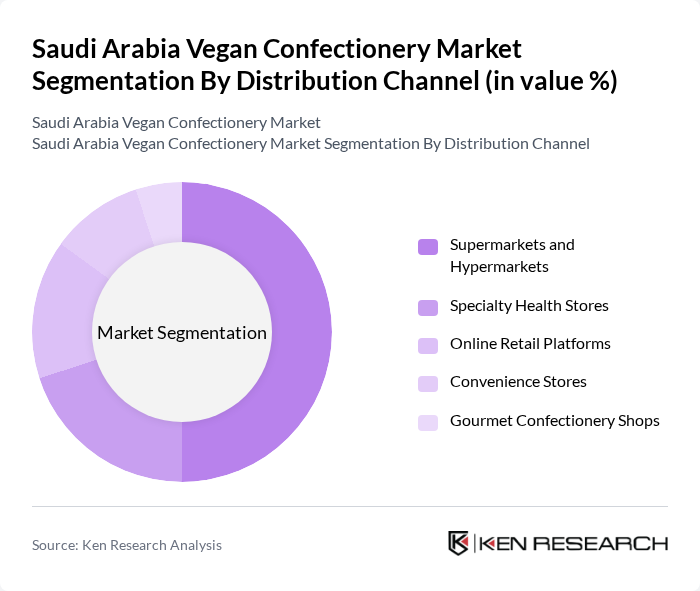

By Distribution Channel:The distribution channel segmentation includes Supermarkets and Hypermarkets, Specialty Health Stores, Online Retail Platforms, Convenience Stores, and Gourmet Confectionery Shops. Supermarkets and Hypermarkets dominate due to their extensive reach and diverse product offerings, making them the primary destination for vegan confectionery purchases. Online Retail Platforms are rapidly gaining traction, particularly among younger, tech-savvy consumers who value convenience and variety. Specialty Health Stores serve a niche but growing segment, while Convenience Stores and Gourmet Shops address specific consumer preferences and premium gifting needs .

The Saudi Arabia Vegan Confectionery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro, Green & Black's, Lindt Excellence (Vegan Range), Enjoy Life Foods, Hu Chocolate, Pascha Chocolate, Vego, Taza Chocolate, Nibmor, and local Saudi confectionery manufacturers contribute to innovation, geographic expansion, and service delivery in this space .

The future of the vegan confectionery market in Saudi Arabia appears promising, driven by increasing health consciousness and a growing vegan population. As consumers continue to prioritize ethical and sustainable products, brands that innovate and expand their offerings are likely to thrive. The rise of e-commerce and digital marketing will further enhance product accessibility, allowing companies to reach a broader audience. Additionally, collaborations with health-focused brands can amplify market presence and consumer trust, fostering long-term growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Molded Bars Boxed Confectionery Chips & Bites Truffles & Cups |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Health Stores Online Retail Platforms Convenience Stores Gourmet Confectionery Shops |

| By Consumer Segment | Health-Conscious Consumers Lactose-Intolerant Consumers Ethical/Vegan Lifestyle Adopters Urban Middle-Class Demographics |

| By Price Range | Premium Mid-Range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Vegan Confectionery | 100 | Health-conscious Consumers, Vegan Diet Adopters |

| Retail Distribution Insights | 100 | Retail Managers, Category Buyers |

| Manufacturing Perspectives | 80 | Production Managers, Quality Assurance Officers |

| Market Trends and Innovations | 70 | Food Technologists, Product Development Managers |

| Health and Nutrition Expert Opinions | 50 | Nutritionists, Dietitians, Health Coaches |

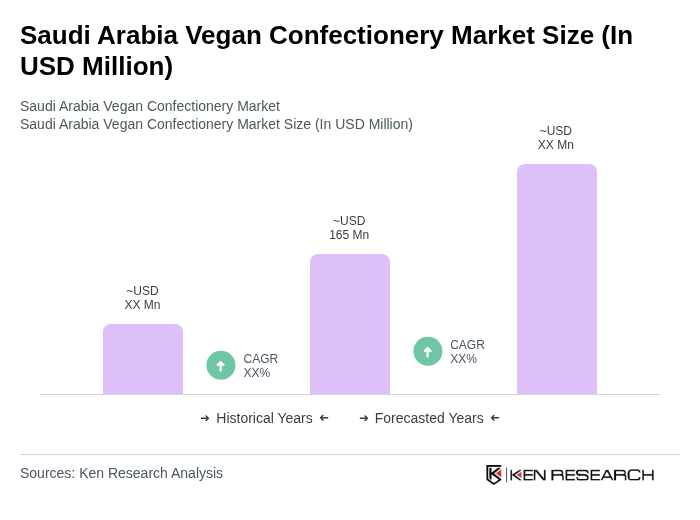

The Saudi Arabia Vegan Confectionery Market is valued at approximately USD 165 million, reflecting a significant growth trend driven by increasing health consciousness and the rising demand for plant-based products among consumers.