Region:Middle East

Author(s):Rebecca

Product Code:KRAD8180

Pages:90

Published On:December 2025

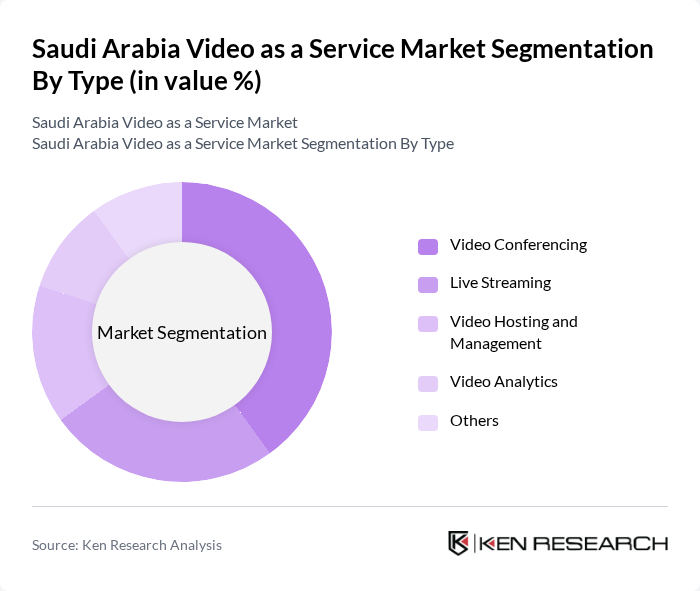

By Type:The market can be segmented into various types, including Video Conferencing, Live Streaming, Video Hosting and Management, Video Analytics, and Others. Among these, Video Conferencing has emerged as a dominant segment due to the increasing need for remote collaboration and communication, especially in corporate and educational settings. The rise of hybrid work models has further accelerated the adoption of video conferencing solutions, making it a critical tool for businesses and institutions. Live streaming holds significant prominence, driven by high engagement in events and entertainment.

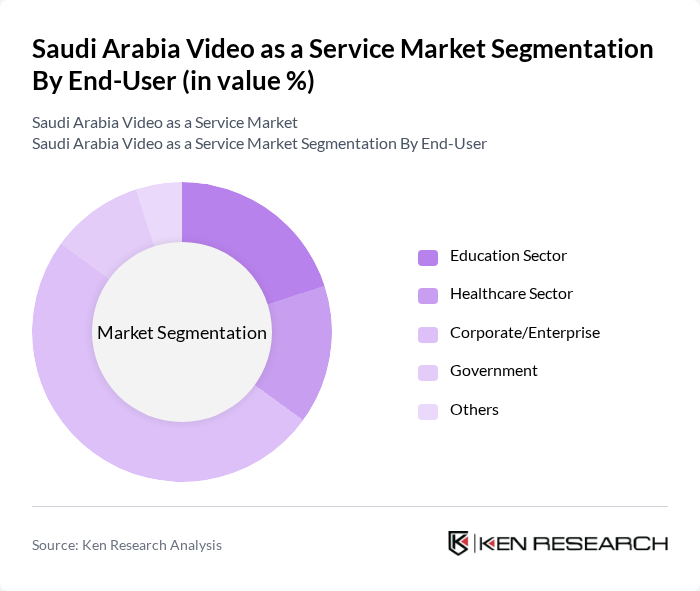

By End-User:The end-user segmentation includes the Education Sector, Healthcare Sector, Corporate/Enterprise, Government, and Others. The Corporate/Enterprise segment is leading the market, driven by the increasing need for effective communication tools and training solutions. Companies are investing in video services to enhance employee engagement and streamline operations, particularly in the wake of the COVID-19 pandemic, which has shifted many businesses towards digital solutions.

The Saudi Arabia Video as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems Inc., Microsoft Corporation, Amazon Web Services (AWS), Google Cloud (Alphabet Inc.), IBM Corporation, Brightcove Inc., Kaltura Inc., Vimeo Inc., Akamai Technologies Inc., Wowza Media Systems LLC, STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA (Zain Saudi Arabia), Amagi Media Labs, Cineverse Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Video as a Service market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and the increasing integration of advanced technologies. As organizations continue to embrace hybrid work models, the demand for flexible and scalable video solutions is expected to rise. Furthermore, the government's commitment to enhancing digital infrastructure will likely facilitate broader access to VaaS, enabling businesses to leverage video collaboration tools effectively and improve operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Conferencing Live Streaming Video Hosting and Management Video Analytics Others |

| By End-User | Education Sector Healthcare Sector Corporate/Enterprise Government Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Region | Riyadh (Central Region) Eastern Region Western Region Southern Region |

| By Application | Internal Communications and Meetings Training and Development Customer Engagement and Support Marketing and Events |

| By Pricing Model | Subscription-Based Pay-per-Use Freemium Enterprise Custom Pricing |

| By Content Type | User-Generated Content Professional Content Live Events and Webinars Training and Educational Content |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Entertainment Sector VaaS Adoption | 120 | Content Managers, Streaming Service Executives |

| Corporate Training Solutions | 100 | HR Managers, Learning and Development Heads |

| Education Sector Video Services | 80 | School Administrators, IT Directors |

| Healthcare Video Consultation Services | 70 | Healthcare Administrators, IT Managers |

| Consumer Insights on VaaS | 100 | General Consumers, Tech-savvy Users |

The Saudi Arabia Video as a Service market is valued at approximately USD 30 million, driven by the increasing demand for digital content, remote work, and enhanced internet infrastructure, including the rollout of 5G networks.